Key Points:

- In 2017, Congress enacted the Tax Cuts and Jobs Act (TCJA) that brought about major changes to the tax landscape. The top income tax rate was reduced to 37%, certain business owners were granted a 20% tax break, and the number of affluent estates liable for federal tax was curtailed.

- These tax reductions for individuals are not permanent fixtures. Unless action is taken to extend them, they are slated to expire in 2026.

- The possibility of income tax rates increasing makes financial planning for the future even more important.

Plan for Your Future: Build your own financial and retirement plan. WealthTrace allows you to change tax brackets in 2026 to the higher rates that might exist. You can also run tax scenarios, changing tax brackets to any rate you wish.

In 2017, the Tax Cuts and Jobs Act (TCJA) was enacted by Congress, bringing about tax reductions for numerous individuals and businesses. However, without additional legislative changes, these tax cuts are scheduled to come to an end by the close of 2025. As a result, tax rates and brackets for most households are anticipated to rise in 2026. Taking proactive measures to prepare for the expiration of the TCJA help reduce your future taxes and prepare you for what might be coming.

The Impact of the TCJA Expiration on Different Groups

Towards the close of 2017, the Tax Cuts and Jobs Act (TCJA) was enacted by former President Donald Trump, marking a significant overhaul of the U.S. tax system. This comprehensive tax reform initiative brought about changes to individual, corporate, and estate tax rates.

However, it is important to note that the effects of the TCJA's expiration differ significantly between households and corporations. Let's examine these impacts for each group:

For Corporations:

Corporations emerged as the primary beneficiaries of the TCJA. This legislation permanently reduced the top corporate tax rate from 35% to 21%. Because of this, corporations remain unaffected by the law’s expiration.

For Households:

In the absence of further legislative action, the tax cuts extended to households under the TCJA are scheduled to expire at the close of 2025. This means that by 2026, tax rates for households would revert to their 2017 levels, resulting in a potential increase in the tax burden for many individuals.

Breaking it down by income quintiles:

Lowest Income Quintile: Only 27% of households in the lowest income quintile witnessed a tax cut or an increase in their tax refund, with most experiencing negligible changes in their tax liability.

Middle Income: Taxpayers within the middle income quintile, with incomes ranging from approximately $49,000 to $86,000, enjoyed an average tax cut of about $800, equivalent to 1.4% of their after-tax income.

High Income: Taxpayers in the 95th to 99th income percentiles, earning between approximately $308,000 and $733,000, experienced the most substantial benefit, with an average tax cut of approximately $11,200, constituting 3.4% of their after-tax income.

Highest Income: Taxpayers within the top 1% of the income distribution, those with incomes exceeding $733,000, received an average tax cut of nearly $33,000, amounting to 2.2% of their after-tax income.

In summary, the expiration of the TCJA is poised to have varying impacts on different income groups, with households, particularly those in the higher income brackets, potentially facing increased tax burdens.

Estate Taxes

Also beginning in 2026, federal taxation will apply to more multimillion-dollar estates. With the impending expiration of temporary provisions in the 2017 tax law, the estate tax threshold is expected to drop to roughly $6 million by 2026, adjusted for inflation.

Pass-Through Businesses

A significant aspect of the 2017 tax law was the introduction of the pass-through deduction. This provision granted entrepreneurs who operate their businesses as pass-through entities (such as partnerships or sole proprietorships) the ability to deduct up to 20% of their business income from taxes. The rationale behind this was to create a semblance of parity with corporations, which enjoyed a substantial tax cut from 35% to 21% under the same law.

How to Prepare For Potential Increased Tax Rates

When running projections for a financial or retirement plan, it’s important to cover all the bases. This means running scenarios where tax rates go back to where they were before 2017.

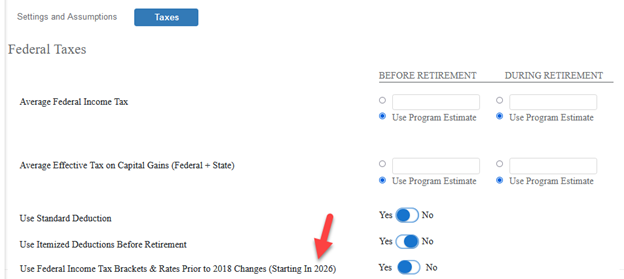

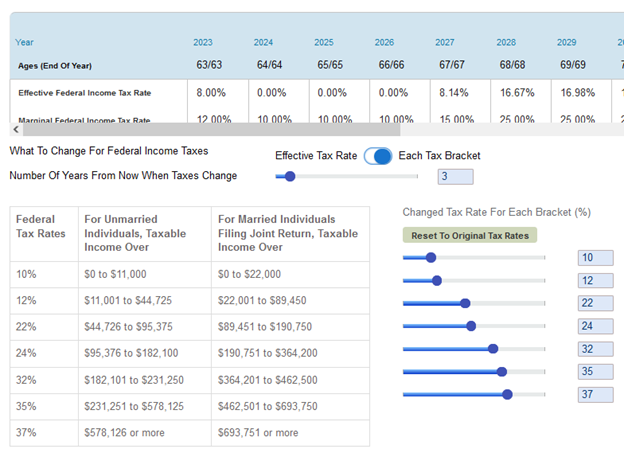

Use WealthTrace to run scenarios where tax rates go back to pre-2017 levels.

Using a typical couple’s retirement plan, we found that they would incur about $125,000 more in taxes over their lifetime if tax rates are increased. We also found that their Monte Carlo probability of never running out of money would decrease by 2% on average.

Many believe that Congress will intervene and extend the tax law changes for those in the middle and lower tax brackets. You can run this scenario in WealthTrace as well.

Choose which tax brackets will increase and when it will happen using WealthTrace tax scenarios.

One strategy that will definitely become more valuable if tax rates do indeed increase is Roth conversions. If you believe your tax rates will be increasing in 2026 it could make a lot of sense to convert some of your retirement funds to a Roth IRA because when required minimum distributions (RMDs) begin, your taxes could be higher than they are today. The WealthTrace Roth conversion scenario feature even accounts for increases in Medicare premiums when your income increases.

Other ways WealthTrace helps you accurately run tax planning scenarios:

- Tax Estimates: WealthTrace automatically calculates your federal and state gross taxable income, deductions, and estimated taxes for each year, using the most up-to-date tax tables and rates.

- Social Security Tax Estimation: The tool automatically estimates the portion of your Social Security income that may be taxable at the federal level and based on your state of residence and yearly gross taxable income.

- Easily change the order of withdrawals from investments to see the tax impact.

- Investment Taxation: Accurately calculates taxes due to capital gains, dividends, and interest based on the type of investment and the cost basis.

- RMD Projections: Accurately projects required minimum distributions (RMDs) from retirement accounts, a critical factor in determining your tax liability during retirement.

- Roth Conversion Insights: If you're considering a Roth conversion, the calculator provides estimates for the tax implications at the time of conversion and the future benefits when you withdraw from the Roth account.

- Relocation Planning: If you plan to move, WealthTrace takes into account your new state's tax rates for the years following your relocation, ensuring accurate tax planning.

Bottom Line

The expiration of the TCJA is poised to have varying impacts on different income groups, with households, particularly those in the higher income brackets, potentially facing increased tax burdens. It is becoming more important than ever to plan for retirement and run tax planning scenarios for the future.

Are you prepared for higher taxes? Will you need to make changes to your retirement plan? To find out, sign up for a free trial of WealthTrace and run tax planning scenarios today.