Key Points

- There is new data showing that the average senior is getting by with much less than the recommended savings.

- According to Fidelity, you should have saved at least 10x your annual income by age 67 to retire comfortably.

- The average American now thinks they need around $1.46 million to retire.

How much money you need to retire has been a hot debate for decades. Some believe you need millions to retire, others believe in the 4% rule, and some say you need 10 to 12 times your final annual working salary. But are these strategies realistic for most Americans, or are they inflated and difficult to achieve?

There is new data showing that the average senior is getting by with much less than the recommended savings, and they are living comfortably. Andrew Biggs, a senior fellow at the American Enterprise Institute says you can retire for much less - $50,000 to $100,000 in total savings.

So why do “experts” and investment firms recommend the saving strategies above? Is it to bring in business, since the more we save the more we pay in various fees? Let’s look at a few of these strategies in more detail.

The 4% Rule

This saving strategy is relatively simple, but also quite vague. The 4% rule assumes you withdraw the same amount (4%) from your portfolio every year, adjusted for inflation. This basically means that despite how your portfolio performs or how your spending habits change, you will withdraw and spend the same amount of money year after year.

The rule also assumes that you are invested in a 60/40 split between stocks and bonds, which may not be the recommended portfolio model for everyone. Another assumption made is that the lifespan of your withdrawal strategy is 30 years - if you are retiring early or late, this time horizon may not work.

Let’s not forget too that using the 4% rule would require you to have $1 million dollars in retirement savings in order for it to last 30 years. If those savings are in tax-deferred accounts, then any taxes would need to be paid out of the 4% being withdrawn. This strategy was designed by a financial adviser named Bill Bengen in the 1990s. It may have been a viable strategy 30 years ago, but is it viable now?

10-12 Times Your Annual Salary

According to Fidelity, you should have saved at least 10x your annual income by age 67 to retire comfortably. To succeed with this savings strategy, the assumption is made that the person will have saved 15% of their annual income beginning at age 25, invests more than 50% of their savings in stocks over their lifetime, retires at 67 and plans to spend the same money in retirement as pre-retirement.

There are additional milestones to help stay on track as well; Aim to save at least 1x your annual income by age 30, 3x by 40, 6x by 50, and 8x by 60. This may sound like a relatively simple strategy, but if you are behind on the milestones and haven’t followed the initial steps, this may be difficult to achieve for the average investor.

80% Of Your Pre-Retirement Income

A relatively new savings strategy, developed by the financial planning industry, suggests that most retirees can live on less than they earned during their working years. This seems pretty reasonable since when you retire, you no longer have to pay for Medicare and Social Security taxes, and any 401k/IRA contributions will end. They believe that replacing 80% of your income means that your lifestyle can essentially stay the same. This percentage can be even further reduced if you no longer pay for things like a mortgage, debt and commuting costs when you retire.

Based on this rule, if you were earning $100,000, you will need $80,000 per year to cover your expenses. Some of that will come from Social Security benefits, pensions, annuities and the rest from retirement savings. If we assume you can collect $30,000 from Social Security benefits along with pension income, then you will still need an additional $50,000 per year in income. If we assume an inflation rate of 4% and a conservative investment return of 5%, you will still need to have saved around $1.3 million to fund a 30-year retirement that begins at age 67. For most Americans, this target is way out of reach.

The median retirement savings for Americans aged 65-74 in 2022 was $200,000 and the average was $609,230 (the average tends to be inflated due to high net worth individuals driving up the number), as reported by the Federal Reserve’s Survey of Consumer Finances. Neither of these numbers are even close to the amount recommended by the financial planning industry, yet many Americans report they are getting by just fine.

According to the survey of Household Economics and Decisionmaking by the Federal Reserve the median 65-74 year old who reported that they were doing OK or living comfortably had between $50,000 and $99,999 In savings. The median retiree who reported they were living comfortably had $100,000 to $249,000 in savings. This is a stark difference from the recent study conducted by Northwest Mutual in which the average American now thinks they need around $1.46 million to retire; a dramatic increase from 2020 when the number was $951,000 and 2023 when it was $1.27 million.

To test this theory of saving much less for retirement and spending less, we have created a retirement plan in WealthTrace for a retired couple aged 67 with the following details.

$45,204 in combined annual Social Security income

$20,000 in combined annual pension income

$5,000 in annual dog walking income for 10 years

$50,000 saved in a taxable account, 60/40 stocks and bonds

$200,000 saved in a 401k, 60/40 stocks and bonds

$70,000 in Annual expenses for the first 10 years, decreasing to $50,000 until the end of their plan.

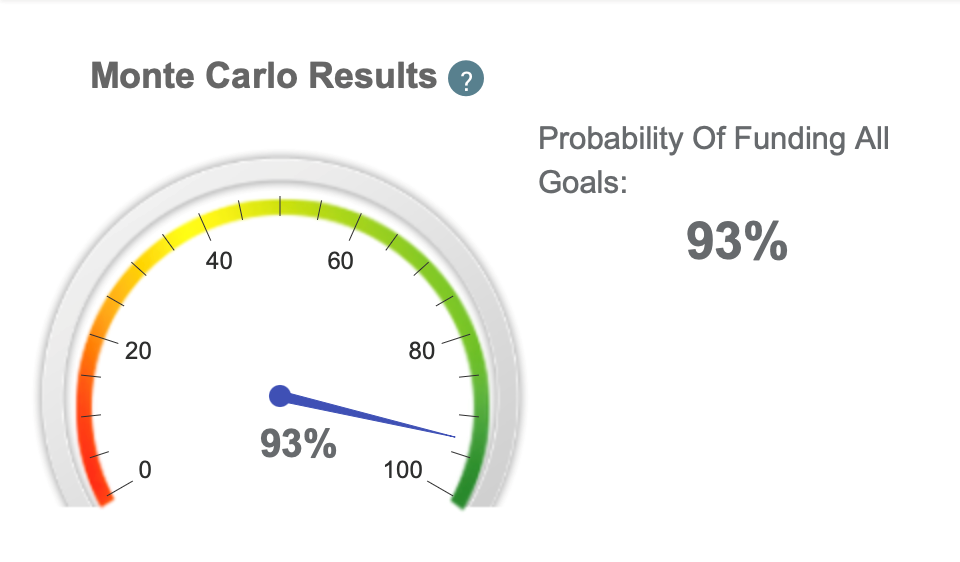

Despite their modest savings, this couple still scores a high probability of funding all goals in the Monte Carlo Simulations.

The Bottom Line

Bad news is good news for newspapers, and the same can at times be said about the financial industry. Fear mongering around the recommended retirement savings can help drive in business for financial planners, investment firms and the stock market. We will face challenges as life spans increase and the Social Security trust funds run dry, but staying realistic is the best course of action. Most couples end up spending much less in retirement as kids move out, mortgages are paid off and overall expenses decrease.