Key Points

- Recessions can occur or be worsened by consumer reaction and spending habits.

- Estimated Q2 GDP Growth shows economy expansion, not contraction.

- Recessions almost always mean a bear market for stocks.

Predicting whether a recession is on the horizon is difficult to do and most recessions are, in fact, declared around a year after they have started. Recessions typically mean consumers are spending less, a rise in unemployment due to layoffs, stocks and real estate losing value, and our country’s Gross Domestic Product (GDP) declining. Given our existing monetary institutions recessions are inevitable, so how can we prepare for them?

Consumer Reaction Can Worsen A Recession

There have been 13 recessions since World War II; some have been short and painful like the Covid-19 recession, also known as the Great Lockdown, and some have lasted longer, such as the Great Recession of 2008. A big part of why recessions happen is how we as consumers react to the environment around us. We are currently dealing with high inflation, the Federal Reserve raising interest rates, a war in Ukraine and Israel, riots and unrest in Europe and a pending presidential election.

It makes sense for consumers to feel under pressure and nervous about their financial future and overall sense of security. But, as with most things in life, the best course of action is to stay calm and have a plan.

GDP Growth Is Strong

Despite the growing fears of a pending recession, there are many factors that are pointing to the opposite. A preliminary estimate of second quarter GDP growth showed that the economy expanded at an annualized rate of 2.8% during the period, compared to 2023’s annual GDP growth rate of 2.5%. Market analysts have been anticipating slowing economic growth given factors such as climbing interest rates, yet the second quarter growth reflects increased consumer spending.

Spending on goods has remained stable but spending on services has grown. Rob Haworth, senior investment strategy director of U.S. Bank Wealth Management says “Consumers may have been feeling somewhat of a wealth effect from recent strong stock market returns. They are saving less while maintaining a solid rate of spending”.

U.S. Unemployment Rate Rises

The job market is another major contributor of whether a recession is on the horizon since it heavily influences consumer spending habits. The labor market remains tight, but is showing signs of softening.

The unemployment rate has been rising after a 54-year low of 3.4% was reached in 2023, reaching a “normal” level of 4.3% in July. To put things in perspective, the unemployment rate peaked at around 10% following the 2008-09 financial crisis, and 14.7% following the shelter-at-home orders in 2020 due to the COVID-19 epidemic. A very low rate of unemployment, similar to what we have experience recently, can however have negative consequences such as increased inflation and reduced productivity.

The U.S. economy has remained strong despite its high inflation and the Federal Reserve continuing to raise interest rates. How long this period of stability will last is however unknown, so preparing for an economic downturn is vital.

Important Questions to Ask Yourself

As you take a look at your financial plan in WealthTrace, you should ask yourself the following questions.

- How much cash do I have available?

- How much debt do I currently have?

- What are my basic monthly living expenses?

- Do I have any major life events coming up with significant expenses attached (wedding, house purchase, retirement)?

Reviewing your upcoming expenses, debt, and portfolio liquidity will help you anticipate your needs over the next 6-12 months.

Review Your Current Asset Allocation

In WealthTrace you can review your Asset Allocation across all of your Investment Accounts, enter your current debt, create a detailed Budget Worksheet and add any significant upcoming expenses.

Using the Budget Worksheet allows you to easily add expenses and toggle between three separate budgets to see how this will affect your plan. By changing the budget in scenarios you can see how saving more money can increase your chances of a successful retirement.

Run Bear Market Scenarios in WealthTrace

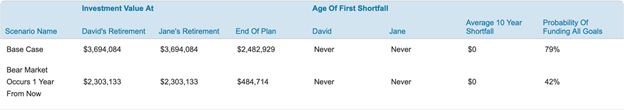

You can run Bear Market scenarios to see how your portfolio would react to a future recession, and you can choose from one of our pre-set recessions or create your own. In the scenario below, we selected the 2001 Bear Market scenario and set it to start 1 year from today, with no Market Rebound.

This couple has a conservative portfolio of investments, so they can withstand a recession without too much concern. If they had an aggressive portfolio, their results would look very different, as shown in the screenshot below.

Conclusion

The average length of a recession, going back to World War II, has lasted an average of 11.1 months. One of the worst effects of a recession is the possibility of losing your job, which is why having liquidity in your portfolio is so important. With investment vehicles such as Money Market Funds offering yields that top 5%, putting your emergency funds in these types of investments can offer you both liquidity and investment returns. Bolstering your emergency fund ahead of time can help you ride out a potential layoff and a downturn in the stock market. Reviewing your plan in WealthTrace and running multiple scenarios can help you make a plan and stay prepared.

Do you know how much your retirement plan would be impacted by a recession? If you aren’t sure, sign up for of free trial of WealthTrace to get started on your financial and retirement planning.