Key Points

- 529 plans can be a strategic and tax-advantaged way to save for educational expenses

- You can roll over unused 529 funds into a Roth IRA for the beneficiary

- The rules for 529 to Roth IRA rollovers vary by state

529 to Roth IRA Rollovers

As part of the Federal Secure Act 2.0, owners of a 529 college savings plan are allowed to roll unused funds into a Roth IRA for the beneficiary. There are rules and stipulations that must be followed including rollover limits and waiting periods. Let’s first start by looking at how 529 plans work and why they exist.

What is a 529 college savings Plan?

A 529 college savings plan is a state-sponsored investment plan that allows you to save money for a beneficiary and pay for education expenses. These accounts can be a strategic, tax-advantaged way to save for various educational expenses. These expenses can include paying for kindergarten through grade 12 and college tuitions, certified apprenticeship programs, on-campus meal plans, books, school supplies, qualified student loan repayments and more.

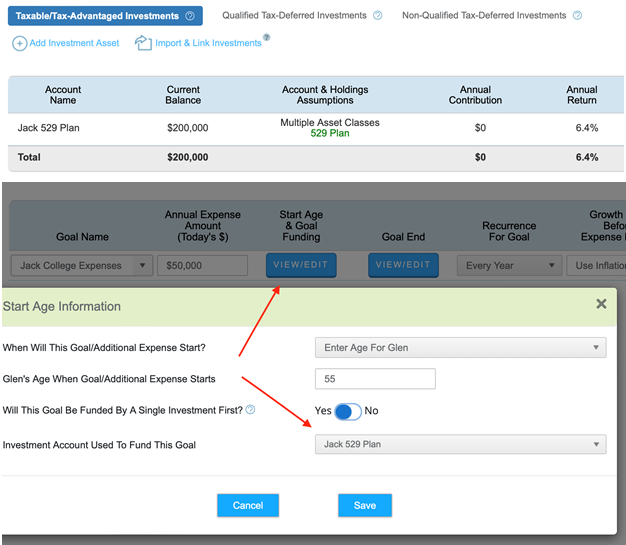

If you plan on funding your child’s educational expenses with a 529 Plan, you can add this into your financial plan in WealthTrace. You can add the qualified educational expenses as a goal and tie that goal to be funded by the designated 529 plan.

In WealthTrace you can also create a hypothetical 529 plan account to compare what the difference would be if you were to fund educational expenses using a taxable account vs. a 529 plan account.

Benefits of 529 plans

There are multiple benefits of saving for educational expenses in a 529 college savings plan, especially when we compare it with a standard savings account or investment account. Some of these benefits include:

- The person who establishes the 529 plan is considered the owner of the assets, not the beneficiary. This is beneficial when applying for financial aid. If the owner is a parent of the beneficiary, the maximum amount that the student’s aid package can be reduced by is 5.64%. If the student is also the owner, then their package could be reduced by up to 20%.

- 529 plans offer tax deductible contributions in many states, often up to a certain limit. You can click here to look up the deduction for your state.

- Money invested in a 529 plan grows tax deferred.

- Withdrawals from a 529 plan are tax-free when used for qualified education expenses.

- 529 plan beneficiaries can be changed at any time, making it easy to use the funds for multiple children (or you can use them for your own educational expenses).

- You can roll the unused 529 funds over to a Roth IRA (keep reading to learn more about this option).

- The account owner of a 529 plan controls the funds, unlike a custodial account (UGMA/UTMA), where the child takes control of the assets once they reach legal age.

Disadvantages of 529 plans

We cannot just look at the benefits of 529 college savings plans without also looking at some of the negatives. Some of the disadvantages of a 529 plan include:

- The state that you reside in dictates the nuances of your 529 plan. Like we mentioned above, some states offer tax deductibility for contributions, but not all. The investment options available, including the costs of those investments, minimum contributions and how the plans are administered, will also vary by state.

- If you use your 529 plan funds for something other than qualifying educational expenses, you will owe taxes on the withdrawal plus an additional penalty rate of 10%.

- Investment management and funds fees can be high.

Rolling Unused Funds Into a Roth IRA

Let’s say you have set up a 529 plan for each of your two kids and funded it for the last 2 decades. Both of your kids received scholarships and didn’t end up using all the funds in their 529 plans. You could keep the funds in the account for future children/grandchildren, keep them for your own educational expenses (if applicable), withdraw the funds and pay the taxes and penalties, or you could roll part (or all) of the unused funds into a Roth IRA.

Before deciding to roll over any unused 529 funds into a Roth IRA it is important to know the restrictions surrounding this.

Rules of a 529 to Roth IRA Rollover

The option to be able to roll 529 funds into a Roth IRA is undoubtedly a great benefit, however there are restrictions that limit the potential upside of this option. These restrictions include:

- The 529 plan must have been established for at least 15 years before making a rollover.

- The Roth IRA rollover cannot include funds, and any earnings on those funds, contributed to the 529 plan in the last 5 years.

- The amount of each rollover cannot exceed the IRA contribution limit for that year ($7,000 in 2024).

- The maximum amount that can be rolled into a Roth IRA from a 529 plan is $35,000

- The beneficiary must have earned income equal to at least as much as the amount transferred in any year.

Rolling over unused 529 plan funds into a Roth IRA is a great way to not only avoid penalties on withdrawing the funds, but also allows the beneficiary a great head start on their retirement savings. Using our example above, the parents can choose to roll over up to $35,000 from their kids 529 college savings plans into a Roth IRA for each of their kids.

The Bottom Line

There are still a lot of grey areas regarding the new option to roll 529 plan funds into a Roth IRA. Some states impose a tax on rollovers from a 529 plan if the contributions received a tax break going in, and some states don’t (some are even undecided). It is also unclear if the 15-year rule means that the account must have had the same beneficiary over the time-period or if this doesn’t matter. Whether or not the $35,000 lifetime maximum applies per 529 plan or per beneficiary is also unclear. There is still a lot of clarification needed regarding this new rule, but sometimes ambiguity can be beneficial.

Should you be contributing to a 529 plan for your children’s education? If so, how much? If you aren’t sure, sign up for of free trial of WealthTrace to get started on your financial and retirement planning.