Key Points

- You can only collect spousal benefits when your spouse starts collecting.

- Claiming benefits early can impose a steep penalty on the spousal benefits.

- Waiting until at least Full Retirement Age usually makes the most sense.

Social Security benefits are the biggest source of retirement income for most retirees, and roughly half of individuals 65 or older live in households where 50% of the family income comes from Social Security. Most people assume they will pay into Social Security up until they retire and then collect their benefit.

If you are married however, you have the option to collect spousal benefits instead of your own based on the earnings record of the other spouse. This may allow you to collect a higher benefit than if you collected your own. There are some rules to consider, which we will discuss below.

What is Social Security?

Before we dive into the rules regarding collecting spousal Social Security benefits, let’s first look at how Social Security benefits work. Social Security was created to promote the economic security of Americans. It helps provide a source of income when you retire, or if you cannot work due to a disability. Your individual benefit is calculated by looking at your highest 35 years of earnings (AIME), adjusting them for inflation and then applying a formula to calculate the Primary Insurance Amount (PIA). Your monthly benefit that has been derived from the PIA may be higher or lower than the PIA. If you retire before your full retirement age, you will receive a reduced benefit. If you retire after your full retirement age, your monthly benefit may be higher than the PIA due to credits given for delayed retirement.

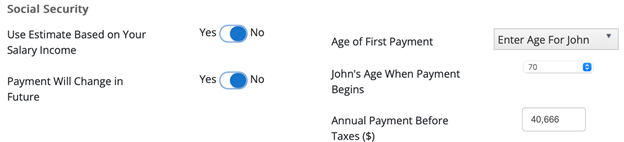

You can enter your Annual Social Security payment in WealthTrace, indicate when the payment will begin, and whether payment will change in the future.

What is COLA?

Once you have started taking your Social Security benefit, the amount you receive will be continually adjusted for inflation. This is referred to as a Cost-of-Living Adjustment, also known as COLA. The purpose of COLA is to ensure that the purchasing power of Social Security is not eroded by inflation.

Per the Social Security Administration; It is based on the percentage increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers from the third quarter of the last year a COLA was determined to the third quarter of the current year. In layman terms, as the price of goods and services go up, the Social Security benefit should increase proportionally as well. Go here to see the Social Security changes for 2025.

One interesting thing to mention however is that if we look at the past 20 years, the average annual change in the CPI is 2.6% and the average COLA increase for the last 20 years is 2.5%, showing that COLA is moving slightly behind the rise in consumer prices.

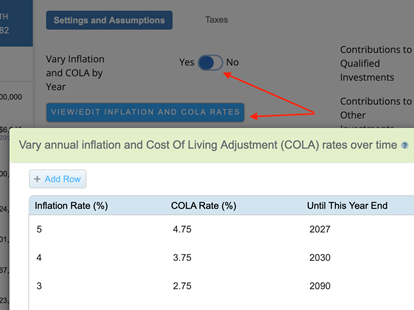

In WealthTrace you can enter a static rate for inflation and COLA, or you can choose to enter varying rates which adds to the accuracy of your plan projections.

Three Rules for Receiving Spousal Social Security

Once you have reviewed your own future Social Security benefit, it is worth considering if taking your spouse’s Social Security is more beneficial. For example, if your estimated monthly benefit is $1,500 and your spouse’s estimated benefit is $4,000, you could be eligible to collect up to half of their benefit, meaning you can receive up to $2000 per month instead of $1,500. Let’s look at a few of the rules surrounding this.

1. You can only collect spousal benefits once your spouse starts collecting

You will only be eligible to start receiving your spouse’s Social Security benefit once they have decided to start collecting theirs. This means that if the higher-earning spouse decides to maximize their benefit by waiting until age 70, the other spouse will need to wait until then to be able to claim spousal benefits. The other spouse will have to settle for a lower benefit, or no benefit at all, in the meantime. You are still able to claim your own benefit as early as age 62, and then you can choose to apply to receive the spousal benefits once they start taking theirs.

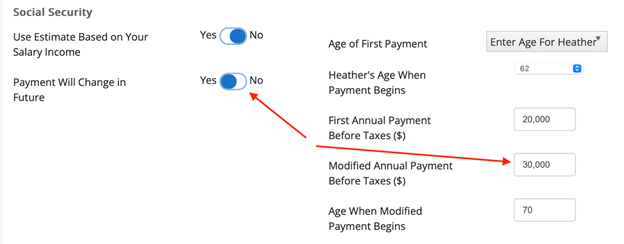

You can indicate if, and when, your Social Security payment will change in the future in WealthTrace.

2. The spouse will not be eligible for delayed retirement credits

The maximum amount that you will be eligible to receive from your spouse’s benefit is 50% of their Primary Insurance Amount (PIA) at full retirement age. Your spouse can still choose to delay receiving benefits to receive delayed retirement credits, but this will not carry over to the other spouse. It usually makes the most sense for the higher-earning spouse to start collecting benefits at their full retirement age (FRA), if the plan is for the other spouse to start collecting half of their benefit as well.

3. Claiming benefits early will reduce spousal benefits

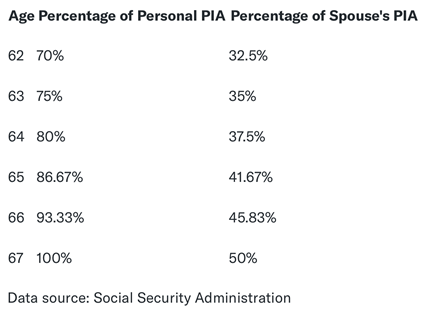

If the higher-earning spouse decides to collect their benefits before full retirement age, there will be a penalty imposed on the spouse planning on collecting spousal benefits. The only exception to this rule is if you are caring for a qualifying child of your spouse’s.

Using the table above, if the higher-earning spouse is eligible to receive $3,500 per month at age 62 and decided to start collecting, this means that the spouse collecting spousal benefits would receive a monthly benefit of $1,137.50. If the higher-earning spouse waits until age 67, his benefit would be $5,000, and the other spouse would receive $2,500.

The Bottom Line

Being strategic about when, and how, to collect your Social Security benefit is an important piece of the retirement puzzle. Everyone’s situation is unique, but most of the time it makes sense to delay receiving Social Security until full retirement age, especially if one of the spouses plans on collecting spousal benefits.

Do you know when you should start claiming your Social Security benefits? If you aren’t sure, sign up for a free trial of WealthTrace to run what-if scenarios on this important decision.