Key Points:

- You can build your own accurate retirement plan and be empowered.

- Do not trust free calculators for something as important as your retirement.

- Using WealthTrace to run Roth Conversion scenarios can help improve your chances of a successful retirement.

Owen and Amanda Swensen are a couple based in Connecticut who are starting to plan for retirement, but they are unsure of where to start. They are working professionals in their late 40’s and would like to retire at the same time when Amanda turns 60. Neither of them have experience with financial planning.

They have been receiving advice from friends and family about how much they should put away for retirement, but they are looking for an accurate and detailed prediction of how much they need to retire. They have friends who use financial advisors, but they do not want the hassle of having to schedule meetings that fit someone else’s schedule, being unable to control their own assets, and incurring a large annual bill.

They have tried free online retirement calculators and they just know they can’t trust the results. They can’t see the tax assumptions used and they’re not sure where other assumptions such as inflation, annual returns, and medical costs are coming from. They also know that these calculators don’t correctly handle complex Social Security rules, Required Minimum Distributions, capital gains, and so much more. Perhaps most important, these calculators don’t know what their individual investment holdings are.

If the calculator doesn’t handles taxes correctly and doesn’t know what they own, it can’t possibly run accurate retirement scenarios. It’s garbage in, garbage out. Amanda has heard of financial planning software and decides to sign up for a trial of WealthTrace to see if it will suit their needs.

Starting With WealthTrace

Amanda starts by creating a plan that includes their current salaries, $120,000 and $110,000, their annual living expenses, $80,000, their investment assets, $390,000 in taxable accounts and $500,000 in traditional retirement accounts. They add their estimated Social Security payments which they will be taking at their Full Retirement Age (FRA), and their future spending goals.

Both plan to purchase a new car twice during their plan, starting at age 50, so she adds that in the “Goals & Additional Expenses” section along with their annual mortgage payment of $25,000.

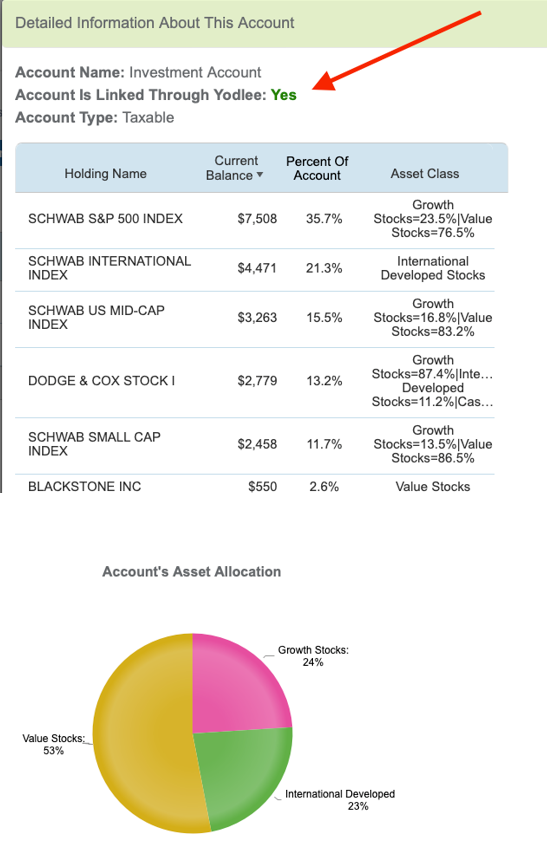

They choose to link their investment accounts directly to their plan using our third-party integration partner, which enables WealthTrace to be able to drill into each holding to find historical annual returns, asset types, and volatility information.

WealthTrace can look at each individual holding and find their asset type and historical returns.

Monte Carlo

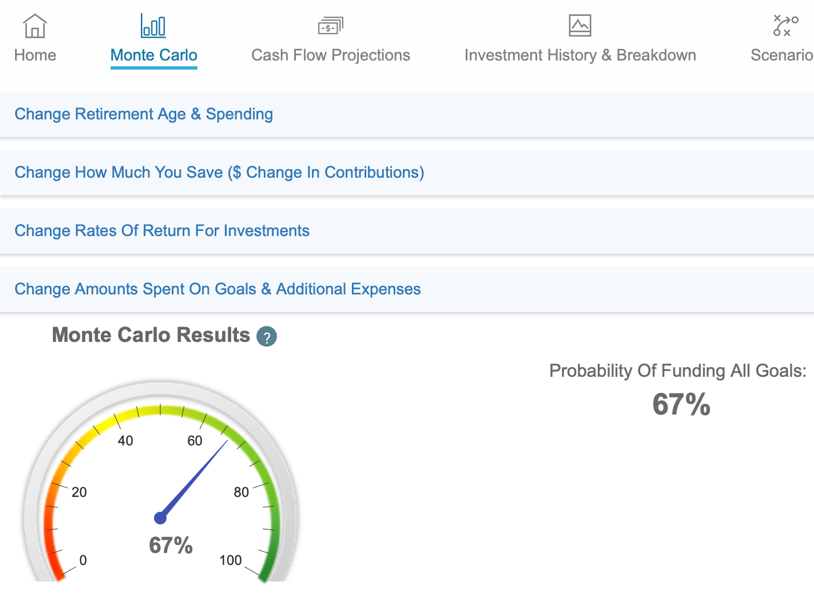

Once Amanda has reviewed her plan assumptions and plan settings, she heads over to review their Monte Carlo results. She is familiar with Monte Carlo as she has heard of it previously. She knows it runs multiple scenarios using her plan data and gives her a percentage probability of never running out of money.

The WealthTrace Monte Carlo simulator is particularly accurate because it can look at every holding you own throughout every account. Each holding is mapped to an asset type and then historical information on annual returns, volatility, and correlations are retrieved. This important information is assigned to every holding and then simulations are run on the annual returns every year. By mapping everything down to the holding level, WealthTrace can produce the most accurate Monte Carlo results.

Amanda sees a Monte Carlo probability of 67% for her plan, which is not as high as she would like. She wants to figure out how she can make changes to their retirement plan to receive a higher probability and give her and Owen ease of mind.

What if They Spend Less?

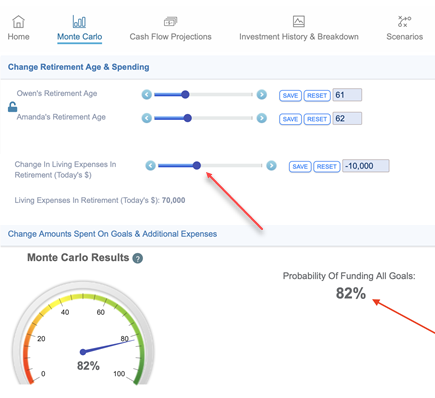

Above the Monte Carlo Results, Amanda notices that she can click on the headers and quickly explore scenarios of how she can improve their results. She can see in real-time what happens if they decide to retire later, spend less, save more or re-allocate to a more aggressive portfolio.

She decides that retiring later is not an option for them and saving more might be tricky. However, spending less annually is something they have discussed, so she uses the slider and sees that reducing their annual living expenses in retirement by $10,000 increases their probability to a more comfortable 82%. The ability to quickly analyze their retirement plan and make changes on their own time is one of many things that Amanda appreciates with the software.

Asset Allocation

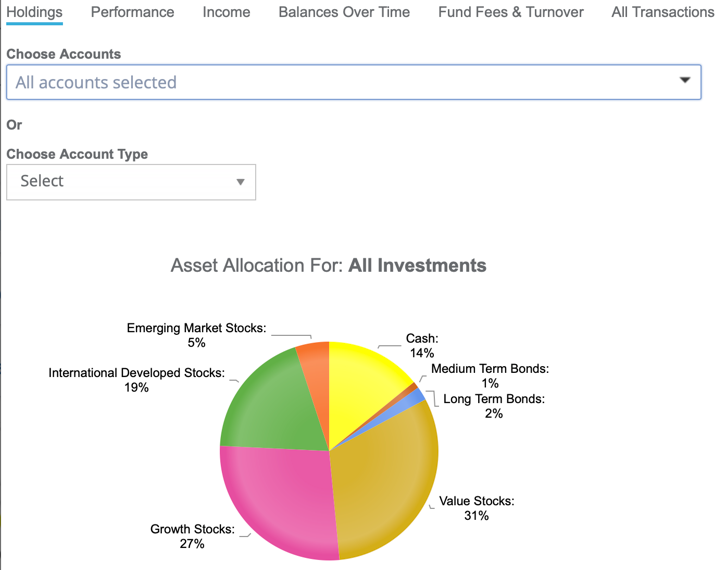

Amanda does not want to jump the gun and plan to reduce their annual expenses in retirement unless absolutely necessary. They both linked their investment accounts directly to their plan which means she can view all their accounts in one place, which is something that was not previously possible for them.

They can now dig into their asset allocation to see if there are changes they can make to their investments to generate higher returns to help fund their retirement.

Roth IRA Conversions

Amanda and Owen have talked about whether it would be wise for them to convert their IRAs to Roth IRAs, and she wonders if this could help increase their odds of a successful retirement.

In the Roth IRA Conversion Scenarios section she runs a scenario where she starts converting her $200,000 IRA to a Roth IRA at age 48 over 10 years. They want to stay under 24% Federal Tax Bracket, so she selects that as well.

As displayed below, she can view her Base Case scenario and her Roth Conversion scenario and quickly deduce whether a Roth Conversion makes sense. In Amanda’s case, converting her IRA to a Roth IRA slightly increases the amount left at the end of their plan.

She can view the amount to convert annually in the table below and see how the conversion would affect her future RMD’s, taxable income, Medicare premiums, and much more.

The Bottom Line

There are many factors that affect whether your retirement plan will be successful. It is vital when you are planning for retirement that you build a plan that is customized and tailored to your situation. Using WealthTrace you can quickly and easily create an accurate and detailed retirement plan, giving you the peace of mind and the ability to track your wealth, your progress towards a successful retirement, and portfolio performance over time.