Key points

- Your Social Security benefits may be subject to federal income taxes depending on your combined income.

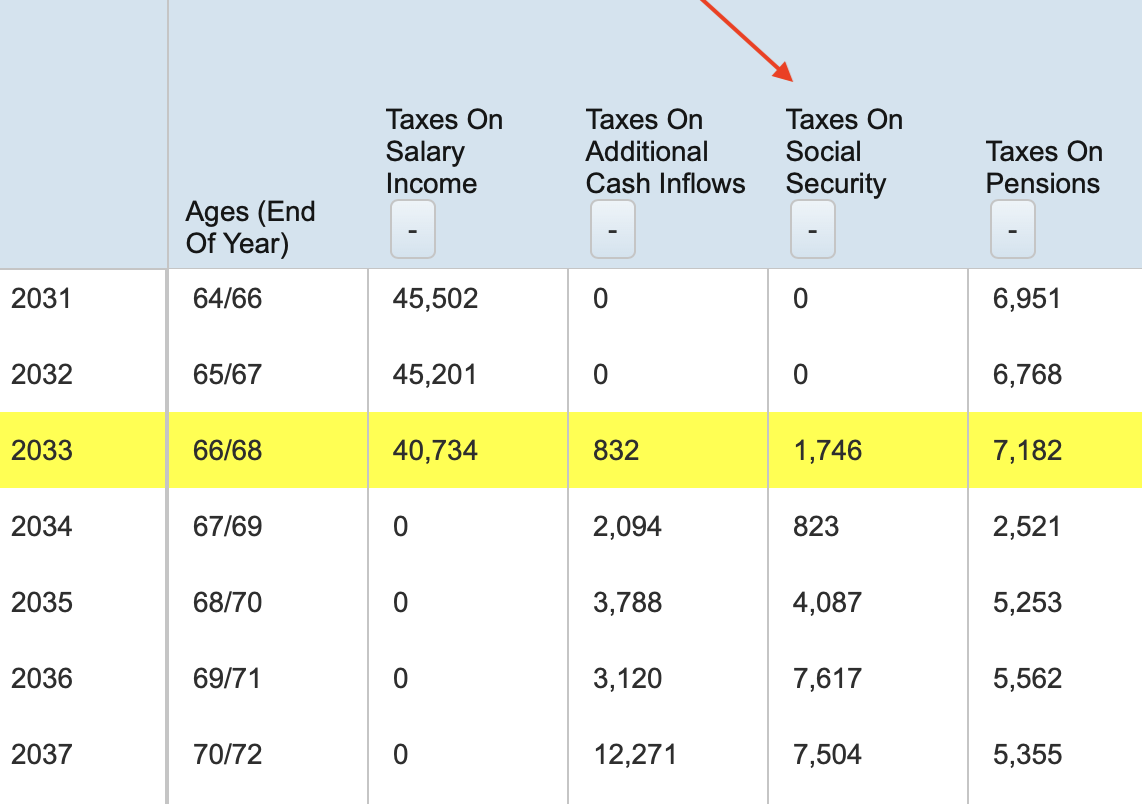

- Retirement planning software, such as WealthTrace, can help you calculate your future estimated taxes on your Social Security benefits.

- Contributing to a Roth IRA can help minimize taxes in retirement, as qualified withdrawals are tax-free.

Most people are subject to federal income taxes on their Social Security benefits, but it will depend on your total income. If you have additional retirement income, such as taking distributions from a 401(k) or part-time employment, you’ll likely need to pay taxes on your Social Security benefits. If Social Security is your sole source of income however, you may not owe any federal income taxes.

State tax laws for Social Security benefits vary, and as of 2025, only 9 states still tax Social Security benefits, you can read more about this here.

It’s also important to note that, unlike federal income tax rates, Social Security tax rules are not indexed to inflation. This means more and more people will pay income taxes on the full 85% of their benefits over time.

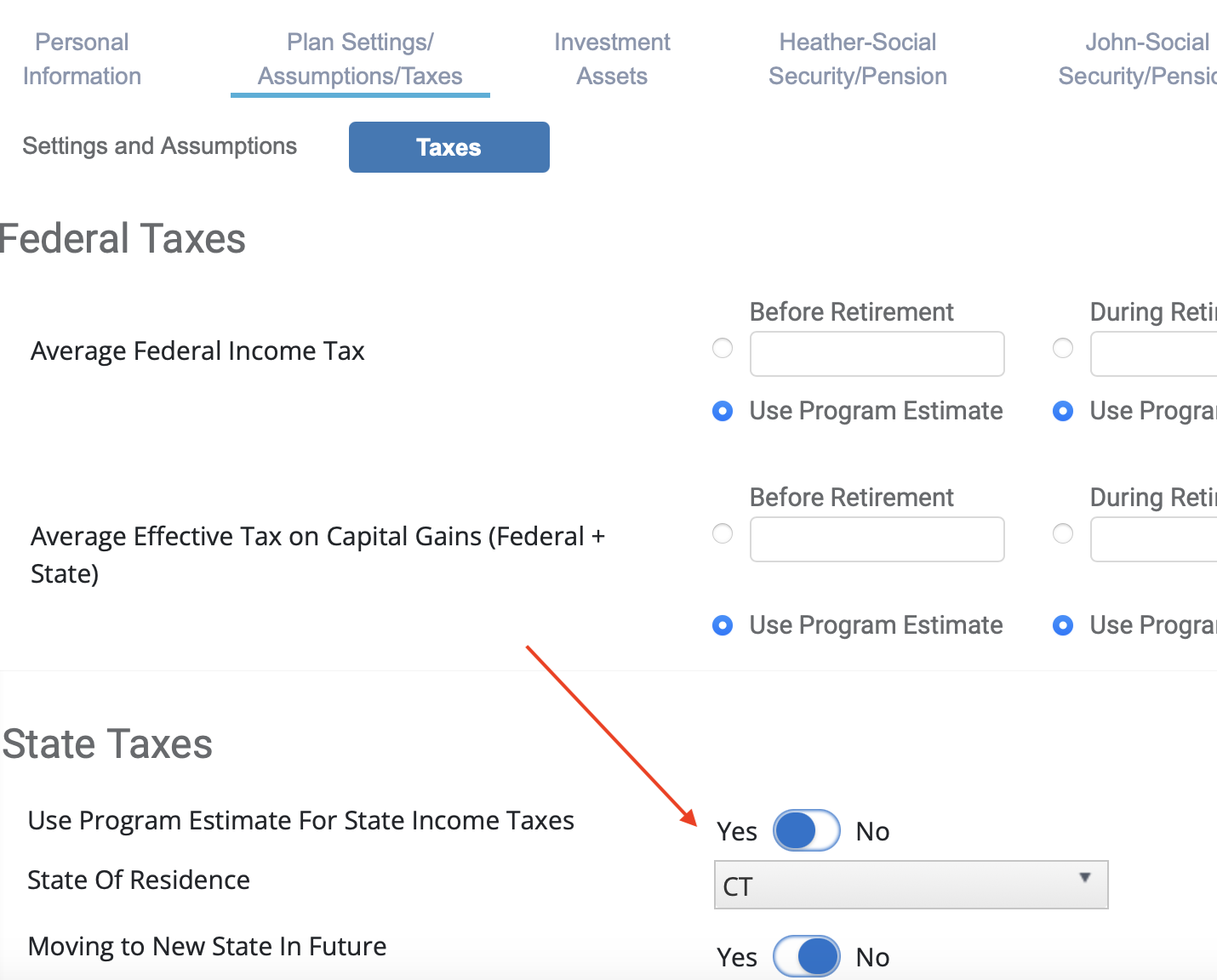

When you select your state of residence in WealthTrace, the software will identify if your Social Security benefits are taxable and calculate those for you.

How to Determine if Your Social Security Income is Taxable

To determine if your Social Security income is taxable, you will need to calculate your combined income. This is done by adding half of your Social Security benefits to all other sources of income, including tax-exempt interest.

Combined income = Adjusted Gross Income (AGI) + Nontaxable interest + Half of Social Security benefits

If your combined income exceeds a certain threshold, referred to as the "base amount" by the IRS, some of your Social Security benefits may be taxable. The base amount thresholds remain unchanged in 2025 from 2024.

- For single filers, heads of households, or qualifying widows/widowers with dependent children, the threshold is $25,000.

- For joint filers, the threshold is $32,000.

- For those who are married and filing separately, the threshold is $0, so you will likely owe taxes on your Social Security benefits.

How To Calculate Your Social Security Income Taxes

If your Social Security benefits are taxable, the amount of tax you owe depends on your total retirement income. However, the maximum amount of your Social Security benefit that can be taxed is 85%.

For single filers:

- If your combined income is between $25,000 and $34,000, up to 50% of your Social Security benefits may be taxed.

- If your combined income exceeds $34,000, up to 85% of your benefits may be taxable.

For married couples filing jointly:

- If your combined income is between $32,000 and $44,000, up to 50% of your Social Security benefits could be taxed.

- If your combined income surpasses $44,000, up to 85% of your benefits will be subject to tax.

To calculate the taxable amount, if 50% of your benefits are taxable, you would include the lesser of:

1. Half of your Social Security benefits, or

2. Half of the difference between your combined income and the base amount.

For example, if you are a single filer receiving $1,543 per month in Social Security benefits (a total of $18,516 annually). Half of this is $9,258. If your combined income is $30,000, the difference between your combined income and the base amount ($25,000) is $5,000.

Since the difference between your combined income and the threshold is less than half of your Social Security benefit amount, you would enter $5,000 as the taxable amount on your tax return.

These calculations become more complex if you’re subject to 85% taxation, but the IRS offers tools and worksheets to help you calculate your tax liability.

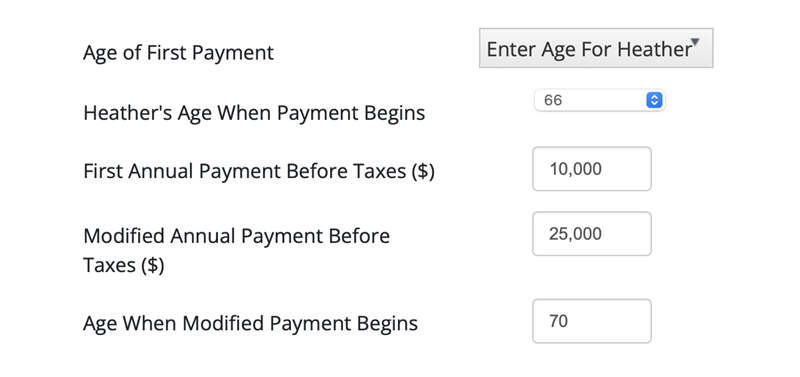

You can enter your annual Social Security payment in WealthTrace and also indicate whether this payment will change at some point in the future. WealthTrace can then calculate the annual estimated taxes on your Social Security income for you.

Roth IRAs and Tax-Free Retirement Income

If you are looking for ways to minimize your tax burden in retirement, you may want to consider contributing to a Roth IRA or doing a Roth IRA Conversion. Since you contribute after-tax dollars to a Roth IRA, qualified withdrawals are tax-free. Roth IRA distributions do not count toward your combined income for Social Security tax purposes, meaning they won’t increase your tax burden. This makes the Roth IRA a valuable tool for boosting your retirement income without raising your taxes.

Additionally, individuals aged 50 or older can make "catch-up" contributions to their Roth IRA, up to an extra $1,000 per year. These contributions must be made by the tax filing deadline to count toward that year's contribution limit.

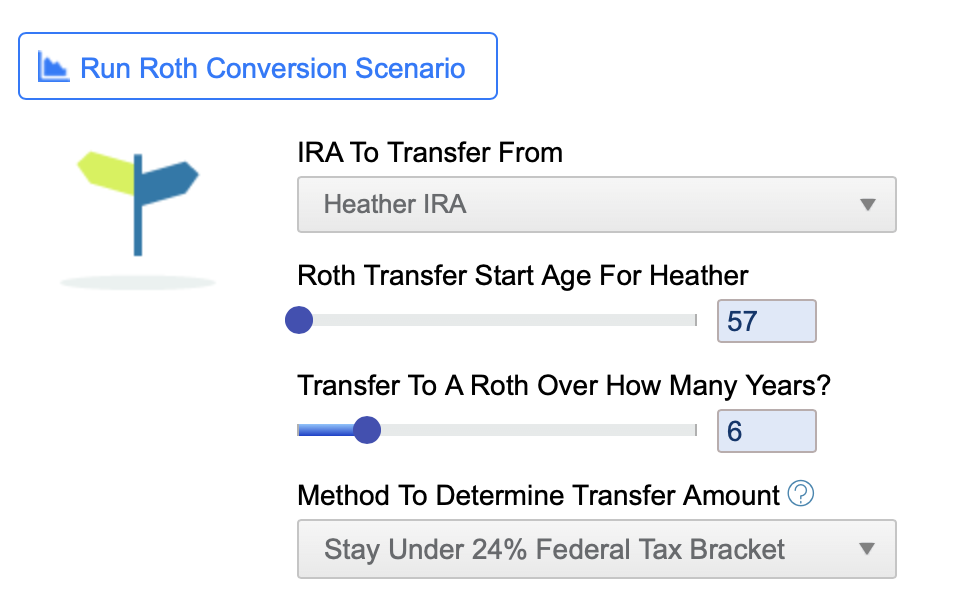

Running a Roth IRA Conversion Scenario in WealthTrace can help you decide if a Roth IRA conversion will benefit you. You can view projections such as total taxes paid, tax rates, income for IRMAA, Social Security tax estimates and overall taxable income in the base case and the conversion scenario.

The Bottom Line

Everyone wants to minimize their tax burden, especially in retirement when you may be living off a set amount of savings. Relying only on your Social Security benefits to fund your retirement isn’t usually enough, so having other sources of income is important.

The key to minimizing taxes in retirement is developing a strategy to manage your various income sources. Additionally, having after-tax savings in accounts like a Roth IRA is often a highly recommended approach.