Key Points

- Update your budget to avoid overspending and help you stay on track.

- Review the holdings in your retirement accounts to ensure they are performing as expected.

- Staying healthy can help you save thousands in the long run.

As we approach the New Year, it is important to sit down and review your finances. Most of us have been spending the last few weeks buying gifts, eating out, going on vacations and spending too much money.

Recent studies show that many Americans go into debt each year due to holiday spending and many are willing to break their budget. With the holidays soon coming to an end, getting your budget and finances in order for the New Year should be your top priority.

Update Your Budget

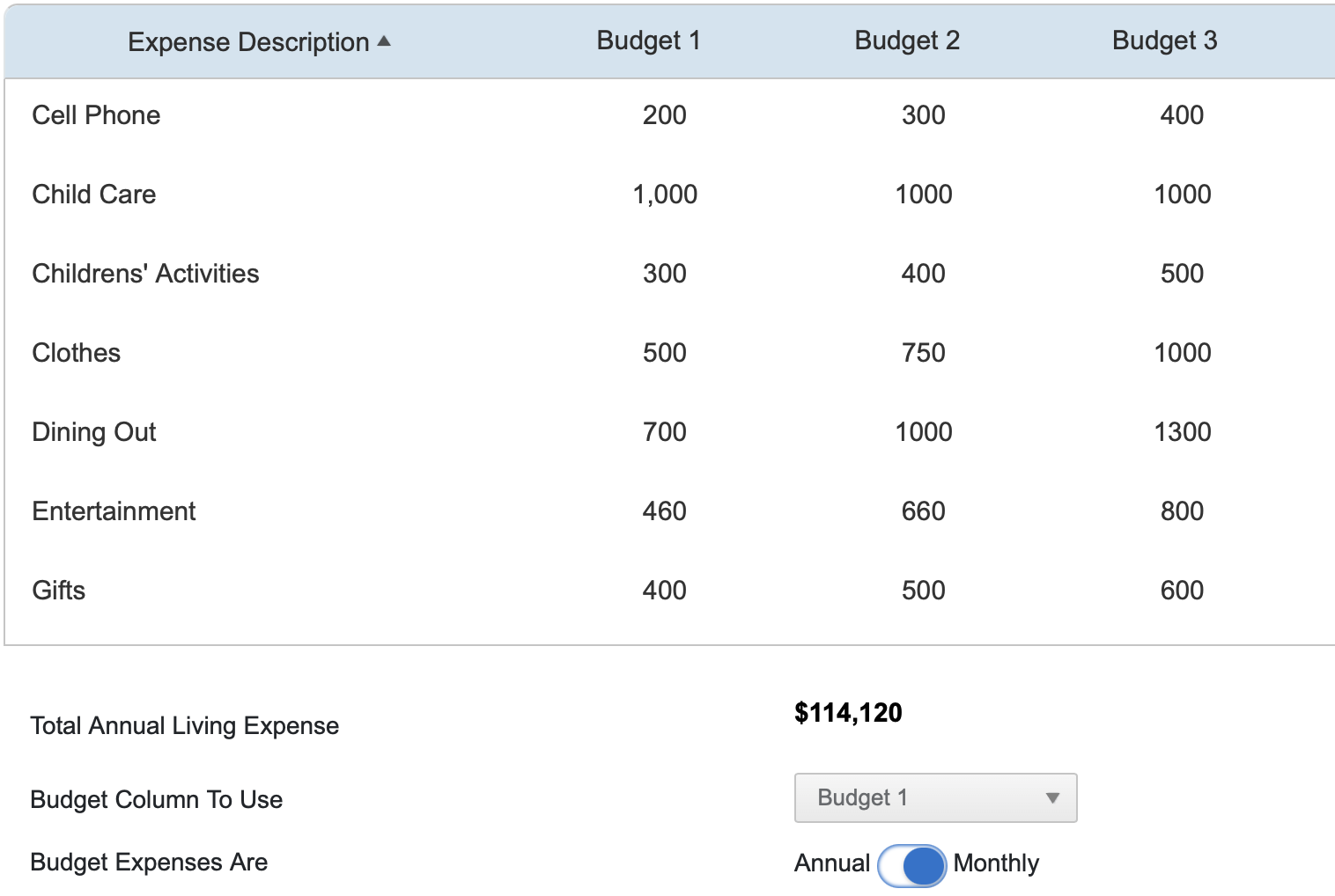

Updating your budget is one of the easiest and most effective ways to make sure you are staying on track and not spending above your means. You can update your budget in WealthTrace using our built-in budget worksheet. You can easily add and delete expenses, edit the expense description and amount, and add up to 3 separate budgets. Adding multiple budgets and toggling between them will show you how spending more, or less, will affect your financial plan in the long run.

Review Your Retirement Goals

Whether you are in your 30s or in your 60s, setting goals is one of the most important aspects in terms of planning for retirement. Setting goals while in retirement will also help you stay on track and make your money last.

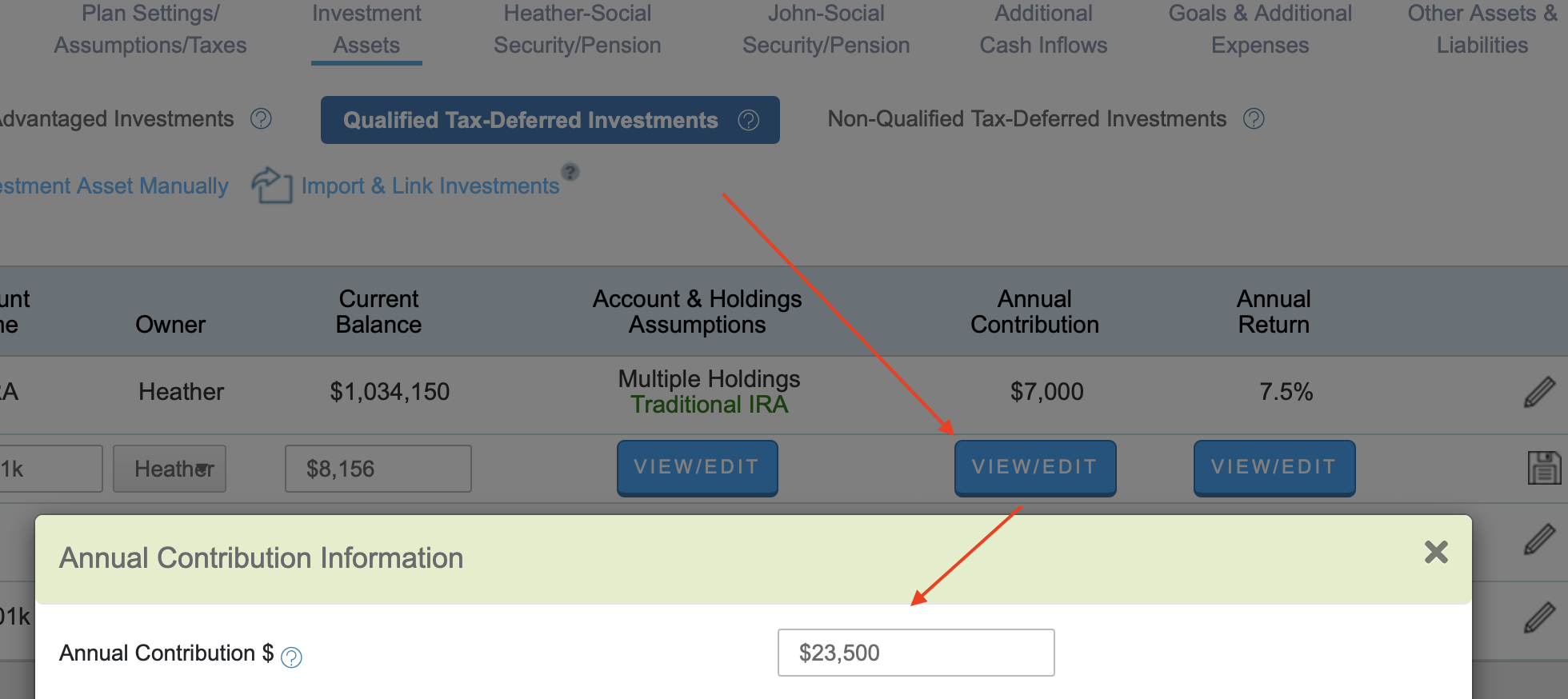

There are two big aspects of goal setting that should be reviewed every year; your contributions to retirement accounts and the amount of money you’d like to spend on additional expenses in the near and long-term. The contribution amounts for IRA’s/401k’s and Roth IRA’s change annually, staying updated on these is important.

Knowing how much you expect to spend on large items such as annual vacations, car purchases, college tuition for children/grandchildren etc. will allow you to prepare and plan for those expenses.

You should update your annual contributions to all your investment accounts annually in WealthTrace to keep your plan projections as accurate as possible.

Review Your Investments

Do you know how all your investments have performed in the last few years? If not, reviewing your assets and holdings should be on your list. You may be keeping track of the investments that you have made yourself, but what about the investments that are being managed by an investment advisor such as your 401k?

Most employer sponsored retirement plans are being managed by an investment advisor, yet many people don’t realize that they can request to review their portfolio annually and change their investments if they are not performing as well as they expect. You are paying a fee to have your investments professionally managed, so it is wise to take advantage of this.

In WealthTrace you can view the historical performance for all the investments that you own. Using our third-party aggregator, Yodlee, you can view all your investments from your various brokerages and banks in one place. You can compare holdings, review your transactions and trades, see the income generated by your investments and much more.

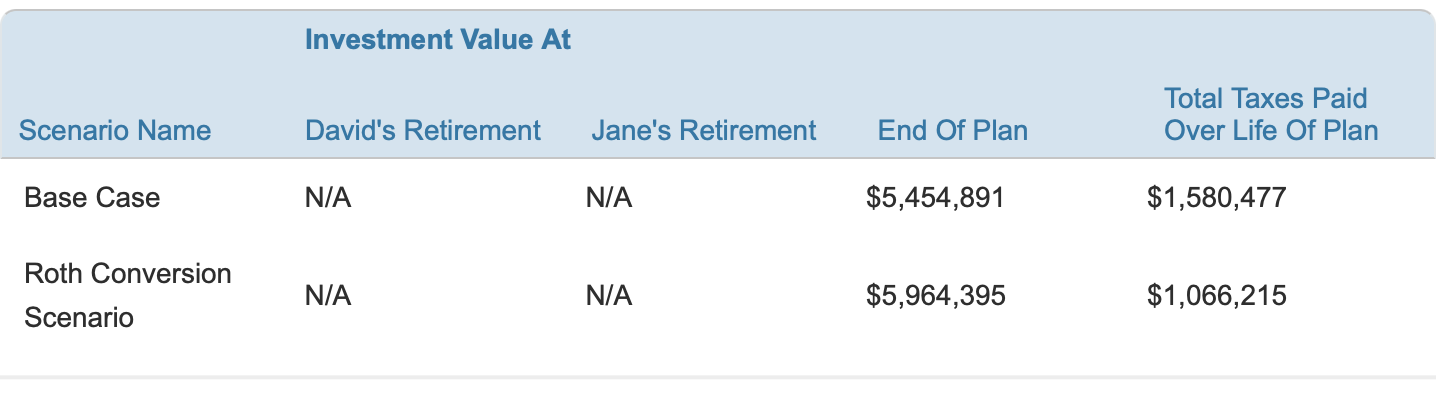

Run A Roth IRA Conversion Scenario

If you haven’t considered if a Roth IRA Conversion can benefit you, then running a Roth IRA Conversion scenario in WealthTrace is a great place to start. A Roth IRA conversion can potentially help you save thousands and reduce your overall taxes paid.

In WealthTrace you can choose which IRA you want to convert from, when to start and for how long, and which tax bracket you’d like to stay under. We will then show you how much to convert in each year to maximize your savings. The Roth IRA Conversion scenario will show you how the conversion affects your overall savings, RMD’s (Required Minimum Distributions), Medicare premiums, taxes on Social Security and more.

Review Your Overall Debt

The most common financial New Years resolution among Americans is to reduce their overall debt. Accumulating and managing large amounts of debt can completely derail your finances and cause a lot of stress and anxiety.

Paying off short term, high interest, debt such as credit cards will make a huge difference on your monthly expenditures. Some debt is unavoidable for most people such as a mortgage, student loans and car payments, but being strategic and setting a realistic budget can help you manage these debts and pay them off sooner.

Make Your Health a Priority

Last, but certainly not least, getting healthy should also be on everyone’s New Years resolutions list this year! Sticking to a healthy diet and exercising more can help you save thousands in the long run on things like groceries, prescriptions and health care costs.

We all know that being healthy is important, but once you realize just how big of an impact it can make on your finances, mental health, life longevity and overall quality of life, you may take your New Years resolution to lose those extra pounds a bit more seriously.

Do you know if you’re ready for retirement? If you aren’t sure, sign up for a free trial of WealthTrace to build your retirement and financial plan today.