Key Points

- Social Security is now projected to dip into its reserves this year.

- Do not assume that Social Security will pay you your full, promised benefits.

- Something must eventually be done to shore up Social Security, but it might not happen until the last minute.

Many of us know by now that the Social Security fund will not be able to pay out full benefits within 15 years. But there is news today that for the first time since 1982, the cost of the Social Security program will be greater than its inflows. This means that Social Security will need to use part of its $3 trillion fund in order to pay out benefits.

Sooner Than Expected

Just a year ago the projection was that Social Security would dip into its trust fund in 2021. So today’s news is a bit shocking in that it has happened three years earlier than expected. The main reason cited for this is lower economic growth projections.

Social Security gets its funds from payroll taxes paid by both workers and employers. Any amount not paid out to current recipients goes into the trust fund. It is this trust fund that is now being tapped.

The costs of both Social Security and Medicare are rising quickly due to the country’s aging population. Slower economic growth over the past decade have added to the woes of the program.

Around 61 million people receive retirement or disability payments from the Social Security program while a little over 58 million use Medicare benefits.

How To Use This Information

We have discussed this issue extensively before. Congress will likely kick the can down the road as long as possible. Then you can bet that they will cut benefits for those who “don’t need” as much money. That means those with a lot of assets and/or income. They might also start increasing the age at which we can take Social Security, as well as increasing the maximum pay subject to the Social Security tax.

If you fear that Social Security might not be fully there for you in retirement, you need to take action and see how this might impact your retirement plan. You can use the WealthTrace planning software to run scenarios on what reductions in Social Security might do to your plan.

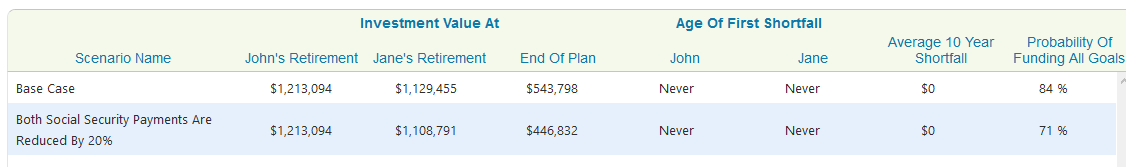

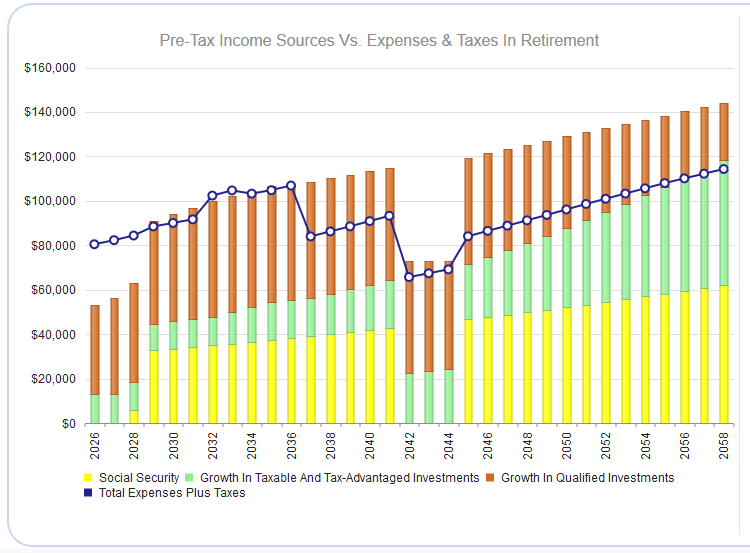

In the above scenario I wanted to see what happens to this couple if their Social Security payments are reduced by 20%. You can see that the money they have left at the end of their plan (when both people have passed away) is reduced by almost $100,000. Also, their probability of never running out of money declines by 13%.

What Else Can You Do?

First off, if you plan on having more than $1 million in retirement, you should assume that your full Social Security benefits will not be there as Congress is very likely to go after high net worth individuals. So instead you need to make sure your other income in retirement covers your expenses.

You can do this by investing in solid dividend paying stocks and making sure you max out your contributions to your 401(k) plan if you have one.

You should also see if a Roth Conversion makes sense for you. This is one easy way to potentially save a lot of money in retirement by reducing the taxes you pay. It’s possible that converting to a Roth IRA from a non-Roth IRA during low tax years can help you significantly reduce your future tax burden.

So don’t just bury your head in the sand. Figure out how much income you need in retirement to never run out of money. Then run some what-if scenarios to figure out how much of a cut in Social Security you will be able to take. This will help you make important decisions (such as possibly retiring later) so that your retirement is secure.