Key Points

- There are numerous benefits to a tax-deferred investment account like a 401(k).

- It's nearly always preferable to put off paying taxes, and 401(k)s can help with that.

- If you're not participating in your 401(k), get on it; if you are participating, how about bumping up your contributions?

How much money should you have in your 401(k)? It's a tough question. I have written before about how much you should have saved (and invested) overall if you want to retire at a certain age (like 60, or even 50). And I have talked about the average 401(k) balance by age. But I have not addressed this question of how much to put in your 401(k) question directly.

But before getting to that, let's recap the benefits of a 401(k):

You Can Forget About It

With a 401(k), you forget about the

act of saving. You forget about how much higher your paycheck would be without your 401(k) contribution. You don't have to write a check every time you want to contribute to your 401(k), because those contributions are automatic. The money is also not readily available for you to spend, so you are less likely to be tempted to try to get to it.

In recent years, some employers have begun offering the option of automatically increasing your 401(k) savings rate every year. Take advantage of this if it's offered (and do it yourself if it's not).

Tax Deferral

I'll be talking about this particular item more in a moment. But the crux of this benefit is that you fund your 401(k) with pretax money, thereby lowering your current income taxes at a time when your tax bracket is likely higher than it will be in retirement. The funds aren't taxed until later--and later is almost always a good thing with taxes. On top of that, you don't need to worry about tracking capital gains and the taxes that result from them. Once you start taking the money out, it will be taxed as ordinary income regardless.

Matching

We are talking about free money here. The amount varies considerably by employer, but there's a good chance that your employer will match a portion of your 401(k) contributions. It could be dollar for dollar up to a certain amount or percentage; it could be fifty cents on each dollar contributed up to a point. In any case, that match should be a big incentive to take part in the plan. At the very least you'll want to participate to the extent that contributions are matched, but while you're at it, why not max it out, or get close?

Cheap Funds . . . Maybe

Institutional classes of funds that might normally require big minimum investments (like $1 million or more) are often offered as part of 401(k) plans. Those funds normally offer substantially lower fees than their retail-investor, $100-minimum-investment share classes. Over time, fees on investments can really take a bite out of your returns, so this can be an important benefit. (Just as often, unfortunately, 401(k) plans offer expensive, mediocre funds. But you should invest in them anyway, given their other pluses. If your plan has some index funds, consider those, as they are normally the cheapest and best option.

Target-date funds can be a simple set-it-and-forget-it option too.)

The Importance Of That Whole Tax-Deferral Thing

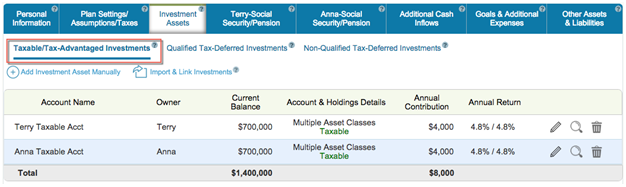

Let's look at two couples with identical savings habits and financial situations. For simplicity's sake, we'll say that one couple saves their money exclusively to 401(k) accounts, and one saves only to taxable accounts. The couples are about 50 years old and hoping to retire in 15 years. Each couple brings in a combined $85,000 in gross annual salary, and each couple projects spending $70,000 annually once retired.

-plan.png?sfvrsn=0)

The first couple invests in 401(k) accounts exclusively. The second couple puts all of their investment dollars into taxable brokerage accounts.

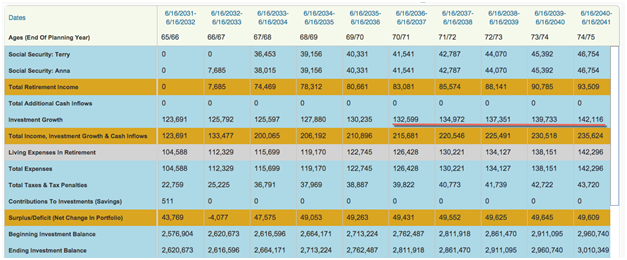

When we run the projections on the two couples' plans, the only differences should be tax related. Let's have a look:

-vs-taxable-account.png?sfvrsn=0)

The first case is our 401(k) couple, and the second is the taxable-only couple. We've highlighted the investment growth line here over a five-year time period. The investment growth is substantially higher for the 401(k) couple, and the difference (in percentage terms) becomes greater each year over time due to the effects of compounding.

The money going in is the same in both cases; the average rate of return is the same as well. But taxes on investment growth are assumed to have been paid along the way in the case of the taxable-only couple. That's not happening with the 401(k) couple.

And that is kind of the point of a 401(k). This would be an even bigger deal for a younger couple, again due to the effects of compounding. Tax deferral is your friend.

Back To The Original Question

We can see that it makes sense to fund a 401(k), just from a tax perspective alone, all else equal. But how much should you have in it?

It really depends on a lot of factors--there's no one-size-fits-all answer. For most people, the answer will be to fund it like crazy, but to not be as extreme as to put all of your investment savings there. As of 2017, you can only put $18,000 in a 401(k) annually (or $24,000 if you're over 50). As a general rule, fund your tax-deferred accounts (401(k) accounts and IRA accounts, usually) first.

Later On

Once you get to age 70 1/2, you'll have to start taking distributions from your IRA (which is what your 401(k) will normally become after you retire). It's the law. This means taxes will finally come due.

WealthTrace can estimate what those required minimum distributions (RMDs) will look like, and how they will be used (or not used, in which case they might flow into a taxable account).

That comes later--and later is better than now when it comes to taxes. But now is far better than later when it comes to saving and investing. A 401(k) can be the foundation for a successful retirement plan.

Are you on the path to early retirement? The WealthTrace Financial & Retirement Planner can help you find out. Start a 14-day free trial now.