Key Points

- Wealth management software and web sites aren’t just for the pros anymore.

- Personal finance and wealth management are separate, but related, things.

- Make sure your wealth management software answers a few important questions.

Wealth management software used to be the domain of professionals only. Now, individuals can get their hands on web sites and software as powerful as wealth management professionals use.

Before we dive into this, though, let’s make a few distinctions between a couple of terms. First is personal finance. How much money do you have, owe, save, and spend? Those questions are largely personal finance questions. A budget--also a personal finance item--normally ties it all together.

Wealth management, though, refers to something more. Arguably it encompasses all of the items mentioned above. But it mostly focuses on taking care of your assets--your investments--once you have acquired them. You might be at a stage in life where you are still accumulating those assets, or you might be spending them. But over time they will make up the lion’s share of your wealth, and you likely need help (in the form or a person or some software) managing that wealth.

If you picture a Venn diagram, these two terms usually overlap to a varying degree, depending on who is doing the defining. Throw in financial planning and all three terms would overlap.

In any case, here are a few questions we feel any piece of wealth management software should answer.

What if I invest in other assets instead?

Wealth management is partially about knowing what your other options are--and exploring those options. Just because you’re investing a certain way now doesn’t mean you have to continue investing that way forever. But you want some idea of how any changes will affect you.

WealthTrace can take a close look at what a reallocation of your wealth would mean to your retirement plan.

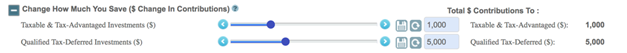

What if I change the amount I’m saving and investing each year?

You could be one of those lucky people who are actually saving at a clip that puts them on track for early retirement. More likely, you might have some catching up to do to get to your target retirement date. Either way, you’ll want to know--and you’ll want to know what the effect would be of socking away a little more (or a little less) each paycheck.

WealthTrace can show you how a small change to retirement contributions can have a big effect on your wealth. Learn more.

When should I start taking Social Security? (And what if it’s not there for me to take?)

For better or worse, a lot of people think of Social Security as the foundation of their retirement plan. But a lot of people are starting to worry that it might not all be there when it comes time to take it. Given the uncertainty, it’s prudent--especially if you’re getting close to retirement age--to run through a number of Social Security scenarios and find out how dependent your retirement plan is on Social Security. Some examples might include:

- What if you take it later?

- What if your spouse takes it later?

- What if your projected benefits are cut by, say, 30%?

Make a few changes and click a button, and WealthTrace will re-run the numbers for you.

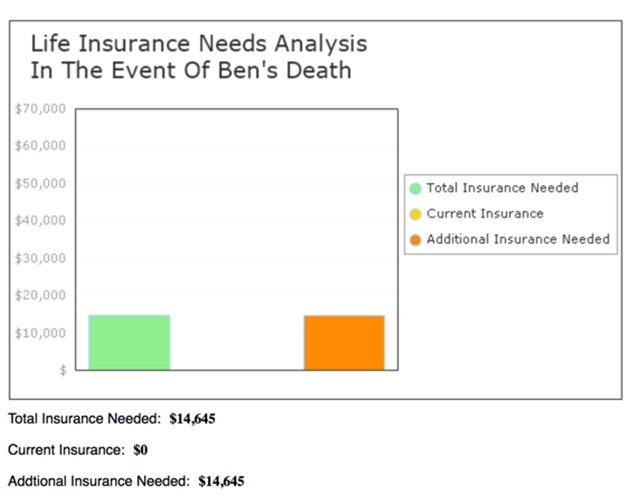

What are my insurance needs?

Insurance often gets the short shrift in wealth management--especially among individual investors managing their wealth themselves. Often, an individual not working with someone whose job is to sell them an insurance package won’t get around to buying it on their own. That can be a mistake.

Yes, it’s important to make sure your spending and budgeting and personal finance matters are in order. But pay as close attention to wealth management too--and make sure these key questions are answered, whether by your advisor or by your software.

WealthTrace is the whole package: Financial planning software that is as powerful as an advisor would require, but easy enough for individual investors to use. Click here to sign up for a trial subscription.