Key Points

- The traditional withdrawal method may not be the best option for you.

- Saving your Roth IRA account for later in life can sometimes be the best option.

- It’s important to run several scenarios for withdrawal strategies.

When preparing for retirement, there are many recommendations about how much money to save and where to save it. But many people feel lost as to how to withdraw their funds in the most tax efficient way, and typically default to the most recommended option.

Withdrawal Strategies

One common strategy is to start by withdrawing from your taxable accounts first, then your retirement accounts and finally your Roth IRA’s. But what if we flipped the script and started with our tax-deferred retirement accounts first, and then used our Roth IRA or taxable accounts? This option would give you the opportunity to lessen your tax burden later in life, but does it make sense financially?

The main reason behind the recommendation to use your taxable accounts first is that saving your retirement accounts for as long as possible means giving those accounts a chance to grow over more time tax-free. Typical retirement accounts (IRA’s, 401k’s etc.) are funded with pre-tax earnings, then typically invested into a variety of funds which grow tax-free. You then pay ordinary income tax when you make a withdrawal.

There are however a few negative aspects of traditional retirement accounts such as required minimum distributions, early withdrawal penalties, and having to pay income tax on all withdrawals later in life. Roth IRAs however allow you to fund an account using after tax income, allowing the funds to grow tax-free, and you can then withdraw the funds tax and penalty free after age 59 ½. Taxable accounts are funded with after-tax earnings and normal tax rules apply, meaning you pay taxes on interest, dividends and capital gains. The main benefit of a taxable account is that there are no withdrawal restrictions or rules.

Case Study

To test our alternative withdrawal theory, we will be looking at a case study of a California couple in their mid 60’s, Jane and John, both retired, with all their savings invested in IRA’s and Roth IRA’s. We estimate that Jane’s life expectancy will be 90 years old, and John’s will be 80 years old. John will receive an annual Social Security benefit of $55,000, and Jane will receive an annual Social Security benefit of $45,000. Both will start taking their Social Security benefit at age 70. John will also receive an annual pension starting at age 70 of $25,000 with a 3% growth rate and a 100% survival benefit. They own a home valued at $500,000 with no mortgage, and their annual living expenses are $175,000. Their joint IRA balance is $3,500,000 and their joint Roth IRA balance is $1,000,000.

It is also important to point out that both the Roth IRA and traditional IRA have the same annual return so we are comparing apples to apples.

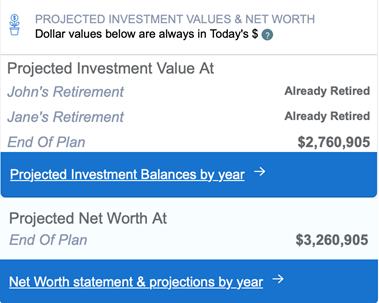

With a traditional withdrawal method of using the Roth IRA accounts first, and then their traditional IRA accounts, their Projected Investment Value at the end of their plan is $2,760,905.

By looking at the investment value at the end of the plan we can see all of the compounded benefits of a strategy vs. another strategy over time.

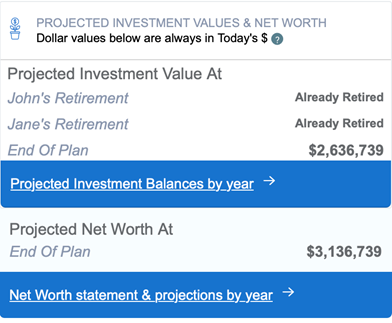

If we lock their Roth IRA accounts out to be used last, forcing WealthTrace to use their traditional IRA accounts first, their Projected Investment Value at the end of their plan decreases to $2,636,739.

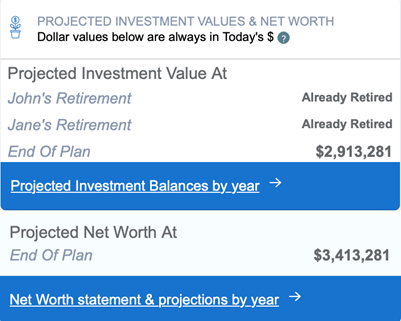

If we instead tell the software that their Roth IRA accounts can only be used at John's life expectancy (age 80), their Projected Investment Value at the end of their plan increases to $2,913,281.

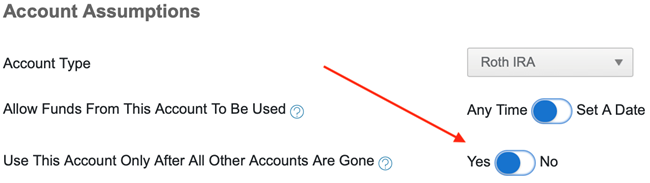

In WealthTrace you can set the age when funds from an investment account are allowed to be used.

One piece of the puzzle that many future retirees fail to consider is what happens to the remaining spouse’s tax implications when the other one passes away. Running scenarios where one spouse passes away earlier than the other helps illustrate whether saving a taxable account for later may end up benefiting the remaining spouse. When we allowed the Roth IRA account to be used at John's life expectancy, it provided Jane with a tax-free source of income which ended up increasing her Projected Investment Value at the end of the plan.

Conclusion

Although this may seem like a rare case, this is a testament to all plans being different and it is important to run various scenarios to see which one is best for you. Another option that could have been considered here is if the couple converted some of their IRA balance into a Roth IRA earlier in the plan. However, for this couple that would not have been a good option since they have no taxable funds to pay for taxes on the Roth IRA Conversion.

Using the WealthTrace planner can help you figure out which strategy is best for you. In WealthTrace you can easily change the order of investment withdrawals and set dates as to when investment accounts can be used. You can also run multiple what-if scenarios to see which withdrawal method works best for you, and whether a Roth IRA Conversion can help you save thousands in taxes

Do you know the best withdrawal strategy for your investments? If you aren’t sure, sign up for of free trial of WealthTrace to get started on your financial and retirement planning.