Key Points:

- Solo 401(k) plans can be a great way to save for small business owners.

- One of the primary advantages of a Solo 401(k) is the ability to contribute more money than other retirement plans for self-employed individuals.

- Solo 401(k) plans are designed for businesses with no full-time employees other than the owner(s) or a spouse. If you hire employees who meet specific criteria, you may lose eligibility for this type of plan.

The sole proprietor 401(k) (better known as a Solo 401(k)) is a retirement plan specifically designed for small-business owners who do not have any employees, or in some cases, only have a spouse as their sole employee. This unique retirement vehicle offers the advantage of allowing participants to invest more funds than what is typically available with a traditional 401(k).

.png?sfvrsn=0)

Sign up for a free trial of the WealthTrace Planner to determine how much you need to save to a 401(k) plan in order to retire comfortably.

What Is a Solo 401(k)?

A Solo 401(k) goes by various names, including Self-Employed 401(k), Sole Proprietor 401(k), and Individual 401(k). However, its operational mechanics differ significantly from a traditional 401(k), making it particularly appealing to small-business owners. Furthermore, managing a Solo 401(k) is relatively straightforward.

Solo 401(k)s function much like traditional counterparts, where you invest with pre-tax income, leading to a reduction in your taxable income for the year. Consequently, the government taxes you as if you earned less money. Additionally, the earnings within the account grow tax-free until you make eligible withdrawals upon retirement.

Since a Solo 401(k) typically covers one or two individuals, the financial institutions managing these plans often charge minimal fees for their services. Furthermore, they typically offer a broad spectrum of investment choices, allowing you to invest in various securities such as stocks, bonds, mutual funds, exchange-traded funds (ETFs), and Certificates of Deposit (CDs). Regardless of your investment choices within your solo 401(k), it is crucial to select an asset allocation that aligns with your time horizon and risk tolerance.

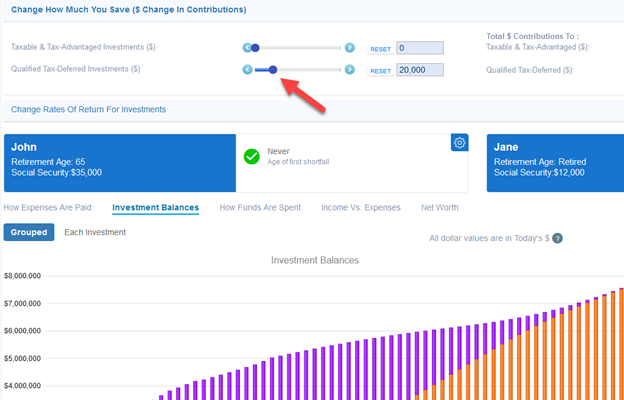

In WealthTrace you can change how much you save using the savings slider and watch your financial projections change immediately.

Contribution Limits

Saving the maximum you can for retirement is the best way to retire stress-free. In a Solo 401(k), you play the dual roles of both employee and employer. This distinction allows the IRS to permit larger maximum contributions for the Solo 401(k) compared to traditional 401(k) plans sponsored by companies with multiple employees.

Here's how it works: as an employee, you can contribute up to $23,000 to your solo 401(k). If you are at least 50 years old, you can make an additional catch-up contribution of $7,500. As your own employer, you can contribute up to 25% of your compensation to the plan, with a maximum employer contribution limit of $46,000 in 2024. If you are 50 or older, the combined contributions (employee plus employer) can reach up to $76,500.

The large contribution limits are extremely helpful to those saving for retirement since they are pre-tax and get to grow tax-deferred, which will be even more important as tax rates are set to increase in 2026. It’s also important to save as much as you can to a retirement account since there are still risks that Social Security will not pay the full benefits that many people are expecting.

Taking Distributions from Your Plan

The IRS has specific guidelines regarding when you can withdraw funds from a 401(k), whether it's a traditional or solo account. Generally, you must reach the age of 59.5 before you can access your retirement savings, or you will incur a 10% early withdrawal penalty in addition to income taxes. There are exceptions to the penalty, such as using the funds for a first home purchase or in cases of permanent disability.

If you wait until you reach the specified age to start making withdrawals, there are no penalties, but the withdrawals are treated as taxable income. An advantage is that any contributions made are deductible as a business expense. If you prefer to defer the tax benefit until later, you can designate your solo 401(k) as a Roth account, making qualified withdrawals tax-free.

Apart from withdrawal restrictions, the IRS also enforces other rules on sole proprietor 401(k)s, many of which apply to traditional 401(k)s as well. For people who reach age 72 after Dec. 31, 2022 and age 73 before Jan. 1, 2033, required minimum distributions (RMDs) will begin the year in which they turn 73. For those who are age 74 after Dec. 31, 2032, the age of RMDs is 75.

Some plan administrators structure solo 401(k)s to allow hardship distributions before age 50.5, but these exceptions are limited, and you may face the 10% early withdrawal penalty tax. Certain plans also permit rollovers from other retirement accounts, but it's essential to verify with your plan administrator for the most up-to-date information.

Additionally, if your account balance exceeds $250,000, you must file IRS Form 5500-EZ.

The Bottom Line

For most people the key to an earlier retirement or at least a stress-free retirement is saving enough money into a tax-deferred retirement plan where it gets to compound tax-free over many years. When considering the tax benefits and higher contribution limits, a Solo 401(k) outshines other individual retirement account options. Depending on where you open your account, you might even have the option to take a 401(k) loan against your balance.

Are you saving enough for retirement? To find out, sign up for a free trial of WealthTrace and build your financial plan today.