Key Points

- Free retirement calculators are easy right? But they can be very inaccurate and dangerous.

- Free calculators are fine for a quick estimate, but you do not want to base big decisions on them.

- You must use accurate, detailed software like WealthTrace when making retirement decisions.

Use A Retirement Calculator With All The Details To Get Meaningful Information

You probably know the saying "garbage in, garbage out." It originates with computer programming: If the programming is sloppy, the results will be inaccurate.

The same idea applies to a lot of things. But it has an important corollary, albeit a less catchy-sounding one: Incomplete data in, inaccurate results out.

Take The Long Way

What we're talking about here is calculating what you need to have saved in order to retire, and what you can reasonably assume you'll be able to spend in retirement. Taking shortcuts when putting these calculations together (the "incomplete-data-in" part) can lead to big surprises or even disaster (the "inaccurate-results-out" part) if it means you find out too late that you don't have enough saved.

In planning for retirement, you're already making assumptions about something that is, by its very nature, unpredictable. The more accurate you can be about the knowns, the less impact the inevitable inaccuracies about the unknowns will have.

Even the most popular free retirement calculators out there fall dangerously short. Let's have a look.

T. Rowe Price Retirement Income Calculator

The retirement planner from this asset management company is not bad as far as it goes, but it does not go far enough. On the plus side, it includes a Monte Carlo simulation that runs through 1,000 different outcomes. WealthTrace has this as well, and we approve.

But there are too many limitations to the calculator to make it useful. Taxes? No mention of them to be found in this calculator. Also, there's one single total return number--4.9%--that gets applied to the entire stock market. Any stock you buy is assumed to return 4.9%.

You need more control over total return numbers to get more accurate results.

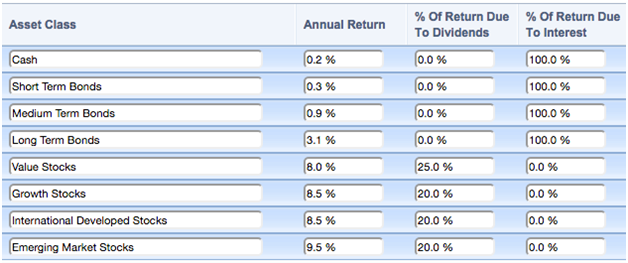

Let's see how WealthTrace handles this-

With WealthTrace, not only can you specify total return numbers for different asset classes (and we include some to get you started), we allow you to specify where the returns are presumed to come from (dividends, interest, or capital gains), so your taxation assumptions are more accurate.

"Explore your options in 10 minutes or less" might make for nice marketing copy, but don't the last 30 years or so of your life warrant more consideration than just 10 minutes?

CNN Retirement Needs Calculator

This calculator makes far too many assumptions (which you have no way of adjusting) to be useful: The rate of inflation, rate of salary growth, the percentage of current income you'll be able to live on in retirement, and many more items are all locked down. Perhaps worst of all, the calculator assumes a single total return figure of 6%, regardless of asset class--stocks, bonds, cash, whatever.

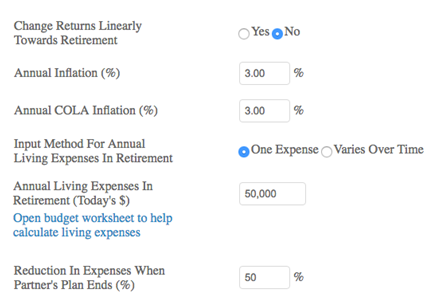

There's a fine line between keeping things simple and dumbing things down. CNN, true to form, dumbs it down in a major way with this calculator. You need control over more inputs to get meaningful results. Here are just a few offered by WealthTrace:

Vanguard Retirement Income Calculator

We have a lot of respect for Vanguard, but their calculator is another one that is simply too basic to get you reasonably accurate information. You can only choose a single average annual rate of return, for example, and taxes are barely addressed.

Vanguard also uses the so-called "4% rule," which assumes that, each year in retirement, you can spend 4% of what you have accumulated at the start of your retirement. But not everyone is comfortable with that rule anymore, and anyway, wouldn't you like to test it by running some hypotheticals? WealthTrace lets you do so.

What If?

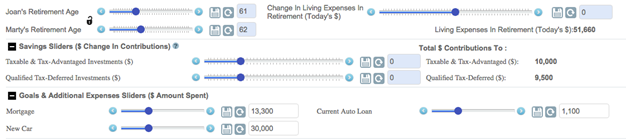

And speaking of hypotheticals, what happens if one of these calculators gives you the "sorry, you're not on the right track" message? Most likely, you would want to know why: What items are pushing my spending beyond my means in retirement? What can I do about it? These free calculators can't help you with follow-up questions, but WealthTrace once again has you covered:

You can change all of the items with the blue dots in this image on the fly, and see immediately how those changes might affect your plans. We have written a popular piece title "how much do I need to retire?"where you can see our powerful software in action.

For a detailed, accurate look at your retirement situation, sign up for a free trial of WealthTrace.