Key Points

- The target amount to be saved before retirement is important, but it's not everything. In this article, updated for 2022, we use WealthTrace's Retirement Planning Software, which is available to the public as well, to look at retirement scenarios.

- The points to consider when evaluating a retirement plan are almost the same for everyone, regardless of the amount they have saved.

- "Edge case" scenarios like persistently high inflation or a bear market won't feel like edge case scenarios if they happen during your retirement, so it's best to model them in advance.

I have written a number of articles about whether a certain amount of money would be enough to retire with. A million dollars. Two million dollars. I put a hypothetical couple through a hypothetical saving-and-spending scenario, and we see how it goes. I used the WealthTrace Planner to calculate all of the scenarios in this article and you can do the same using our free trial.

This time around, with $3 million, I wanted to take a slightly different tack. I realize not everyone is going to be in the fortunate position of being able to retire with $3 million, so I wanted to make some points that would be applicable to people considering retirement regardless of how much they have saved.

In 2022 $3 million is not what it used to be, especially with inflation running at near double digits. Ten years ago, adjusted for inflation, $2.25 million has the same purchasing power that $3 million has today. In fact, so much purchasing power has been lost that some financial advisors believe the new rule of thumb is $3 million for retirement.

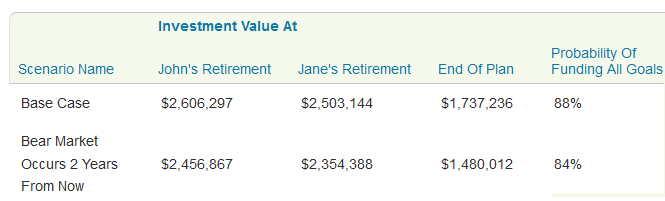

Let's take a look at a few permutations for our couple this time around. The first row is the base case, and the rest of the rows are variations on that case.

| Retirement Age | Living Expenses | Additional Expenses | Annual Return | Wrench In The Works | Probability of Success |

| 60 (both) | $100,000 | $7,500/yr for 20 years | 5.2% | None | 81% |

| 60 (both) | $100,000 | $7,500/yr for 20 years | 6% | None | 85% |

| 62 (both) | $90,000 | $5,000/yr for 20 years | 5.2% | None | 94% |

| 60 (both) | $100,000 | $7,500/yr for 20 years | 5.2% | Bear market in 5 years | 35% |

| 60 (both) | $100,000 | $7,500/yr for 20 years | 5.2% | Inflation a full percentage point higher annually | 64% |

| 65 (both) | $100,000 | $7,500/yr for 20 years | 5.2% | None | 90% |

The Base Case

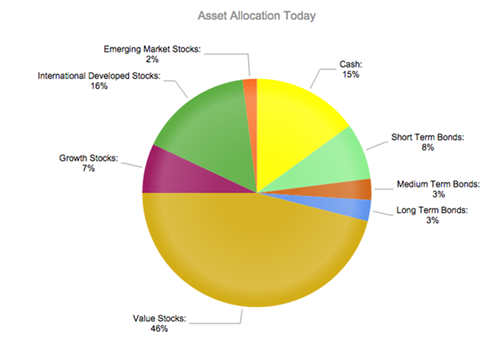

Our couple is 60 years old and they are wondering if $3 million is enough money to retire at age 60. They are hoping to retire pretty much immediately. Half of their $3 million is in taxable accounts, and half is in tax-deferred accounts. Also, nearly half of the couple's assets are in value stocks, with the rest spread around different equity and fixed income investments (aside from their cash holdings):

Know what you own: WealthTrace can look at your portfolio and tell you how your investments are allocated.

Know what you own: WealthTrace can look at your portfolio and tell you how your investments are allocated.

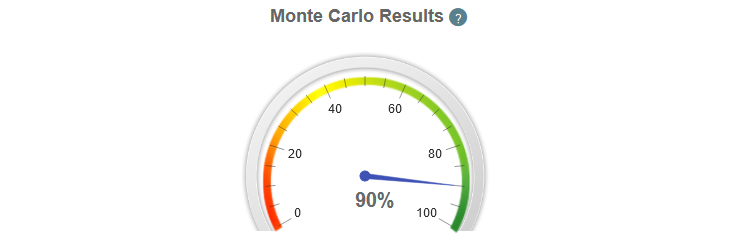

According to WealthTrace's Monte Carlo simulator, the couple's plan has a reasonable 90% chance of succeeding:

Variations On The Theme

Capital markets are inherently volatile, of course. We can't predict what will happen, especially over short periods of time. Just look what the financial markets have done so far in 2022. In the past 15 years we only saw volatility like this in 2020 when Covid hit and in 2008 and 2009 during the financial crisis. So we need to take a look at what might happen if we throw the proverbial wrench in the plan's works.

You can see in the table above that I have varied some of the inputs on the rows after the base case row. The inputs that I changed are in red.

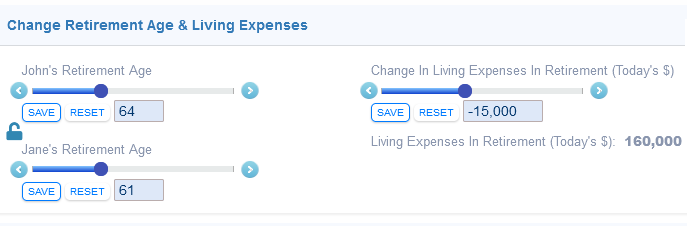

The results of the changes make intuitive sense: Push retirement out by a couple or five years, and the probability of the plan's success increases. Reduce spending and push out retirement, and the probability really increases.

Total Control. With WealthTrace, you can run a plan through some what-ifs right on the screen and see what the effect of any changes would be on the plan's success. In this case, we're increasing the age of retirement and decreasing living expenses. Learn more.

I wanted to point out a couple of cases that might not be so obvious but that should be on the minds of anyone nearing retirement. First is the detrimental effect of inflation. For the base case, we've assumed 3% inflation annually. If we make that 4%, our clients' plan doesn't do nearly as well, with a 64% probability of success.

What's going on here? Simply put, inflation chips away at your purchasing power over time. If the assumed inflation rate goes up while the assumed total return number does not, you'll effectively have less money over time. Stress testing a plan's ability to withstand a spike in inflation is an oft-overlooked step.

The other thing I wanted to highlight is the effect of a potential bear market on this couple's portfolio. People nearing retirement often do not give this possibility much thought. Sometimes, they will have a withdrawal rate in their head--3%, say, or 4%. They will have done the math and figured that as long as they stick with that withdrawal rate, and that as long as markets remain stable, they'll be OK.

But that's a little too much "as long as" for comfort, especially with a portfolio as dependent on stocks as this one. If a bear market like the one we had in 2008 hits this portfolio, the couple could be in big trouble. They would need to draw down on their portfolio even as it is dropping in value--a double whammy of sorts. The Monte Carlo simulation knocks the probability of the plan's success to 36%.

Put It Through The Wringer: If you're thinking about retirement, make sure you are considering a wide range of what-ifs--and that you are using accurate tools like WealthTrace to help. Learn more.

For this couple, I might encourage a less equity-heavy portfolio, and for them to trim back their spending a bit. For example, if we put half of that slug of value stocks in long-term bonds while reducing annual spending to $90,000, that bear market has a far less deleterious effect on the plan, with probability of success of around 70%.

More Than Just A Number

Whether you have saved $3 million or just a fraction of that amount, that total is only one piece of the puzzle. Make sure you're also looking at day-to-day spending, one-off spending (on things like cars and vacations), the effect of retiring later, and the "known unknowns" mentioned above.

Setting a target for an amount to save before retiring is a good idea, of course, but it's not everything. There is a lot more to a successful retirement plan than just hitting your number. Sign up for a free trial of WealthTrace to start your retirement plan today.