Key Points:

- The yield curve is flattening, at least at the moment.

- Stress testing a plan for a variety of scenarios, including a flattening yield curve, is something everyone should do periodically.

- Higher interest rates can be a good thing for a retirement portfolio, though there are exceptions to that rule.

If you're a stock investor like we are (and like we recommend you be in retirement), you may have missed it, but the yield curve has been flattening.

A History Lesson

Historically speaking, a flattening yield curve that turns into an inverted yield curve has been a pretty good predictor of recessions. Under normal circumstances, with an economy humming along the way ours has, long-term rates will be significantly higher than short-term ones, creating an upward sloping curve. The main idea here is that bond investors demand higher yields in the longer term to account for the risk of inflation, which would eat away at their returns the same way it eats away at your purchasing power.

When long-term rates don't budge much, even as short-term rates creep up, it can indicate that bond traders are worried that long-term growth is in jeopardy. The yield curve flattens. It may even invert, meaning short-term rates are actually higher than long-term ones. Over the past 60 years, an inverted yield curve has foreshadowed every recession.

Some say this time it's different, and in a sense it is. Long-term rates were probably lower than normal because central banks were buying trillions of dollars' worth of government bonds up until recently. Meanwhile, the Federal Reserve has been raising short-term rates for about two and a half years, and has signaled it will continue to do so. Arguably the yield curve has had nowhere to go *but* flatter, regardless of what's going on with the economy.

Regardless of whether it's different this time around, the topic makes for a good excuse to do a bit of stress testing on your retirement plan. What will happen when the bear market finally comes? What happens if rates rise?

A Case Study In Retirement

Consider a couple in their early 50s hoping to retire in 2025. They have around $1.2 million in invested assets, and project their spending in retirement to be in the $65,000 range, in addition to a mortgage for a few years and accounting for supplemental Medicare insurance.

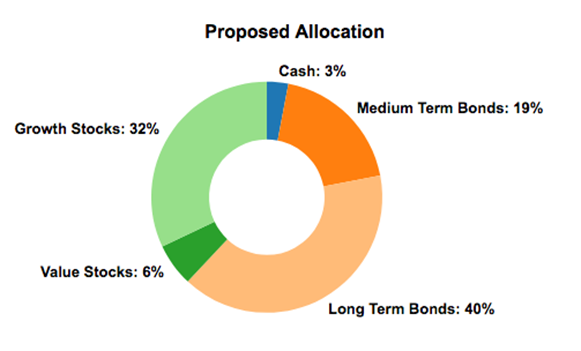

Their investment portfolio is fairly well diversified across asset classes . . .

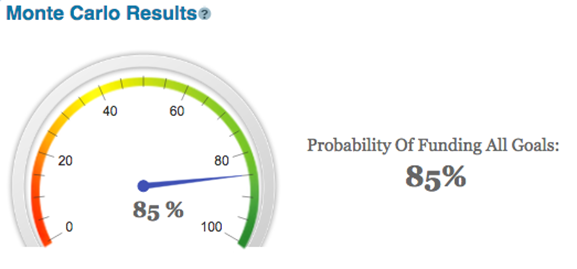

. . . and Monte Carlo says it should be pretty smooth sailing for them:

But if we throw a bear market at them two years out, things get ugly fast:

What's going on here? In short, it's the stocks. They got pummeled in the last big bear market, as one would expect. This portfolio is full of them.

We're no fans of market timing, but given the duration of the current bull market in stocks, and rumblings about higher interest rates, maybe we should take a look at changing up the asset allocation a bit.

Let's see what happens if we make a few changes to the portfolio and anticipate long-term bond yields going up by 50 basis points.

Our portfolio makeover is pretty drastic, as you can see. Long-term bonds are way up as a percentage of the portfolio, and growth stocks are up as well. Value stocks, meanwhile, are drastically reduced:

Even with such a big shift in assets, the probability of success only declines by two percentage points to 82%, and the plan will likely see a lot less volatility.

Survival Of The Dividend Payers

Sure, but if wishes were horses, beggars would ride, right? We can hope for higher interest rates all we want, or think they're on their way, but in fact we simply don't know where they're headed.

We always talk about the importance of dividend stock investing to a successful retirement plan. Our thinking on that has not changed. To us, these stocks remain the most near-certain option for income in retirement.

It is worth noting that in a rising-interest-rate environment, dividend- and distribution-paying stocks can fall out of favor, especially in certain segments like Real Estate Investment Trusts and Master Limited Partnerships. So on paper, you could see some losses.

If you're living off of the income exclusively, or close to it, what the market thinks about the shares of such companies is almost immaterial. The stocks will bounce around, but the income will still be there. Even so, it's tough to put a price on a good night's sleep. If market volatility makes you nervous, there could be a place in your portfolio for some fixed income investments.

What would increasing your savings rate or investing in different asset classes do to your retirement plan? Could you handle a stretch of stock-market volatility? WealthTrace can help you find out. See how making changes to your investments affects the probability of your plan succeeding. Click here to learn more.