Key Points- Anyone can open a Roth IRA for a child and contribute to it.

- Contributions can only be made if the child has earned income.

- Roth IRAs aren’t just for retirement—they can also help fund education or a first home.

Establishing a Roth IRA for your kids can be a fantastic way to jumpstart their financial future. The main idea behind a Roth IRA is to save for retirement with tax-free growth, and it can also be a great way to introduce your kids to investing and the power of compound interest.

Who Can Set Up a Roth IRA?

Anyone can open a Roth IRA for a child and contribute to it. Technically the child must have earned income to be able to contribute to their Roth IRA, but they do not have to use their own funds to do so. As long at the contribution does not exceed the child’s earnings, or the IRS contribution limit, relatives or family (or anyone) can contribute.

If the child is considered a minor, they cannot manage the account themselves. Instead, it will be set up as a custodial Roth IRA, with a responsible adult overseeing it until the child reaches the age of maturity (usually 18). At that point, the account transitions into a regular Roth IRA, and the now-adult child can take control of their funds without needing parental permission.

There is no minimum age to establish or contribute to a Roth IRA, as long as the child has earned income. This can come from a W-2 job or even from side gigs like babysitting or dog walking. However, gifts or allowances do not count as earned income. Also, keep in mind that the IRS only requires gross income (before taxes) for IRA contributions—not net income. Go here to read more about the Roth IRA contribution rules.

Light Blue Text Box Roth IRA Fact Box

- Tax Treatment: Contributions are made with after-tax dollars; earnings grow tax-free, and qualified withdrawals are tax-free.

- Contribution Limits (2025):

- $7,000 per year (under 50 years old)

- $8,000 per year (50+ years old, catch-up contribution)

- Eligibility:

- Must have earned income (e.g., wages or self-employment income).

- Income limits apply for eligibility to contribute.

- Age for Tax-Free Withdrawals: 59½ years old (with the account held for at least 5 years).

- No RMDs during the account holder's lifetime.

- Best for: Individuals who expect to be in a higher tax bracket in retirement or who want tax-free growth and flexibility.

The Benefits of a Roth IRA

One of the biggest benefits of a Roth IRA is how the funds are able to grow tax-free. The contributions and earnings can be distributed tax-free after the account holder reaches age 59 ½ and has held the account for at least five years. The Roth IRA contributions can be withdrawn tax-free and penalty-free at any time, no matter how old the child/person is.

For example, let’s say 24-year-old John has $20,000 in his Roth IRA, with $15,000 of that being his contributions. He can withdraw that $15,000 tax-free and penalty-free. The longer the funds stay in the account and grow, the bigger the benefit, so it is generally recommended to leave the funds in the account as long as possible.

Funding Higher Education Using Your Roth IRA

If you have higher education costs, you can withdraw your contributions, and earnings, penalty free. You will still need to pay taxes on the earned income, but the 10% penalty will not apply.

Another benefit to consider is that Roth IRA funds are not considered assets when filling out the FAFSA for financial aid, so it won’t hurt your chances of qualifying for aid. However, distributions from a Roth IRA may count as untaxed income on the FAFSA, so be aware of that.

Saving For a Home

If you’re looking ahead to homeownership, Roth IRA funds can help with a first home purchase. As an eligible first-time homebuyer, you can withdraw up to $10,000 in earnings without paying the 10% early withdrawal penalty. If the Roth IRA has been open for at least five years, you won’t pay any taxes on the $10,000 either. If you haven’t met the five-year requirement, you will pay taxes on the earnings, but not the penalty.

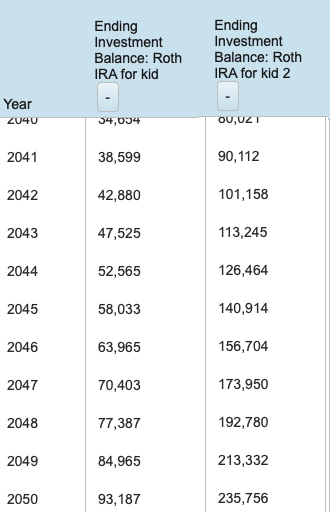

WealthTrace can show you the power of compounding growth in two separate Roth IRAs over the span of 25 years. Both accounts started with a $1000 balance, invested into growth stocks. The account on the left has a contribution of $1000 per year and the account on the right has a contribution of $2000 per year.

The Bottom Line

When it comes to building wealth for retirement, the earlier you start, the better. A child’s maturity and financial literacy will play a role in how they manage their Roth IRA down the line, so it’s a great idea to start conversations about saving and investing early on. This way, they’re more likely to understand and value the long-term benefits of their Roth IRA.

Do you know how much you or your family need to save for retirement? If you aren’t sure, sign up for a free trial of WealthTrace to build your financial and retirement plan today.