Key Points

• The impact of one spouse passing away on the tax rate for the remaining spouse is often overlooked in retirement planning.

• A Roth IRA Conversion can help reduce your taxable income in retirement.

• A life insurance policy can help cover unexpected expenses in retirement.

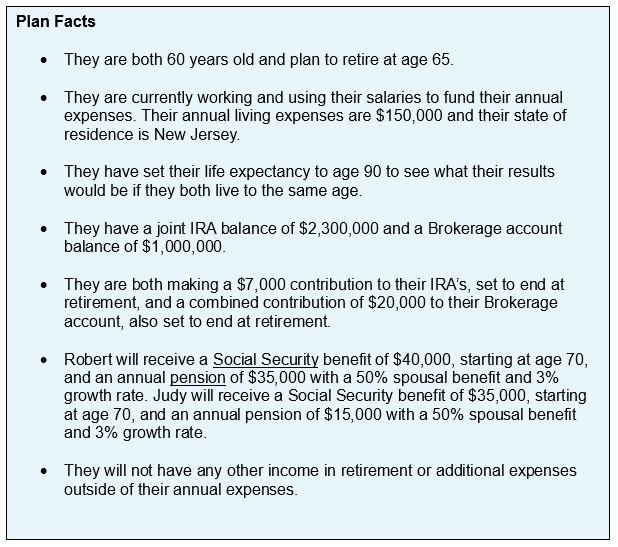

Judy and Robert Miller are a 60-year-old couple, based in New Jersey, with a planned joint retirement age of 65. They are both high earners, with most of their retirement savings in IRA’s and some in a joint Brokerage Account. They feel as though they are ready for retirement, and they have a good grasp of how much they can spend to make their money last. There is however something that has been weighing on Judy’s mind, and that is what happens if Robert passes away before her? Robert has a family medical history that may indicate he will pass away much earlier than her and she is unsure of what this would mean for their retirement plan.

Diving Into Their Plan

Before we address Judy’s concern, let’s take a look at their retirement plan that they created using the WealthTrace Retirement Planner.

Plan Results And Cash Flow Projections

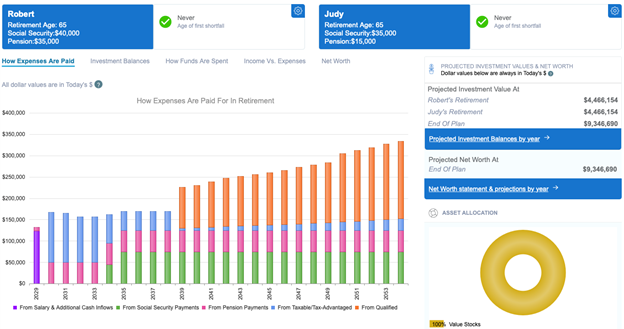

Looking at their Home Screen plan results, they are quite pleased with the Plan Projections and do not see any major cause for concern, but they are worried about their future taxable income. Starting in year 2039, a large portion of their expenses will be funded by their IRA’s since their Required Minimum Distributions (RMD’s) will start to kick in, which will increase their tax burden quite significantly until the end of their plan.

*Expenses funded by their retirement accounts are represented by the orange bar.

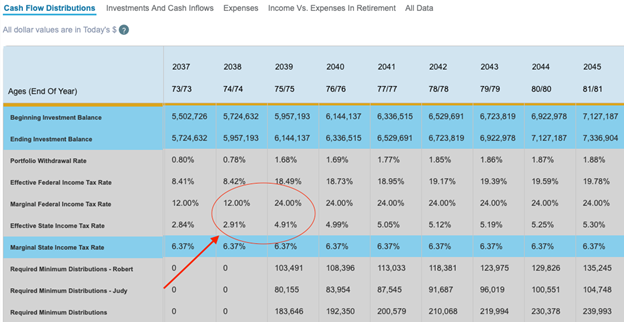

If we look at their Cash Flow Projections, we can see that starting in year 2039 when they start taking their RMD’s, they get bumped up from the 12% marginal federal tax bracket into the 24% marginal federal tax bracket. Since they live in New Jersey, they are also subject to a progressive tax rate which also increases quite significantly.

Changing Life Expectancy

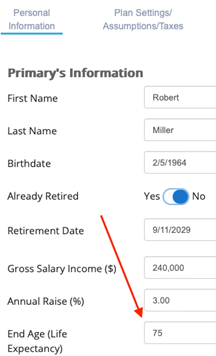

This couple knows that they will be subject to a higher tax rate in retirement due to most of their savings being in tax-deferred retirement accounts, but what will happen to these rates should Robert pass away earlier? Judy and Robert have navigated back to the Plan Inputs & Assumptions tab and changed Robert’s End Age in the Personal Information section to age 75 instead of age 90 to see what happens to their future tax rates in the Cash Flow Projections.

When we set Robert’s life expectancy to age 75 instead of age 90, it dramatically increased Judy’s tax liability in retirement, sending her into the 35% marginal federal tax bracket starting in 2040. If Robert passes away earlier than Judy, this will require her to file as a single taxpayer instead of joint taxpayer, which is why her tax liability increases. The impact of one spouse passing away on the tax rate for the remaining spouse is often overlooked in retirement planning.

Strategizing To Reduce Taxable Income In Retirement

Whether or not Robert passes away earlier, there are ways to reduce both of their future tax liability. There are various options that are not suitable for this couple such as reducing living expenses in retirement, saving in a Roth IRA account before retirement instead of traditional IRA’s, making qualified charitable distributions, investing in real estate and so on. For this couple, there are however a few strategies that could benefit them:

Roth IRA Conversion

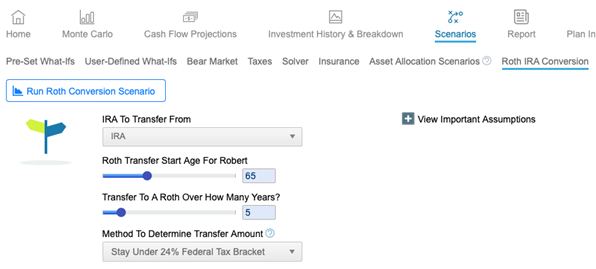

Both Judy and Robert are good candidates for a Roth IRA Conversion once they retire at age 65. From age 65 to age 70 (when they start taking their Social Security benefits), they have no taxable income. Taking advantage of these years to do a Roth IRA conversion can significantly help reduce the overall taxes paid during their lifetime. They can run a Roth IRA Conversion scenario in WealthTrace to see the amounts they need to convert, and in what years, to maximize the conversion benefit.

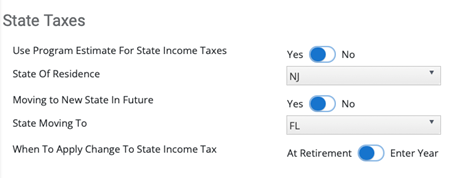

Move to a Different State

Relocating to a state with a lower tax bracket can be a viable strategy for those who would be willing to move in or before retirement. Judy and Robert are living in New Jersey which means they are subject to a rather high progressive state income tax rate, and they are subject to state income tax on their pensions.

Purchase a Life Insurance Policy

Purchasing a life insurance policy on either of them could offer them both peace of mind. A life insurance policy can offer the ability to cover the increased tax liability should one of them pass away before the other. There are many options out there from term life to whole life, consulting with a life insurance specialist is recommended.

The Bottom Line

Using WealthTrace, you can explore these options and many more to see how you can best plan and strategize for your retirement. Being prepared for various scenarios, such as one spouse passing away earlier, can help reduce your financial stress in retirement.

Do you know how much your retirement plan would be impacted by your spouse or partner passing away earlier than expected? If you aren’t sure, sign up for of free trial of WealthTrace to get started on your financial and retirement planning.