Key Points

- Many Americans are playing roulette with their retirement as they don’t have enough saved for emergencies.

- It’s so important to start saving early and often in order to have a safety buffer of investments for unexpected expenses.

- By saving early in life you can take more risk and thus reap higher returns over the long run.

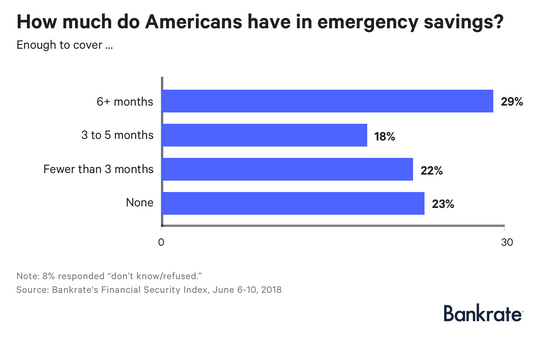

A survey by Bankrate.com last month showed that nearly 25% of adult Americans have nothing saved for an emergency.

The survey also found that, generally speaking, the older the person is the more likely they are to have more saved for an emergency. More than a third of baby boomers in the survey said that they have at least 6 months of expenses saved up. But given how many baby boomers are now in retirement, this number is also disconcerting.

Emergency Spending In Retirement

Not a lot of people have millions saved for retirement. Many people in retirement have very little saved and are living off of Social Security and pension income. But it is very dangerous to have nothing in reserve in case a large unexpected expense comes up.

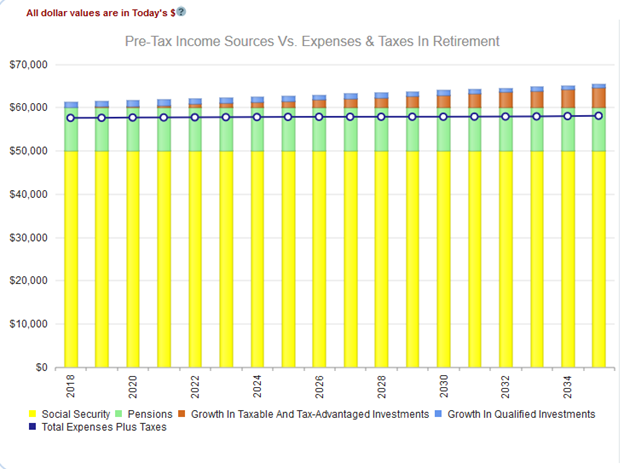

Let’s take a look at a couple that is currently retired. I used the WealthTrace Planning Application for this retirement analysis, which you can sign up for as well. This couple is 67 years old and they are living off of a combined $50,000 in Social Security and $10,000 annually in pension income. Their expenses before taxes are $57,000 per year. They currently have $20,000 saved in an IRA. You can see that they are able to cover all expenses in every year below.

They might be able to cover their expenses each year, but this of course assumes they don’t have any unexpected expenses.

What A Large Expense Can Do To A Retirement Plan

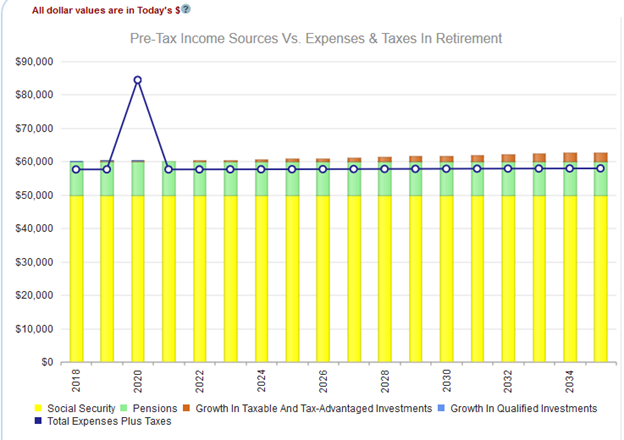

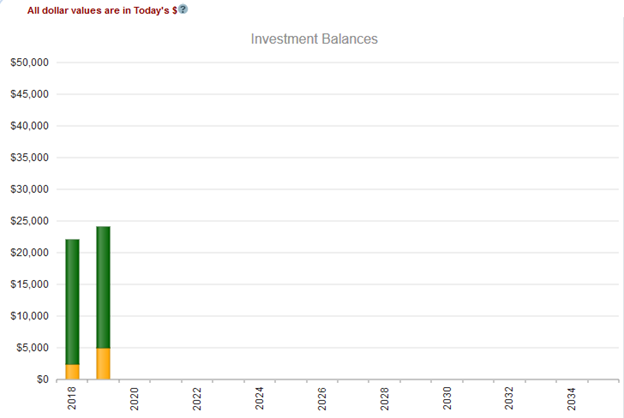

If you have a large sum built up in your IRA or 401(k) plan, then congratulations! This will help with any unexpected expenses all through retirement. But the couple we are looking at does not have much saved at all. Let’s look at the case where they have a large, unexpected expense in three years. Let’s say there is a flood that causes $25,000 worth of damage to their home and they are not insured for this. You can see how this blows through their income below:

You can also see their investment savings drop to $0.

This means that they are out of money. Not only can they not afford the entire expense to fix their house, but now they have no safety buffer at all going forward.

Make Sure You Have Enough Saved

It is so important to save early and often for retirement. Let the power of compounding work for you. Figure out how much you need to save when you’re relatively young and make sure you are diligent about it. At an 8% annual return, saving just $5,000 extra per year when you’re 35 years old gives you nearly $400,000 extra in your retirement portfolio at age 65. Again, that’s the power of compounding over time working for you.

If you have access to a 401(k) plan, do not let this go to waste. The matching that most companies provide is free money and at the very least you should be getting every penny of match that you can.

You should also make sure your asset allocation makes sense for your age. When you’re younger, you should be taking way more risk in your retirement portfolio because you won’t need the money for a long time. This means investing a portion of your retirement funds in international and potentially emerging market stocks as well. As you approach retirement, the risk in your retirement portfolio should start to decline, which means shifting from stocks to bonds gradually.

It is of utmost importance to know how much you can spend in retirement and when you can retire comfortably. WealthTrace will show you how much you need to save, when you can retire, and allow you to run what-if scenarios on your plan. Learn more.