Key Points

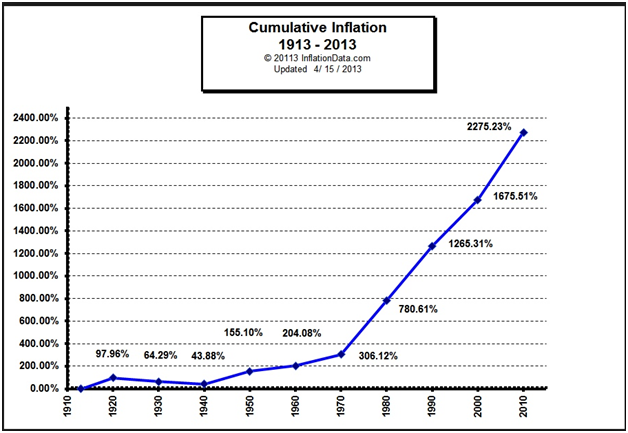

- Inflation creates phantom taxes on investments that most people don’t understand.

- The higher the inflation rate, the more taxes you will pay.

- Keeping more money in tax-deferred accounts can limit, but not erase, the taxes that inflation creates.

Most of us know that inflation means prices are generally rising and most of us take it as a given that inflation will occur pretty much every year. But what many don’t know is how big of an impact inflation can have on one’s retirement plan.

There are so many articles written about the same financial topics, over and over again, that surprisingly little is dedicated to the topic of how inflation impacts retirement portfolios. Most people know that inflation means their expenses will rise over time, and of course that can impact anybody’s retirement situation. But what the vast majority of the population does not understand is that inflation also creates phantom taxes for nearly everybody due to our complex tax code.

Social Security Is Taxed And Taxed Again

How many people know that Social Security payments are taxed twice? It’s an outrage that has been happening for quite a while You pay income taxes on your salary, including the portion you pay into Social Security. But when you receive your Social Security benefits, you’re taxed on those payments too! This means double-taxation. When Social Security was first begun, we were rightly not taxed twice on it. But in 1983 Congress slipped in a tax on the “wealthy” that most people could ignore. However, in their infinite wisdom, they did not index the tax brackets to inflation. So over time more and people have had to pay taxes on their Social Security payments. Within 20 more years, everybody will be double-taxed on Social Security simply due to inflation pushing everybody into the taxable bracket. You can read more about this double-taxation scheme here.

So the higher inflation is, the faster everybody moves into being taxed on their Social Security payments, and most people have no idea this is happening.

Phantom Inflation Taxes On Capital Gains

Owning a second home and renting it out can be a great way to earn extra income. You will pay income taxes on the rental income, but that is fairly straightforward and most people understand it. But what surprises many people is the taxes they will pay when they sell the property.

Let’s take a look at a typical scenario: Jim owns a second home and rents it out. He bought it this year for $300,000. He plans on renting it out for 20 years. Over the next 20 years the housing market in his area just keeps up with inflation of 3% per year. Inflation of 3% per year over 20 years is 80% inflation compounded over this time frame. So the house is now worth $540,000 for a “gain” of $240,000. But this gain is a phantom gain since all of it was due to inflation. And guess what, you can’t write that part off. Jim will be paying capital gains taxes of $36,000 on a $0 real gain. If you think that seems unfair, well join the club. And if you’re thinking the same issue occurs with stocks whose gains move with inflation, you’re spot on.

Inflation And Your Retirement Portfolio

OK, so we’ve talked about how and why inflation can impact a retirement portfolio, but how big is the impact really? The best way to find out is to run the numbers in the WealthTrace Retirement And Financial Planner. You can sign up for a free trial yourself and see how your plan would hold up as well.

I looked at a 45 year old couple for my case study. My starting assumptions are:

| Inflation (CPI) | 2.0% |

| Current Age of Both People | 45 |

| Age Of Retirement | 64 |

| Age When Both People Have Passed Away | 90 |

| Social Security at age 67 (combined) | $40,000 per year |

| Average Savings Rate | $10,000 per year |

| Total Investment Balance Today | $600,000 |

| Recurring Annual Expenses in Retirement | $60,000 |

| Investment Mix | 70% U.S. Value Stocks, 30% Medium Term Treasuries |

| Investment Location | 25% in taxable accounts, 75% in IRAs |

| Return Assumption Value Stocks | 6% per year |

| Standard Deviation Value Stocks | 16.20% |

| Return Assumption Treasuries | 2.5% per year |

| Standard Deviation Treasuries | 7.20% |

Before getting into the results, it is important to point out that I also increased the annual return assumptions for all investment assets along with inflation in each scenario. In general stocks’ returns tend to move with inflation as revenues tend to increase with inflation. Also, over the long run bond returns move with inflation as yields increase. Below you can see the results of a few different scenarios with varying rates of inflation:

| Inflation Rate | Amount Of Money

Left At Age 90 | Probability Of Never

Running Out Of Money |

| 2.0% | 718,000 | 63% |

| 2.5% | 690,000 | 62% |

| 3.0% | 671,000 | 61% |

| 3.5% | 660,000 | 60% |

| 4.0% | 649,000 | 59% |

We can see that if inflation is 2% higher than what we expect, their portfolio value would fall by about $69,000. This isn’t good news, but it’s also not the end of the world for them. Their probability of never running out of money drops by 4% in this instance.

What If Most Of The Money Is In Taxable Accounts?

In the first scenarios I ran, 75% of their portfolio was in tax-deferred accounts. What if instead only 25% was in tax-deferred accounts and 75% was in taxable accounts? I tested this by running the same plan with these new ratios and I found the following:

| Inflation Rate | Amount Of Money

Left At Age 90 | Probability Of Never

Running Out Of Money |

| 2.0% | 550,000 | 54% |

| 2.5% | 500,000 | 52% |

| 3.0% | 451,000 | 50% |

| 3.5% | 421,000 | 48% |

| 4.0% | 392,000 | 46% |

The drop in their overall portfolio value is now $158,000. This is nearly triple the decline in their investments that we saw in our first example when they had more money in tax-deferred accounts. The explanation for this is worthy of an entire article itself, but generally speaking this occurs because the IRAs are tax-deferred and the money gets to grow longer before the phantom inflation taxes (and all taxes) kick in.

Lessons Learned

It goes without saying that we have yet another reason to max out our 401(k)s and IRAs. They are great investment vehicles for retirement and they can help take the sting out of phantom taxation. Also, we should not assume that today’s relatively benign inflation environment will last forever. Inflation has swung wildly in the recent past. In the 90s we saw a high of 5.4% and a low of 1.6% for the inflation rate. As recently as 2008 we saw inflation of 3.8%.

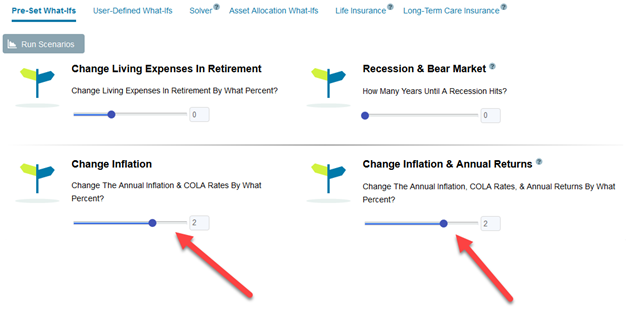

Run Scenarios Yourself

Use the WealthTrace Planner to run scenarios on your own portfolio. You can see in the screenshot below how you can dial inflation up or down and you get to choose what happens to your investment returns while inflation moves.