Key Points

- Once you've retired, you'll most likely have lower income taxes.

- That's great news, but there's still work to be done in terms of making sure you're minimizing the taxes you do have to pay.

- Tax strategizing is a whole lot easier with a program like WealthTrace.

It should be no surprise to you that your income taxes will almost surely drop in retirement. With that salary you've been bringing home for decades in the rear view mirror, you shouldn't owe the taxman nearly as much. (And if you're consuming less than you were before, your sales taxes should drop too, though that's a different subject.)

Retirees usually rely on Social Security benefits, pension payouts, and withdrawals from retirement accounts like 401(k)s and IRAs to get by on. These sources of income are generally subject to lower tax rates than the wages earned during a career.

Additionally, retirees may have other sources of income, such as dividends, rental properties, or part-time jobs. These earnings are generally lower than salary income, resulting in reduced overall taxable income.

Let's take a look at the taxation of various sources of income in retirement.

Favorable Social Security Taxation for Many

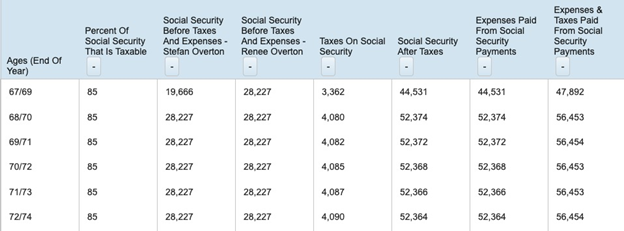

Social Security benefits, a significant source of retirement income for a lot of people, are taxed differently than regular income. Below certain income levels, these benefits are not taxable at all, whereas for those with higher combined incomes, up to 85% of benefits may be taxable (such as in the case below taken from the WealthTrace Financial & Retirement Planner). Social Security benefits' taxation depends on combined income, which includes adjusted gross income, nontaxable interest, and half of the Social Security benefits themselves.

It's also worth noting that 37 states do not tax Social Security benefits at all, and some of the remaining 13 states offer exemptions or deductions to reduce the tax burden on retirees.

Tax Rates on Qualified Dividends and Long-Term Capital Gains Are Often Lower

There's usually more to retirement income than Social Security, though.

Retirees will often have saved and invested in stocks, bonds, and/or funds, collecting qualified dividends or realizing long-term capital gains when they sell their investments. These sources of income are generally taxed at more favorable rates than the ordinary income rates the retirees were subject to during their working years.

For example, for taxpayers in the 10% and 12% income tax brackets, qualified dividends and long-term capital gains are not subject to any federal income tax. Taxpayers in the 22%, 24%, 32%, and 35% brackets pay a 15% tax rate, while those in the 37% bracket pay a 20% tax rate. These reduced rates can result in significant tax savings for retirees who rely on investment income.

The Standard Deduction and Tax Credits for Seniors

We may fight ageing tooth and nail, but it does have its benefits.

The federal tax code includes provisions specifically designed to benefit seniors, such as a higher standard deduction and various tax credits. In 2023, the standard deduction for single filers is $13,850. But those aged 65 or older enjoy another $1,850 deduction on top of that, for a total of $15,700.

The standard deduction for married couples filing jointly is $27,700. If one spouse is 65 plus, the couple can tack on another $1,500; if both are, it's another $3,000. These higher standard deductions reduce the amount of taxable income for retirees--leading, of course, to lower income taxes.

On top of all that, retirees may qualify for tax credits, such as the Credit for the Elderly or the Disabled. This non-refundable credit in particular can be worth up to $7,500, depending on filing status and income level. To be eligible, you must be 65 or older or permanently and totally disabled.

Be Strategic With Withdrawals from Retirement Accounts

Retirees can also lower their income taxes by strategically withdrawing funds from their retirement accounts. The WealthTrace Financial & Retirement Planner can help model various strategies for drawing down on investment accounts so you can minimize your taxes and maximize your chances of a worry-free retirement.

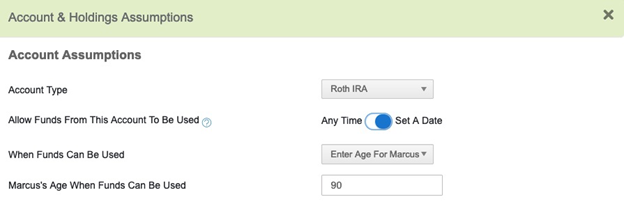

For example, traditional 401(k)s and IRAs are funded with pre-tax dollars, meaning withdrawals are taxed as ordinary income. However, Roth 401(k)s and Roth IRAs use after-tax contributions, making withdrawals on them tax- and penalty-free.

When it comes to retirement, It's generally going to make sense to defer paying taxes as long as possible, so you'd want to use Roth IRA money before traditional IRA money.

That's how WealthTrace handles withdrawals by default, but there are always exceptions to rules, especially when it comes to personal finance. So if you need to hold back some accounts that might normally be used, you can.

By carefully planning withdrawals from their accounts, retirees can manage their taxable income to stay within lower tax brackets. For example, a retiree might withdraw funds from a traditional IRA up to the limit of their current tax bracket, and then take additional funds from a Roth account to avoid pushing themselves into a higher bracket. WealthTrace can help with all of this.

Roth IRA Conversions

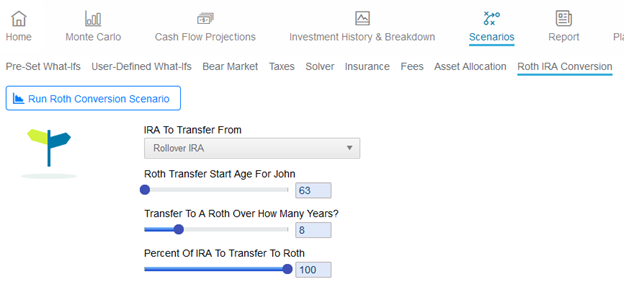

Last, but definitely not least, a benefit of lower income tax rates in retirement can be the potential benefits of converting to a Roth IRA. One key variable when deciding on whether or not to convert a traditional IRA or 401(k) account to a Roth IRA is your income tax rate.

If your income tax rate will be much lower once you retire, but will increase later on once Social Security benefits and/or Required Minimum Distributions (RMDs) begin, a Roth IRA conversion can potentially save you a lot of money because the tax burden on converting pre-tax retirement funds to a Roth IRA is reduced.

Run Roth IRA conversion scenarios in WealthTrace to help you decide if it makes sense for you.

Optimizing and Minimizing

Lower income levels, favorable taxation of Social Security benefits and investment income, and tax provisions specifically designed for seniors all contribute to reduced income taxes in retirement. Understanding all of these factors and working with a program like WealthTrace, retirees can optimize their tax situation and keep more of their hard-earned money.

Do you know how your future income tax rates will impact your retirement? If you aren’t sure, sign up for a free trial of WealthTrace to get started on your financial and retirement planning.