Withdrawing funds earlier in the 10-year period may be a strategic way to reduce the tax burden.

Inheriting an individual retirement account (IRA) can come with exciting opportunities, but it also carries the potential for costly mistakes if you are not careful. Starting in 2025, new regulations regarding inherited IRAs will require certain heirs to take annual withdrawals or face an IRS penalty. Note that the IRS provided a grace period for 2021-2024, meaning beneficiaries didn't have to take RMDs during those years, but the new rules take effect in 2025.

These changes follow the final regulations released in July 2024, which mandate that most non-spouse beneficiaries deplete their inherited IRAs within 10 years while also taking required minimum distributions (RMDs) each year.

Inherited IRA Fact Box

- Who Can Inherit an IRA?

An IRA can be inherited by a spouse or a non-spouse such as adult children, siblings, or other relatives. Inherited IRAs can also be passed along to trusts, charities, minor children, and estates.

- 10-Year Rule:

Most beneficiaries must deplete the inherited IRA within 10 years of the original account holder’s death. Annual withdrawals may be required depending on the beneficiary's situation.

- Required Minimum Distributions (RMDs):

If the original IRA holder had reached the RMD age before passing, the beneficiary must take RMDs each year, starting in 2025.

- Tax Implications:

Withdrawals are taxed as ordinary income. Strategic planning of when to take distributions can help reduce the overall tax burden.

- Exceptions to the 10-Year Rule:

Minor children, disabled or chronically ill beneficiaries, and certain trusts may have different rules or exceptions, such as the ability to take distributions over a longer period.

What the Rule Means for Beneficiaries

Under the new rules, many heirs will need to take annual withdrawals from inherited IRAs beginning in 2025. These withdrawals must continue for 10 years, in line with the "10-year rule". This rule applies to most non-spouse beneficiaries unless they are a minor child, disabled, chronically ill, or certain types of trusts. If the original IRA owner had already reached the age for RMDs before passing away, the new beneficiary will need to comply with this requirement as well.

Before the Secure Act of 2019, IRA beneficiaries could stretch withdrawals over their lifetime, reducing yearly taxes. However, with the introduction of the 10-year rule in 2020, the ability to stretch the withdrawal period was eliminated for most non-spouse heirs. For years, there was uncertainty regarding whether yearly RMDs were required during this 10-year withdrawal period. The IRS's final regulations provide clarity and confirm that some beneficiaries must now take annual distributions.

Avoiding IRS Penalties

The IRS has introduced stricter penalties for failing to meet the RMD requirements. Previously, the IRS waived penalties for missed RMDs on inherited IRAs, but now, if an heir does not take the required withdrawals beginning in 2025, they could face a 25% penalty on the amount they should have withdrawn. However, if the mistake is corrected within two years and a reasonable explanation is provided, the penalty may be reduced to 10%.

It is crucial for beneficiaries to understand these new rules to avoid penalties and ensure compliance with the RMD requirements. The IRS has signaled a willingness to waive penalties in certain cases, but taking the necessary steps to avoid them is clearly in the best interest of the beneficiary.

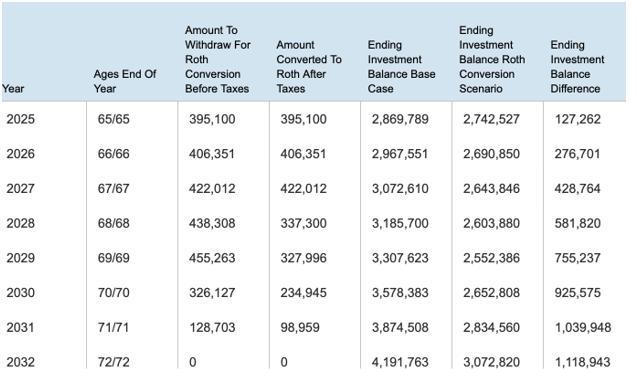

If you are worried about leaving your kids with the tax burden of a large inherited IRA, you may want to consider converting part, or all, of your your traditional IRA into a Roth IRA. In WealthTrace you can run Roth IRA Conversion scenarios to determine if converting your funds can be beneficial for both you and your heirs.

Why You May Want to Start Withdrawals Sooner

While the penalties for missed RMDs are certainly a concern, it may also be beneficial for beneficiaries to consider withdrawing funds earlier rather than waiting until the last minute. Tax planning plays a critical role in this decision. Pre-tax IRA withdrawals are subject to regular income taxes, and taking larger withdrawals later in the 10-year period could push the beneficiary into a higher tax bracket.

By starting withdrawals sooner, especially in lower-income years, beneficiaries may be able to reduce the overall tax impact. Strategic planning can help beneficiaries minimize taxes over the entire 10-year period rather than face a large tax bill at the end.

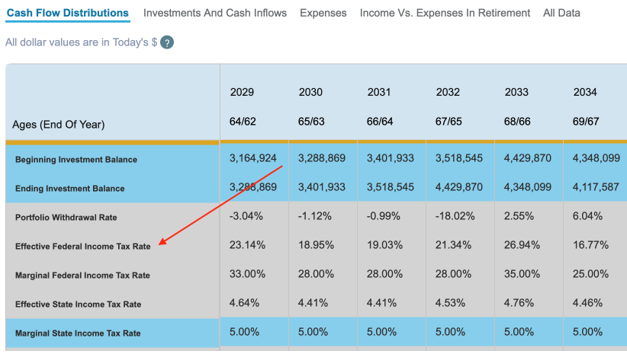

WealthTrace can help you figure out the best timing for taking your inherited IRA withdrawals. You can look for years when your effective federal income tax rate is low and make strategic decisions to lower your taxable income.

The Bottom Line

In conclusion, the new Inherited IRA rules that take effect in 2025 are designed to accelerate the depletion of inherited accounts, and beneficiaries must comply with annual RMD requirements to avoid penalties. While the penalties can be large, starting withdrawals early can provide a chance to minimize the tax burden and make the most of the 10-year window.

Do you know what your projected RMDs will be in retirement? If you aren’t sure, sign up for a free trial of WealthTrace to build your financial and retirement plan today.