The market is having fits again. But you can take advantage by locking in higher dividend yields for retirement.

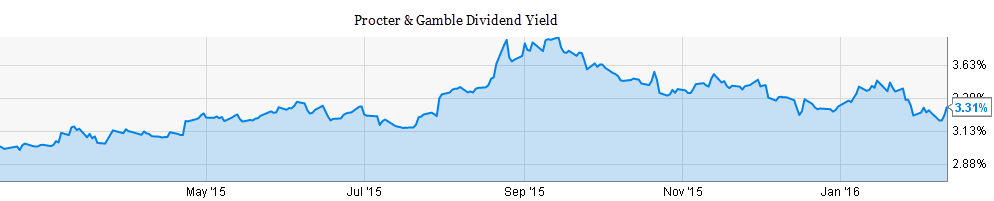

Just one year ago Exxon (XOM) had a dividend yield of 2.9%. But after a stock decline of nearly 30%, its dividend yield is now 3.7%. Johnson & Johnson (JNJ) had a dividend yield of 2.7% earlier this year, but now has a yield of 3%. Procter & Gamble (PG) had a dividend yield of 2.8% late last year, but now has a yield of 3.3%.

Let's analyze just how rising yields can impact a couple's retirement situation. The previous portfolio has a dividend yield of 2.5%. The new portfolio has a yield of 3.5%. I will also assume that dividends grow by 5% annually and the stock price rises by 2% each year.

| Starting Yield | Div. Growth

(Annually) | Price Increase

(Annually) |

| Old Portfolio | 2.5% | 5.0% | 2.0% |

| New Portfolio | 3.5% | 5.0% | 2.0% |

I will also make the following assumptions for a sample couple who is saving for retirement:

| Inflation (CPI) | 2.5% |

| Current Age of Both People | 45 |

| Age Of Retirement | 65 |

| Age When Both People Have Passed Away | 85 |

| Social Security at age 67 (combined) | $40,000 per year |

| Average Savings Rate | $10,000 per year |

| Total Investment Balance Today | $400,000 (50% in Taxable, 50% in IRAs) |

| Recurring Annual Expenses in Retirement | $70,000 |

| Investment Mix | 70% Dividend Growth Stocks,

30% Medium Term Treasuries |

| |

Using our personal financial planning software I generated results for the plan using the older portfolio with the lower dividend yield. The results are below:

| Investment Amount At Retirement | $950,000 |

| Investment Amount At Plan End | $0 |

| Age Of Shortfall In Funds | 86 |

| Probability Of Never Running Out Of Money | 32% |

This couple is in trouble. They run out of money when they are 86 years old.

Even though they will have nearly $1 million when they are retired, their money runs out when they are 85 years old. Also, using our Monte Carlo analysis where 1,000 different scenarios are generated each year, we found that the probability that they never run out of money is a dangerously low 32%.

Now let's look at the results with the higher dividend yields:

| Investment Amount At Retirement | $1,100,000 |

| Investment Amount At Plan End | $615,000 |

| Age Of Shortfall In Funds | Never |

| Probability Of Never Running Out Of Money | 56% |

This looks much better. We project that they will have over $600,000 left at the end of their plan (when they are 85 years old) and the probability of plan success went up by over 30%. This all from just a 1% increase in the dividend yield!

For this couple it still appears that $1.1 million might not be enough for them to retire comfortably. I have written before about analyzing the question how much do I need to retire.

So it's time to make lemon out of lemonades. Interest rates are still historically low, but dividend yields are climbing. The S&P 500 dividend yield is still only 2.1%, while over the last 150 years, the average yield is a much greater 4.4%. If reversion to the mean does occur, we could be in for a wonderful income investing opportunity.