Key Points

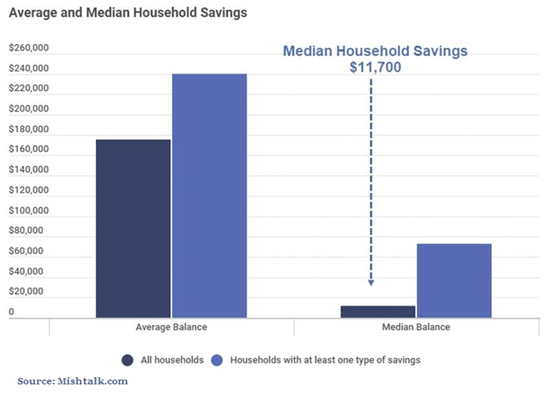

- Half of American households have less than $11,700 saved.

- Average savings are up, but the median is what matters because the average is skewed higher due to the most wealthy Americans.

- Save early as possible in life and take your most risk while you are younger.

The savings picture for Americans continues to look grim. Although the average American household has over $175,000 saved, this figure is skewed by the very wealthy in this country. The median savings number is much important and it tells a different story.

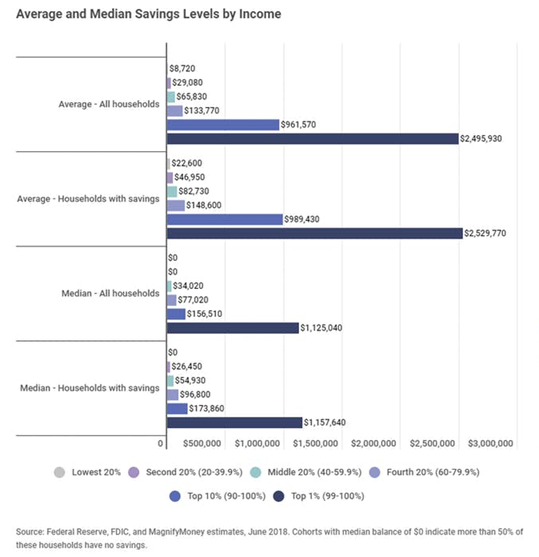

The median household savings figure is $11,700, which means half of all American households have less than $11,700 saved. The bottom 20% of American households, in terms of income, have only an average of $8,700 saved.

Saving Early And Taking More Risk

The best way to get to a secure retirement is to save early and often, preferably to a 401(k) plan or an IRA so the money grows tax-deferred.

Unfortunately most people have no idea how much they need to save in order to retire comfortably. Many hope that Social Security will be enough for them, but they have never really run the numbers using a good retirement calculator.

Let’s take a look at just how important saving to a tax-deferred retirement plan can be. I ran a case study in the WealthTrace Retirement Planner, which you can use as well. I looked at a couple that is 30 years old and saves $3,000 per year, all to taxable accounts which have a current balance of $10,000. Their investments are 70% in stocks, 30% in long-term bonds. They are projected to have a combined $40,000 in Social Security benefits when they retire at age 67. They also plan on spending $60,000 per year in retirement.

After running the calculations I found that they will run out of money in retirement at age 77. Their probability of never running out of money, using Monte Carlo retirement analysis, is a meager 4%.

The Problems With Their Retirement Strategy

There are three main problems with this couple’s retirement strategy. First, they are saving to taxable accounts when they should be saving to a tax-deferred retirement vehicle. If we simply switch them to an IRA they are not projected to run out of money until age 90 and their Monte Carlo probability of plan success jumps to 40%. This shows just how important using the correct retirement account is.

The next thing this couple needs to do is take more risk. Having 30% in bonds when you’re 30 years old is not wise. They have 37 years before they will use this money and stocks have never been outperformed by bonds over such a long time period. I recommend they move to 90% in stocks and 10% in bonds pre-retirement. When they retire they will move to a 60/40 stock/bond split. If we do this their probability of plan success jumps to 50%.

Lastly, they are simply not saving enough money. We want to get them to at least an 80% chance of never running out of money in retirement. Running some what-if scenarios, I found that if they move to an IRA, take more risk, and save $8,000 per year instead of $3,000, their probability of never running out of money goes up to 81%.

Make Saving Automatic

If you are not auto-depositing into a retirement plan, you should do that today. You know what they say: Out of sight, out of mind. Don’t get used to spending the money. Just sock it away each paycheck. The older you in retirement will thank you later.

Find out how much you need to save in order to retireme comfortably. Sign up for a free trial of WealthTrace today. Learn more about how WealthTrace can help you.