Key Points

- Tracking your finances helps provide a clear picture of your financial situation

- Prioritize paying off high-interest debts

- Automate your savings to ensure consistent saving and staying on track

Money is a common source of stress for most Americans, in fact, recent surveys show that over 50% of Americans feel stressed about their finances multiple times per week.

Financial stress can be caused by a variety of factors, and it often stems from a mix of immediate financial difficulties and long-term concerns. Figuring out what is causing your stress may be the key to finding peace.

Find The Cause Of Your Financial Stress

Some of the most common causes for financial stress include living beyond your means, debt, job insecurity, unexpected expenses, lack of savings and most recently, high cost of living.

Some of these stressors may be unavoidable, like unexpected expense and high cost of living, but there are ways to reduce the stress around these. Before we dig deeper into how to reduce your stress, let’s look at the effects that financial stress can have on your physical and psychological health.

Effects of Financial Stress

Financial stress can have both immediate and long-term effects on a person’s mental, physical, and emotional well-being. Constantly being worried about your finances can lead to things like chronic anxiety, depression, sleep problems, conflicts with partners or family and more.

It can also create a cycle of poor financial decisions, which can increase your stress even more. The longer financial stress persists, the more difficult it can be to manage, so coming up with a plan and seeking support should be your first step if you are someone who is dealing with this.

Track And Manage Your Finances

Tracking your finances is a powerful way to reduce financial stress because it gives you a clear picture of where your money is going, helps you make informed decisions, and can lead to a greater sense of control over your situation.

Track Your Income

Tracking your income helps you know exactly how much money you are bringing in, so you can better understand your financial situation. Tracking income can also help you budget better, plan for your financial goals, build wealth and pay off your loans. Knowing how much income you plan to receive in retirement can help reduce anxiety and stress later in life.

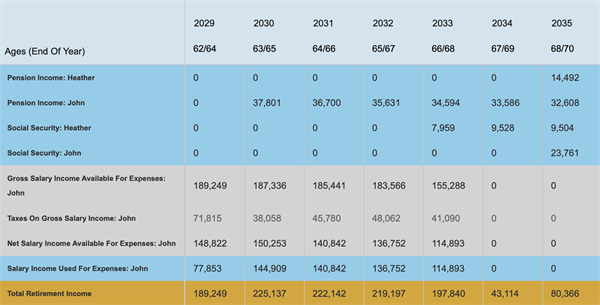

Using financial planning software, like WealthTrace, allows you to track your current and future income. WealthTrace can include your salary, pension income, Social Security income, and any additional cash inflows to help you calculate your total income before and in retirement.

Track Your Expenses & Set Clear Financial Goals

Tracking your expenses is just as important, if not more important, than tracking your income. Creating a budget will help you understand where your money is going each month.

Creating a budget is great for calculating your day-to-day expenses, but tracking larger expenses such as your mortgage, healthcare and car purchases is equally as important. Tracking your total expenses will give you a clearer picture of your financial habits, which can motivate you to make more mindful financial decisions.

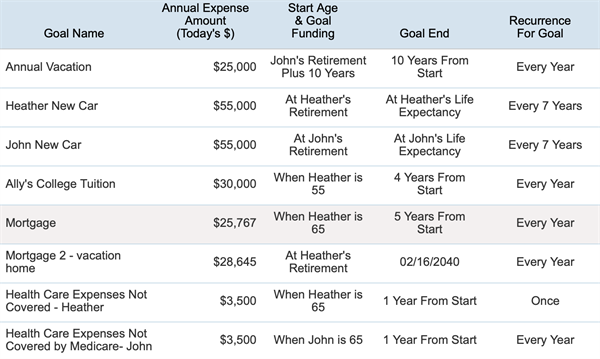

In WealthTrace you can include recurring and one-time financial goals and expenses in your plan projections. You can also run scenarios to see how spending more, or less, on these expenses affects your financial outcome.

Track Your Debt

Tracking your debt can give you an overview of how much you owe across all your loans, credit cards and other liabilities. This in turn can help you see the total amount spent on interest and principal to help you prioritize which debt to pay off first.

By focusing on paying off higher-interest debts first, or consolidating debts with high interest rates, you can save money in the long run. If you are not keeping track of your debt, it is easy to lose sight of how much you actually owe.

Regularly tracking debt and making timely payments can improve your credit score, which helps you qualify for better loan terms or lower interest rates in the future.

Automate Your Savings

Setting up automatic transfers to your retirement and savings accounts ensures that you are saving regularly, without having to think about it. When your savings are automated, you don’t have to decide each month whether to spend that money or save it. This helps reduce the temptation to spend on unnecessary items.

Whether you are saving for a vacation, a new car, or retirement, automating your savings makes it easier to stay on track and reach your financial goals.

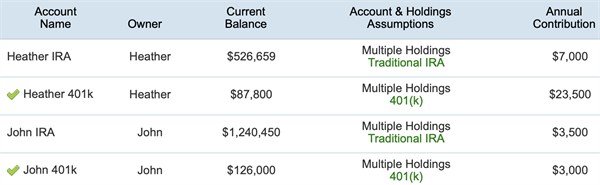

You can add your annual contributions in WealthTrace and specify if these will change in the future.

The Bottom Line

Reviewing and updating your financial plan regularly should be high up on your to-do list. Most people will review and update their income, budget, goals, expenses and contributions at least annually.

Following the steps above can help alleviate anxiety, improve financial decision-making and foster long-term financial well-being. Make sure to also celebrate your wins as this can help you stay on track, feel accomplished and stay motivated to continue working toward your larger goals.

Will you have enough money to retire stress-free? If you aren’t sure, sign up for a free trial of WealthTrace to build your financial and retirement plan today.