Key Points:

- Inflation, long dormant, is rearing its head and roaring.

- Inflation can be detrimental--even destructive--to a retirement plan.

- Running simulations of higher inflation on your plan could put your mind at ease or show you what kind of changes you might want to make.

You don't have to look too far these days for signs of inflation. Beef prices are up more than 12% over the last year, while pork and chicken are up in the high single digits. New vehicle prices are up about 8%; apparel, 4%.

You've surely noticed it in your utility bills and at the gas pump too, though energy prices tend to march to the beat of their own drum. Lumber prices are way down from their highs earlier in the year, but if you're buying a new home, watch out--they're still about 75% higher than their average over the past four years. The Federal Reserve's rate-setting committee estimates that overall year-on-year inflation could be at 4.2% by the end of the year. Its long-term target rate, meanwhile, is 2%.

How permanent or persistent these price increases will be is a topic of intense debate. It's possible that this is largely the result of COVID-related supply-chain bottlenecks that will eventually work themselves out. Pandemic-related restrictions have slowed production of countless consumer goods, or parts that go into final products. Semiconductor shortages have grabbed a lot of headlines, particularly related to auto production.

But if you're retired, or at least headed that direction, you don't want to take a chance that this is all short-term noise. Inflation is one of your biggest enemies if you're retired. You don't have a salary that at least grows with inflation anymore. You mostly have investment assets, and if inflation is raging, your purchasing power--what you are able to buy--decreases, even though your needs and wants do not. That can have a severely damaging effect on a retirement plan.

Let's take a look at a few things retirees should be aware of and prepare for, and run some inflation-related stress tests in WealthTrace.

Vary Inflation Over Time

WealthTrace is the only retirement planning software that allows users to vary inflation over time. This is the most realistic way to handle inflation in today’s environment. Most people don’t believe inflation will stay above 8% forever.

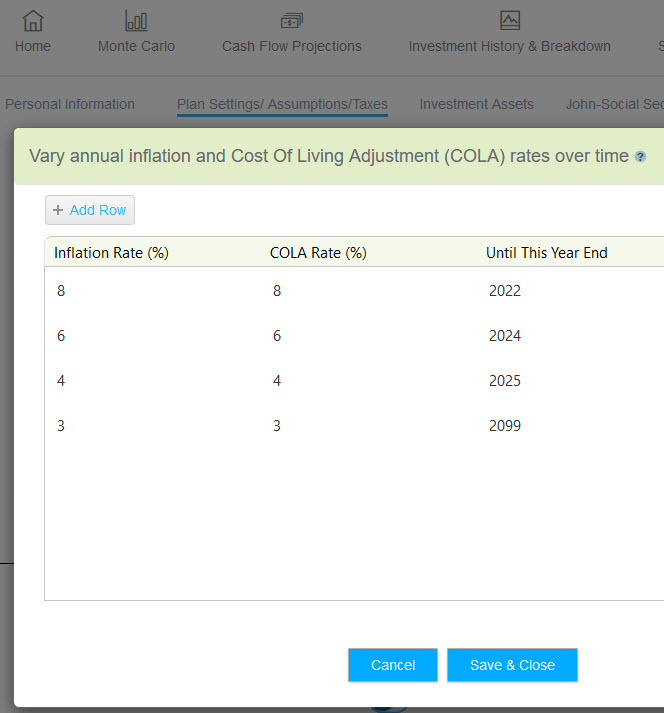

As seen in the image above, you can specify that inflation will be 8% this year, then 6% for two more years, then 4% for a year, then it levels out at 3% forever.

Simulate The Worst, Hope For The Best

With certain versions of the WealthTrace Planner you can run a simulation that puts higher (or lower) inflation figures into a plan. This is a good place to start to stress test your portfolio and your plan.

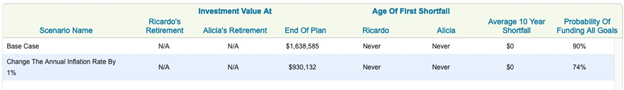

Running this simulation, the program will show you a before/after of Monte Carlo results, taking into account your asset class mix.

Here's a quick example. With inflation estimated to be 2.5%, an already-early-retired couple in their 50s with about $1.8 million in investments is looking at a comfortable 90% chance of funding all their goals in retirement, according to Monte Carlo. But if inflation is estimated to be a full percentage point higher, that drops to a far scarier 74%.

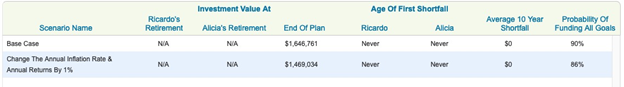

Over time, inflation and investment returns are correlated--and we put "over time" in there to cover market corrections as investors adjust to new expectations. So you might also want to see what things look like if you move both in parallel--which you can also do with WealthTrace:

If we run the same plan through this what-if, things look a fair amount better:

Real returns tend to stay constant as inflation moves up and down--again, though, over time, not necessarily in lock-step.

What's In The Mix?

Let's talk about asset classes for a second. Is there an ideal asset class allocation in times of rising inflation?

There's no one-size-fits-all answer to that question, unfortunately. But there are a few things investors should be aware of.

First, regarding bonds: They're not really a safe haven. In fact, long-term, high-quality bonds--often an asset of choice for investors in retirement--will generally not fare well when inflation is rising. They probably won't collapse, and they'll still pay their coupons, but with inflation rising, those coupons will be worth less--after all, there will be higher-interest-rate alternatives available--so the bonds' values will likely decline.

What about Treasury Inflation-Protected Securities, or TIPS? It says it right there in the name that these bonds are protected against inflation, right?

TIPS do offer a hedge against rising interest rates. Their principal is adjusted based on whatever is happening with the consumer price index (CPI). TIPS will generally do well when inflation expectations--as well as actual inflation--are rising. If rates are rising but the sentiment is that they won't be rising for long, they probably won't do so well.

A potential drawback with TIPS, or at least something to be aware of, is that you can be taxed on principal gains you never receive. This increase in value is sometimes called phantom income. TIPS' principal appreciation and interest are taxed in the year they happen, rather than when the bond matures. When inflation is on the rise, taxes on these bonds' principal will also rise. You may even have to pay taxes that are higher than the value of the bonds' coupon.

The stock portion of your portfolio, meanwhile, should fare well, all else being equal. Companies can generally pass along price increases to consumers or their business-to-business customers, so revenues will rise with inflation.

That "all else being equal" part is a pretty big caveat, though. Inflation can have some significant unwanted side effects that can trigger a market correction. Tech stocks in particular can get hit when inflation and interest rates are on the rise.

Let's go back to our couple for a second. If we modify their plan and really ramp up their bond holdings, what do the before/after inflation-spike results look like?

If we move them to 85% bonds and cash, their Monte Carlo results improve dramatically, going all the way up to 98%. Their projected end-of-plan value, meanwhile, actually drops. This might sound counterintuitive but it makes sense; with Monte Carlo, a large chunk of volatility is removed by going to fixed income, but by going to fixed income, the prospects for capital appreciation are reduced.

Anyway, what happens if we throw our hundred-basis-point inflation increase at this version of the plan?

Inflation hits this plan too, though not as hard.

The Tail Should Not Wag The Dog

The takeaway here is not necessarily that you should start shuffling asset classes around if you feel inflation is going to be with us a while. Each plan is unique. And one thing we didn't cover above: Social Security and pension income. If you are largely dependent on such income (and you're reasonably confident Social Security will be there for you to the degree you've been promised), inflation should not bother you much, because Social Security is indexed to inflation. However, many pensions have no growth rate at all and have a fixed payment amount for life. High inflation can have a massive impact on the real value of these payments.

When it comes to asset allocation strategies, yes, you should be aware of inflation, and you should stress-test your plan for inflation spikes with a program like WealthTrace. But you probably don't want it to completely dictate what you do. If a recession or stock market sell-off comes around, that could be a good time to move some money out of fixed income and into stocks. But your tolerance for risk and your retirement goals should drive your asset allocation more than inflation (or anything else).