Key Points

- Social Security will have to cut benefits by 2034 if Congress does not address the program’s impending funding shortfall.

- If Congress does nothing, there will be only enough money to pay around 78% of promised benefits.

- It is important to run what-if scenarios on Social Security payments to see how your retirement holds up if benefits are cut.

The Social Security program, a critical source of income for millions of retirees and disabled beneficiaries in the United States, is facing a potential threat. According to the Social Security and Medicare trustees' annual report released in September last year, if Congress fails to address the program's long-term funding shortfall, benefits may be cut by 2034. This is a year earlier than reported previously, and by that time, the combined trust funds for Social Security will be depleted, paying only 78% of promised benefits.

The COVID-19 pandemic and the economic recession have been cited as the primary reasons for the accelerated depletion rate. The big drop in employment and the resulting decline in revenue from payroll taxes have significantly impacted the financial stability of the program. In this blog post, we will delve deeper into the factors contributing to the funding crisis and discuss potential solutions to ensure the future of Social Security.

You can prepare for potential cuts in Social Security benefits by running what-if Social Security scenarios using the WealthTrace Financial & Retirement Planner.

The Impact of COVID-19 and Economic Recession

The COVID-19 pandemic has had far-reaching consequences on various aspects of our lives, and the Social Security program is no exception. The widespread job losses and reduced working hours experienced during the pandemic have led to a significant decline in payroll tax revenue, which is the primary source of funding for the program.

Furthermore, the trustees project a higher mortality rate through 2023 and a delay in births in the short term, both of which can exacerbate the strain on the Social Security system. The higher mortality rate means fewer people are paying into the system, while a lower birth rate implies that there will be fewer workers to support the program in the future. However, it's important to note that the long-term effects of the pandemic on the funds remain unclear, and the trustees will continue to monitor developments.

A Looming Crisis: The Depletion of Social Security Trust Funds

The depletion of the combined trust funds for Social Security by 2034 is a cause for concern. If this occurs, the program will only be able to pay 78% of the promised benefits to retirees and disabled beneficiaries. This reduction in benefits could have severe consequences for countless Americans who rely on Social Security as their primary source of income during retirement.

It's worth noting that the Social Security program has faced funding challenges in the past. However, the current situation is different and more dangerous due to the combination of an aging population, lower birth rates, and the effects of the COVID-19 pandemic on the economy.

What You Can do to Prepare

The first thing nearly everybody should do is create a retirement plan. After setting up your retirement plan you can run important scenarios. What if Social Security benefits are reduced? What if the Full Retirement Age (FRA) is changed to a higher number for you? How would these changes impact your retirement situation?

Using WealthTrace you can quickly see if you would be impacted in any major way by these changes.

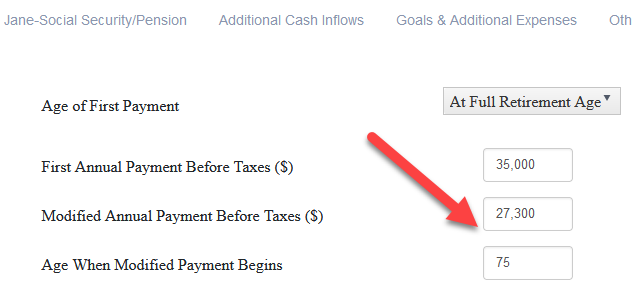

Change the projected Social Security payment in any year. In this example Social Security benefits are reduced by 22% in 2034.

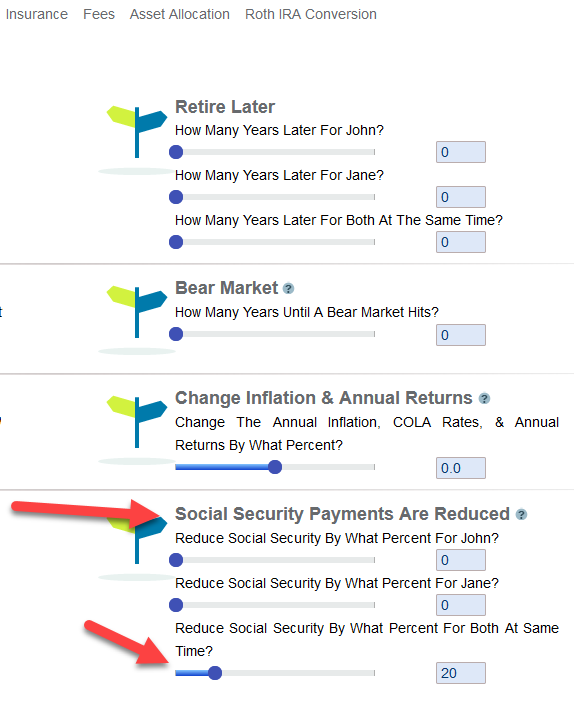

Run a quick what-if scenario on Social Security benefits being reduced for either person in the retirement plan or both at the same time.

It’s possible that after viewing these what-if scenarios you realize you need to prepare better. To prepare for possible cuts in Social Security benefits you can do everything you can to save more money for retirement, consider working part-time in retirement, and make sure you maximize your Social Security benefits, whatever they end up being.

Potential Solutions to Ensure the Future of Social Security

To safeguard the future of the Social Security program and prevent benefit cuts, Congress can implement measures that can stabilize the trust funds. Some potential solutions that have been discussed are:

Raising the payroll tax rate: Increasing the payroll tax rate could help generate additional revenue to support the program. However, this option may face opposition from those who believe that higher taxes could hinder economic growth and job creation.

Increasing the taxable wage base: Currently, only earnings up to a certain limit are subject to Social Security taxes. By raising this cap, more revenue could be generated for the program without increasing the overall tax rate.

Adjusting the retirement age: Gradually raising the retirement age could help alleviate some strain on the system, as individuals would work and contribute to the program for a longer period.

Means-testing benefits: Implementing means-testing for Social Security benefits could ensure that the program provides support to those who need it the most. This approach would involve reducing benefits for high-income earners, freeing up funds for lower-income beneficiaries.

Encouraging private retirement savings: Promoting private retirement savings through tax incentives and other measures could help reduce the reliance on Social Security as the primary source of retirement income, easing the burden on the program.

The Future of Social Security Depends on Congress

The Social Security program faces challenges due to various factors, such as the COVID-19 pandemic, economic recession, and demographic changes. With the 2034 deadline in sight, it is important for Congress to address the funding shortfall to ensure the continued availability of benefits for the millions of Americans who rely on Social Security during their retirement years. By considering and implementing a combination of the potential solutions mentioned above, it is possible to maintain the stability of this program for future generations.

Do you know if your retirement plan can withstand any cuts to Social Security benefits? If you aren’t sure, sign up for a free trial of WealthTrace to get started on your financial and retirement planning.