Key points

- Comprehensive financial planning should be on everyone's to-do list--and should be marked as 'done' as soon as possible.

- How financial planning is defined can vary, but should include a few common building blocks.

- Those building blocks should all support the final goal: A comfortable retirement.

What is financial planning, exactly? To a degree, that's in the eye of the beholder. It can mean a lot of things to a lot of people. It usually involves planning for retirement, but can also include many other items. Is opening a bank account a piece of financial planning? Getting a credit card? What about buying a car?

Further to that, do you need a financial planner to make a financial plan? Or can you do it yourself using comprehensive financial planning software?

Broadly speaking, you could put just about anything having to do with saving or spending money under the financial planning umbrella. But there are some building blocks that should be part of every financial plan. You can build your own comprehensive financial and retirement plan using WealthTrace. Sign up for a free trial today to see just how empowering it can be to build your own financial plan. Let's use the WealthTrace Planner to run through a case study in comprehensive financial planning.

Investments

When it comes to financial planning, it doesn't matter how much money you make. It's how much you save that matters much more. So let's start there.

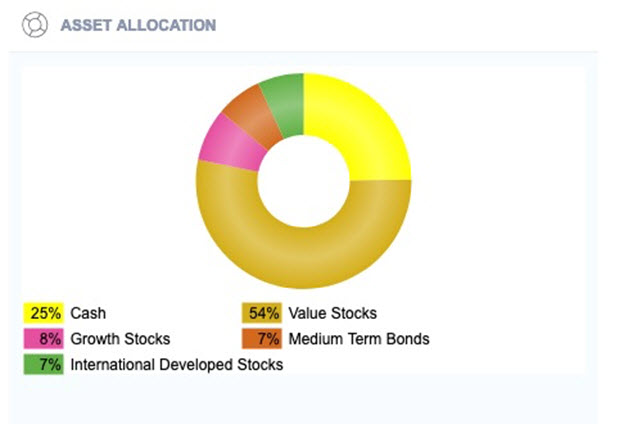

Investing is more than--or should be more than--picking some stocks and funds and bonds and calling it good. It requires an organized plan. For a lot of people, it makes sense to start with asset allocation. Asset allocation will normally be based on your age (how much time you have ahead of you during which you can build wealth), tolerance for risk (like how you might handle the bear market we've just entered), and your goals (a topic we'll get to).

Once you have decided what your asset allocation should look like, it's time to choose some investments that get you there. There are a lot of reputable sites on the web to help with this. For most people, starting out with (and probably sticking with) index funds makes the most sense. These funds will very closely track the markets, which very few actively managed funds can beat, and, just as importantly, their management fees are very low. Fees are a silent killer of investment performance.

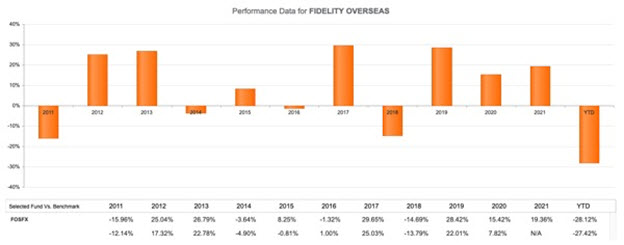

Keeping an eye on investment performance has never been easier--too easy, some might say. You can call up your portfolio on your phone and get up-to-the-second updates on how your investments are doing.

Is this healthy? Probably not, especially in a down market. Still, it's important to know how your investments are faring and review their performance periodically.

That doesn't necessarily mean buying more of the ones that are doing well and chucking the ones that are doing poorly. In fact, you may want to do just the opposite: That's what periodic rebalancing is.

Say you have investments that are underperforming. You should ask yourself a couple of questions:

- Am I still comfortable with my asset allocation targets? If not, OK, it could be time to bail, or at least make some changes. But if so,

- Are my investments in my chosen asset classes the right investments? If you're in passively managed index funds, chances are the answer is yes, and that the asset class is just going through a rough patch. If you're invested in individual stocks, the question gets a lot trickier. In that case you have to keep an eye on management, earnings estimates, valuation, and much more. Buying individual stocks is (or should be) a lot of work.

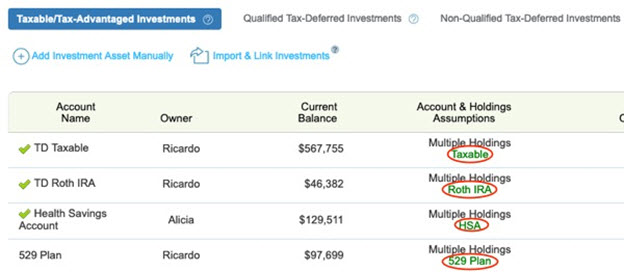

Another piece of the investment portion of financial planning: Where to save and invest that money.

We're not talking about asset allocation this time. We're talking about what kind of investment accounts you should be targeting with your investment money. IRAs, Roth IRAs, 529 plans, 401(k) plans--it can seem like an alphabet soup of account types sometimes.

Financial planning, whether handled via a professional or on your own, can address prioritizing what to fund first. Those decisions will normally be based on your goals. If, for example, saving for retirement and deferring taxes is important to you, you'd want to put your first dollar of savings into your 401(k) or IRA.

If, instead, your top priority is saving up for a down payment on a house, you might want to start with a taxable brokerage account, because money pulled out of a retirement account is normally hit with a penalty (though first-time home buyers can get a break on the first $10,000 taken out).

Later on, after you have multiple investment accounts open, you might get into more advanced strategies, like considering a Roth IRA conversion.

Goals

The word goals is pretty broad, but in the context of financial planning it generally refers to something you want to fund outside of day-to-day living expenses. That could be the aforementioned down payment on a house, or funding college expenses for a kid--an expense that appears for a while outside of day-to-day living expenses and then goes away.

That's pretty straightforward, but still requires answering some financial planning questions. How do you plan to save up for the goal? Can you take a bit out of each paycheck and sock it away to fund it? And in what asset classes should you invest what you're saving? If the goal is in the distant future, you can be aggressive with your asset allocation. But if it needs to be funded soon, you'll want to be very conservative, so you don't get hit with a bear market right when you need the money. This, too, is financial planning.

Insurance

We'll leave homeowners' insurance and car insurance out of this discussion and focus on three other types: Health, life, and long-term care insurance.

All of these fit squarely in the financial planning box, and are not something you can just set and forget. Life insurance can be a critical piece of a plan: If the worst happens to the family's main income provider, will the surviving members of the family be able to get by?

Long-term care (LTC) insurance, which gets a bad rap sometimes, needs to be at least considered. This insurance is meant to cover expenses in old age, like assistance in your home with activities of daily living. At least thinking about and discussing LTC insurance needs to be part of a financial plan, because even if you decide not to go that route, you do need to decide how you'll handle such expenses down the road. (Self-insuring is a common option.)

Health insurance, especially once you're retired, needs to be part of your planning too. People sometimes mistakenly believe Medicare will cover their health insurance needs, but that's only partially true. Supplemental insurance is normally part of a financial plan for retirees; putting money into a Health Savings Account (HSA) is one way people cover it.

Retirement

When thinking about financial planning, retirement is probably what comes into most people's minds first. And that's understandable: It's mainly what we're all saving up for.

Everything we've mentioned so far overlaps with retirement as a part of financial planning. But you do have to actually run some numbers and try to project if what you're saving and investing is going to get you over the line into comfortable non-working years.

This is where the rubber meets the road. You want to make sure a bear market won't derail your retirement, for example. Or an unexpected expense. Or extended periods of high inflation like we could be heading into now.

We have argued that you don't necessarily need an advisor to make and stick to a plan. (That's what we're here for!) Whether you work with a pro, do it yourself, or some combination of the two, comprehensive financial planning should be on your to-do list.

Do you know want to build your own financial and retirement plan? Sign up for a free trial of WealthTrace to be empowered and in control of your finances.