Key Points

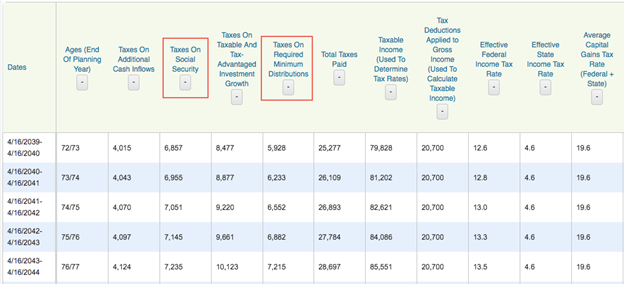

- Required minimum distributions, combined with Social Security benefits, can lead to unwanted tax surprises.

- There are strategies and tools that can help you manage these surprises.

- Taxes should not be the first thing on your list when putting a retirement plan together, but they should at least be on the list.

Spend enough time on personal finance web sites and you can start to feel like tax-avoidance strategies are THE most important factor in coming up with a successful financial plan. (In fact, they're not--saving as much money as possible in low-cost index funds is.) We don't want to pile on, but we do have another piece to consider: Social Security taxation, and what can be done to minimize it.

Up to 85% of your Social Security benefits might be subject to income tax. If you do a little bit of planning, you might be able to keep that at 50%.

Yes, It Probably Applies To You

There are two questions to ask. First, will you have enough income in retirement to be taxed on Social Security at all? Second, is it worth the work to figure out how to minimize that tax?

The first question is fairly easy to answer. If you're reading this as a WealthTrace user and investor who is planning on various sources of income in retirement, the answer is probably yes, you're going to be taxed on it, and it becomes a matter of at what rate. But let's run through some numbers to be sure.

For a couple married filing jointly, so-called provisional income--essentially income from all sources, including Social Security--must be greater than $32,000 for Social Security to be taxed at all. However, only half of Social Security benefits are considered in that combined income number.

Does your household plan to live on more than $32,000 annually in retirement? About how much of your retirement income will be from Social Security (which the Social Security Administration can estimate for you)? A quick back-of-the-envelope calculation probably indicates you're looking at taxes due on at least 50% of your benefits.

WealthTrace can give you an accurate projection of what your tax burden will look like in retirement.

The 50%-taxable number applies to couples filing jointly with combined income between $32,000 and $44,000 (though only counting half of Social Security income, as mentioned above). If you make more than $44,000, it makes the leap to 85%.

To be clear, that doesn't mean 50% or 85% of your Social Security benefits are going to disappear to taxation. It just means that a certain amount of it will be subject to taxation as income above the provisional income level.

Here's how this might work in practice for a retired couple that's older than 59 1/2. They (like any couple) have a $24,000 standard income deduction ($12,000 per person in 2018) to work with. That means that they could take $24,000 from their IRAs before being subject to income taxes--but only if Social Security benefits are limited. If combined Social Security benefits are $12,000 a year, all is well; $24,000 from the IRAs plus half of that Social Security benefit comes to $30,000, which is below the $32,000 provisional income threshold.

Once you get above that threshold, here come the taxes. For a married couple filing jointly in the 12% marginal tax bracket, here's a selection of tax scenarios:

| IRA Distributions | Social Security Benefits | % of Social Security Subject to Taxation | Taxes |

| $24,000 | $24,000 | 8% | $240 |

| $36,000 | $40,000 | 40% | $1,944 |

| $48,000 | $60,000 | 58% | $4,188 |

| $60,000 | $60,000 | 75% | $5,412 |

Full Speed Ahead

That higher income generally leads to higher taxes is not news. But how the issue plays out in real life might be. The "tax torpedo," as it is sometimes called, appears most often at required minimum distribution (RMD) time. There you are, collecting your Social Security benefits and otherwise keeping your taxes low. At age 70 1/2, you have to start taking distributions from your IRA or 401(k). Depending on your IRA balance, what your provisional income looks like, and your tax bracket, your marginal tax rate could really jump. Not only that, adding insult to injury, you might go from 0% to 15% on your capital gains and qualified dividends.

The basic cause of all this is that there's no time left to defer certain income sources. You can't avoid RMDs on your IRAs (though you might soon be able to take them a little later); you can't tell the Social Security Administration to hold off on sending you checks until after age 70 (well, you probably could, but it wouldn't make a lot of sense to do so simply to avoid the taxation on the benefits).

This is all extremely complicated, with lots of moving parts. You can work through the IRS worksheet to see how this might affect you, but a better option is the Social Security tax calculator at the end of this article, which goes a long way toward showing you how it works, and what percent of your Social Security will be taxable based on certain assumptions about other income sources.

Some Advance Planning

You can also use a program like WealthTrace to help you get ahead of the issue. Here are some things you can try:

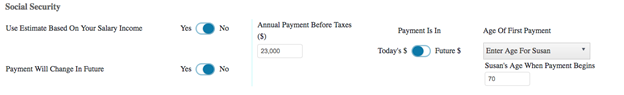

Model various Social Security scenarios. When do you plan to take Social Security? What about your spouse? You can try different variations and time periods and see how they could affect your taxes.

And in combination with that . . . .

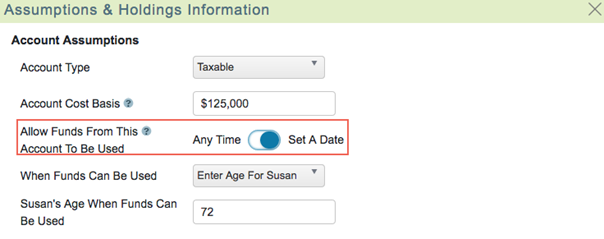

Model the spending down of your qualified tax-deferred accounts (such as IRAs) first, instead of your taxable and tax-advantaged investments (like taxable brokerage accounts or Roth IRAs). This flies in the face of conventional wisdom, but hear us out. The IRA account balance will decline in value as you use it to fund retirement (along with Social Security benefits later). Its RMD will thus be smaller, which should lessen the effect of the torpedo.

WealthTrace allows you to "lock out" accounts so that they are not assumed to be used to cover expenses in retirement until a certain date.

This would probably only be a viable option for early retirees (remember, IRAs can be drawn on without penalty as early as age 59 1/2), but it's worth running the scenario if you might be in that position.

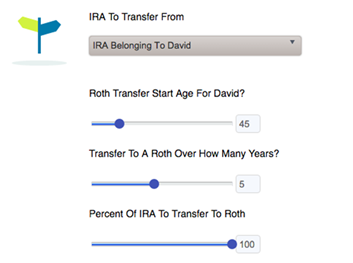

Model a Roth Conversion. Speaking of early retirement, one way people get there is via converting a traditional IRA to a Roth IRA over some stretch of time to avoid the early withdrawal penalty on the traditional IRA. Doing so has the added benefit of lowering your RMD, and thus the potential effect of the torpedo.

A Roth conversion might make sense if you assume your income in retirement will be higher than or similar to what you're making while employed, or if you plan to pass along your Roth IRA to heirs (who generally won't have to pay taxes on its distributions).

WealthTrace can run a Roth IRA conversion strategy for you and tell you if it might make sense.

First Things First

Big picture, the tax torpedo is a good problem to have for most: You're anticipating your income will be so great that your taxes might go up. A lot of people would love to have such a problem. Still, if you've got the basics down (such as by maxing out your 401(k) contributions and just generally investing as you can in cheap index funds), exploring tax minimization strategies like these just makes sense.

WealthTrace covers all the bases of a successful retirement plan. Sign up for a free trial of WealthTrace to find out more.