Key Points:

- There is more than one correct way of building an income-generating portfolio.

- It's worth revisiting the most common asset classes that can be sources of income.

- In the end, it's going to have to do with your tolerance for risk and individual situation.

There is more than one right way to generate the income you need in retirement.

That may be obvious, but it's good news, so it's worth stating and spelling out. Each source of income has its pros and cons--and various mixes of asset classes that generate that income have their pros and cons as well.

For the purposes of this article, we'll leave out non-investment income sources, such as pensions or Social Security (but those sources are certainly not to be ignored).

Interest

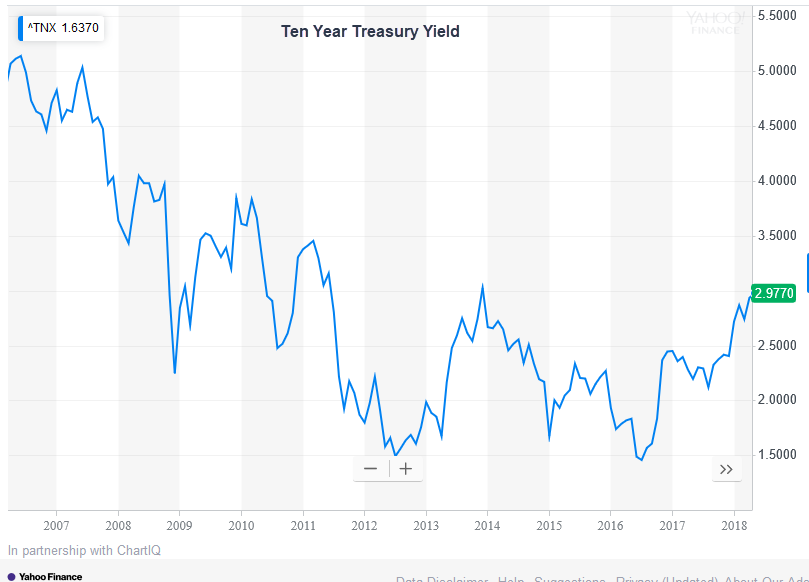

At the most recent Berkshire Hathaway annual meeting, Warren Buffett said, "The one thing we know is we think long-term bonds are a terrible investment at current rates or anything close to current rates." Not long after, JP Morgan Chase CEO Jamie Dimon said, "[The Fed boosting short-term rates more than expected] could force the 10-year up, not down as in the in the past. You can easily deal with 4% bonds, and I think people should be prepared for that."

Buffett was making an observation about sub-3% yields; Dimon was arguably making a prediction.

Buffett was making an observation about sub-3% yields; Dimon was arguably making a prediction.

We would agree that 3% is pretty paltry. 4% would be more palatable if inflation stays in check, given the nature of the asset (virtually risk free and devoid of market volatility).

Although a 4% return isn't going to make anybody rich, there could be a place for it in a retirement plan. It would beat the returns cash will give you, that's for certain.

Keep in mind that bonds with higher interest rates general means more risk. The iShares iBoxx $ High Yield Corporate Bond ETF (HYG), which is largely in junk bonds, has an SEC yield of 4.7%. That sounds pretty good, but junk bonds are called junk bonds for a reason: repayment of the debts issued is no sure thing; default happens.

Dividends

If you can rely on dividends or distributions exclusively, with no need to draw down on the account’s principal, you can worry a lot less about volatility. This is our favorite way to go. Market volatility won't bother you as much if dividends are your biggest source of income, and may even be your friend. If a stock you own with, say, 30+ years of dividend increases is suddenly down 10% or 20% for reasons that have little to do with the company itself (and is the result of simply garden-variety market turmoil), it may be a time to buy more and virtually lock in a nice payout.

Most readers won’t be in the dividends-only boat. But that doesn’t mean some level of relying on dividends won’t work for you.

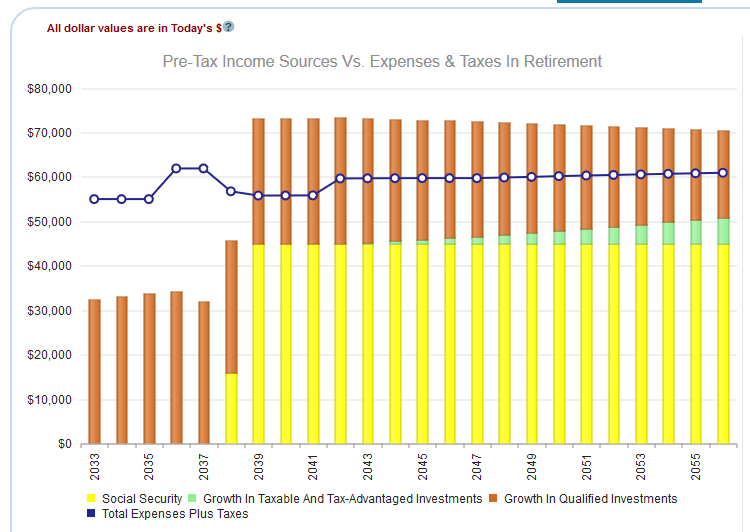

Using WealthTrace, you can view all of your sources of income through time and see if you can cover expenses each year in retirement.

Principal

After years, or even decades, of being diligent about saving for retirement, it can be really difficult for retirees to switch gears and start spending down on their principal. It's a habit that serves a lot of people well, and breaking good habits is not something that comes naturally.

There's a concept known as the 4% Rule, which basically says that if you withdraw 4% of your savings during your first year of retirement, and adjust withdrawals in subsequent years to account for inflation, there's a good chance your savings will last for 30 years.

That sounds great, but the rule has come under scrutiny in recent years. The fact is, the rule is not one size fits all. The flexibility you have in your spending year to year, your mix of assets, and of course how much money you have saved will all factor in to whether the number should be 4%, 3%, or some other figure.

Rebalancing Proceeds (Principal, Sort Of)

Here’s a concept that doesn’t get as much coverage as a potential income source as it probably should.

A lot of people will rebalance their portfolios on a regular basis, perhaps annually. That way, you remedy the situation of a stock or asset class becoming an outsize position relative to where you want it to be.

One option here is to do the rebalancing as normal, but simply take the portion of the rebalancing that is a long-term gain and use it for living expenses

A big issue with this approach will be its variability. You might have some really big years, and you might have some really bad ones--and even multiple bad ones in a row, where you have few or no winners at all. Still, it's another source of investment income to consider.

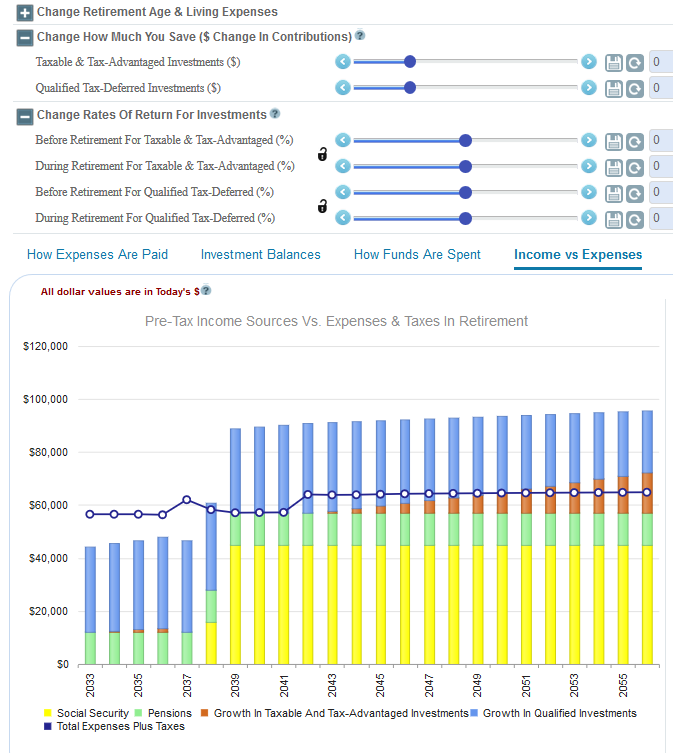

Scenarios That Show You How Things Can Change

Do you think interest rates will continue to rise? Do you want to see how much your retirement income increases if you save more money? Using WealthTrace’s powerful and convenient sliders, you can quickly see how your retirement income changes through time if you change a variety of assumptions. You might be surprised how much just a 1% increase in interest rates can impact a retirement plan. Over time this compounds and can lead to thousands of dollars more per year that you can spend.

Easy Income Scenarios: Change an assumption and quickly see how your retirement income is impacted using WealthTrace.

What's In Your Tool Box?

It's easy to have tunnel vision when it comes to retirement income. The fact is, there are a number of ways to make it work for you. Make sure you understand all the tools available to you, and make use of the ones that make the most sense.

What would increasing your savings rate or investing in different asset classes do to your retirement plan? Could you handle a stretch of stock-market volatility? WealthTrace can help you find out. See how making changes to your investments affects the probability of your plan succeeding. Click here to learn more.