Key Points

- More people than ever are retiring before age 60, but need to answer the question: How much do I need to retire at 55?

- There are several important items to take into account before making this important decision, including how much you have saved, projected spending, and projected retirement income.

- It is extremely important to have a retirement plan in place before making the decision to retire.

How Much Do I Need to Retire at 55?

I have written a number of articles before about how much money you need to retire. Not that long ago I looked at a hypothetical 50-year-old couple hoping to retire by 60. (Spoiler alert: I made some adjustments to their plan and got them there!) I used WealthTrace’s financial planning software for individuals to run these scenarios. You can build your own retirement plan in WealthTrace as well by signing up for a free trial.

I then had many requests for another analysis for people wanting to retire at age 55 or earlier. So as requested, this article will analyze the situation where a couple wants to retire by age 55 and are asking the question, how much do I need to retire at 55? The answer has changed quite a bit since inflation began increasing in 2021 and is above 8% in 2022.

Levers, Not Leverage

Before getting to a case study to answer the question of “Can I retire at 55”, let's zoom out for a second. You normally have a variety of levers you can pull when looking at retirement. If you target a certain age for retirement, you eliminate how far you can pull one of those levers, which is time--you are taking away the option of delaying retirement beyond a certain date. That's OK; it's just something to be aware of.

It also likely means you'll need to be pulling hard on the remaining levers, which are basically these:

- Spending. What is your spending like, both pre-retirement and post-retirement?

- Saving. How much money are you socking away pre-retirement?

- Investing. This one is directly related to saving: Where are you saving what you're saving? What are you earning on your investments? You can't just put the funds in a bank account and hope for the best. The more aggressive you're willing to be in your investments, the better chance you have at hitting that goal of being able to retire at 55.

- Prioritization. You may have a list of things you want to do when you retire. What comes first? What comes last? You may not be able to do them all (or at least not all of the ones that cost money!). Willingness to compromise in this regard can make a big difference in getting to retirement at 55.

With that out of the way, let's get to it.

The Drive To 55

This time around, let's consider a couple in their mid 30s. Their goal is to retire early and they have asked “Can I retire at 55?” They have one child whom they would like to think will be going to college when the couple is in their late 40s. They would also like to believe they will be in a position to help pay for the child's education. The "Prioritization" item from the list above could come into play here.

Some of the fine-print assumptions for our couple include an annual inflation rate of 3%, combined Social Security income of $50,000 starting at age 67, and an 8% average annual return on their investments.

We also assume that the couple brings in $200,000 combined via salary, and that they're contributing 8% of that salary to their 401(k) plans, which have a combined $100,000 value at the beginning of their plan (age 35). Their employers offer dollar-for-dollar matches up to the first 6% of contributions.

They also have a taxable brokerage account worth $250,000 earning 8% and a bank account worth $15,000 earning next to nothing. Finally, we assume $70,000 in living expenses in retirement.

How does it look for an early retirement given these assumptions? Well, it could certainly be better.

The good news is that, using a straight-line assumption of 8% annual return per year on their investments, they would be just fine. They are projected to have a little over $1 million at their retirement age of 55. You can see more of their results below:

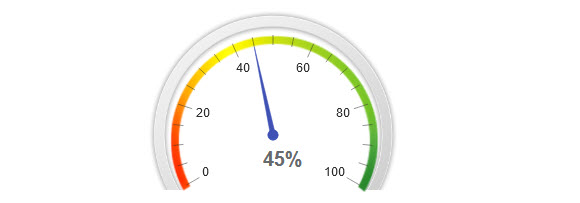

The bad news is that straight-line assumptions don't fully apply to the real world--especially a steady 8% return year-in, year-out. We used WealthTrace’s retirement planning software for personal use to throw a Monte Carlo retirement simulation at this. Monte Carlo analysis (in short) randomizes returns and assigns a probability of plan success based on how many times they never run out of money. For this couple, things aren't looking so great according to the retirement planning software:

So $1 million at their retirement age of 55 probably won't cut it. If this couple asked me, "Can I retire at 55?" I would tell them, "I wouldn't risk it without some changes."

Remember the levers? It's time to start pulling!

Save It For Later

Probably the best thing this couple can do to push that needle to the right a bit is to save more. That 8% pre-tax 401(k) contribution is a good start, as is the employer match, but a little more would go a long way. Most people should do everything they can to max out contributions on their 401(k) plans if they want to retire early.

They might also consider starting contributing to a 529 plan, which is a tax-advantaged savings plan for future college costs. If they could manage to put $5,000 per year into such a plan, and get that 401(k) contribution up to 12% of pretax salary from 8%, things are looking better:

If I were working with these clients, I would try to get that 63% number higher by using our other levers. When they are young they might to invest a portion of their assets in some higher-return, higher-risk assets. They should also start thinking about working a bit longer. Retiring at age 55 might not be in the cards for this couple unless they can start saving more money.

What about You?

The chance that your situation is exactly like this one is pretty slim, of course. But your main takeaway should be that retirement is in your control. You have a number of levers you can pull; you just need to use them effectively.

And if you are fortunate enough to be considering early retirement, you should know that there are strategies that allow you to draw down on your retirement money penalty-free before the typical retirement date. You'll want to bring in a professional if you want to explore this option. We can help via an expert planning session.

Do you want to answer questions such as “Can I retire at 55” or “How much do I need to retire at 55”? Sign up for a free trial of WealthTrace to find out if your retirement plans are on track.