For many investors approaching retirement income planning for retirement has become extremely difficult, if not downright impossible. So many people had hoped to live off of income generated by relatively safe treasury bonds and high quality corporate bonds, but that strategy is out the window for most given where interest rates are today.

Not only are interest rates historically low today, but the Federal Reserve has no intention of letting them rise anytime soon. It is best to assume that interest rates will stay low for a long time to come.

In this article I want to show just how difficult it has become to cover expenses with just income in retirement if an investor is looking to do this with fixed income. I also want to show an alternative to this: Using dividend-growth stocks; but not just any dividend-growth stocks. I want to show how investing in dividend payers with a solid history of dividend growth, even in recessions, can help retirees live off of their income in retirement without touching their principal.

Let's first start off by looking at how much easier it was to live off of bonds in retirement in 2007 when the ten year treasury yield was 5%. I want to look at a couple that is currently 50 years old and will retire in 15 years. My assumptions are below.

| Inflation (CPI) | 2.5% | | Current Age of Both People | 50 | | Age Of Retirement | 65 | | Age When Both People Have Passed Away | 85 | | Social Security at age 67 (combined) | $35,000 per year | | Average Savings Rate | 6% on Income of $100,000 | | Total Investment Balance Today | $800,000 | | Recurring Annual Expenses in Retirement | $50,000 | | Investment Mix | 70% U.S. Value Stocks, 30% Treasuries. Switches to 100% Treasuries at Retirement | | Investment Location | 50% in taxable accounts, 50% in IRAs | | Return Assumption Value Stocks | 6% per year | | Standard Deviation Value Stocks | 16.20% | | Return Assumption Treasuries | 2.7% per year | | Standard Deviation Treasuries | 7.20% | | |

First note that this couple plans on switching completely to treasuries when they retire at age 65. If treasury yields were at the level they were in 2007 this couple would not have any problems. I generated the analysis and graph below using our Retirement Planner. I assumed they invested all of their money at retirement in 10 year treasury bonds yielding 5%, which was the 10 year yield in 2007.

Notice how expenses are covered by income every year in retirement. Not only are expenses covered by income, but this couple will have nearly $900,000 left at the end of their plan. That is a very large safety buffer and it is obvious this couple will have no problem meeting their retirement goals.

But this was before treasury yields fell to below 3%. Using today's yields we see the following:

It now becomes painfully obvious that there is no way this couple can use income for their retirement expenses. Not only that, but their safety buffer (the amount left at the end of their plan) falls to less than $200,000. Also, their probability of success using Monte Carlo analysis falls to 60% from 97% when yields were higher.

Now that we know the problem, what is the solution? May investors have turned to dividend-growth stocks that have a solid history of increasing their dividends over time. One of my favorite such stocks is Johnson & Johnson.

I propose using a combination of high quality dividend-growth stocks and treasury bonds to generate income in retirement. The types of dividend-growth stocks I am referring to are those that consistently raise their dividends and have shown that they can raise their dividends even during recessions. Some other companies that fit this bill are Procter & Gamble (PG), Coca-Cola (KO), Exxon (XOM), Chevron (CVX), Intel (INTC), and Wal-Mart (WMT).

I am also most definitely not recommending that people invest in only one dividend-growth stock. Investors should diversify among many dividend-growth stocks that have characteristics similar to JNJ. I am only using JNJ as an example for this discussion.

Let’s take a look at what makes companies such as Johnson & Johnson such a solid investment for retirement portfolios.

| Div. Yield | Div. Growth

Rate (1 Yr.) | Div. Growth

Rate (5 Yr. Annualized) | Payout Ratio | Growth of

Dividend (1/2008-12/2009) |

| 2.9% | 8.2% | 8.4% | 57% | 18% |

Not only does Johnson & Johnson have a reasonable dividend yield of 2.9%, but their dividend has been growing at a solid rate of 8.2% over the past five years. Their payout ratio is relatively low at 57%, which leaves even more room to grow their dividend over time. And perhaps the most amazing statistic is their dividend growth rate during the painful recession of 2008-2009. Even in this environment they were able to grow their dividend by 18%.

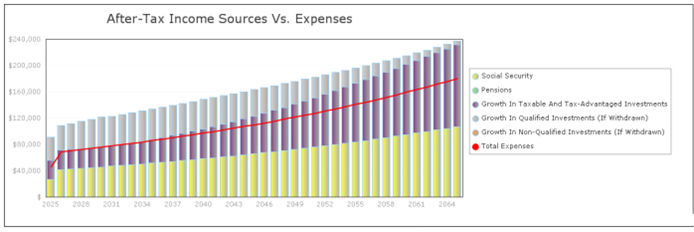

Let's take a look at what happens if they move half of their money into a basket of dividend-growth stocks that have an average dividend yield of 3%, an average dividend growth rate of 7%, and average stock price growth of 3%.

We now see that this couple easily covers their expenses with income (thanks to their dividend payments). They will now have a safety buffer of over $800,000 at the end of their plan and the probability of plan success jumps to more than 90%.

Income planning has become vastly more difficult in today's environment. But with a little bit of research and the right mix of high quality dividend-growth stocks, those approaching or in retirement can still generate enough income to cover all of their expenses.