Key Points

- Using financial and retirement planning software that is also a portfolio tracker empowers you to be your own financial planner and wealth manager.

- Portfolio tracking software should update investment information every day.

- Good portfolio tracking software should also show you the fees you pay for funds you own, performance history, historical balances, and historical transactions across accounts. WealthTrace allows you to view all of this information while giving you a comprehensive financial and retirement plan. Sign up for a free trial to see this yourself.

It used to be that in order to track all of your investment holdings and transactions, you had to log in to the websites of each bank and broker you have investments with. Each site has its own interface and nuances, which makes it cumbersome to actually track what is going on with your investments. Not only that, but you cannot aggregate all of your holdings and see what your overall exposure is to various investments and asset classes.

Aggregating Accounts and Understanding Your Asset Allocation

With today’s financial technology and the ability to link accounts from nearly all banks and brokers, it is now possible to aggregate all of your investments in one location.

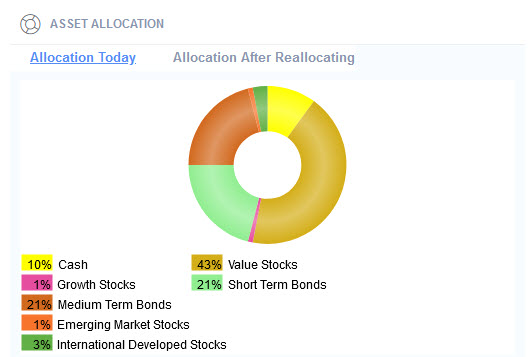

WealthTrace allows you to import and link all of your investments so you can see what your overall asset allocation is across all investment accounts.

Viewing your overall asset allocation is extremely important for retirement planning. When investors are young they should be more aggressive with their retirement investments since they won’t be using these accounts for many decades. When people are older or in retirement, it’s prudent to reallocate to a more conservative mix of investments in order to not risk blowing up their retirement plan and running out of money in retirement.

If you’re not able to aggregate all of your accounts in one location then you don’t know if you need to move more money to other asset classes in order to be more diversified or to have the best asset allocation for your age.

The ability to track your asset allocation across accounts can also quickly tell you if your stock/bond allocation has gotten away from where you want it to be. This happens frequently when stocks perform better than bonds and become a larger share of the investment portfolio.

Tracking your asset allocation and holdings also allows you to see if a large cash inflow has come and needs to be invested. Too many people have cash sitting around, un-invested, because they simply didn’t know the cash was even there.

Tracking Your Portfolio for Retirement Planning

At some point everybody should run a retirement plan using accurate retirement planning software. Otherwise you won’t know how much you need to save in order to retire when you want. You also won’t understand what your risks are and how to meet your financial goals in retirement.

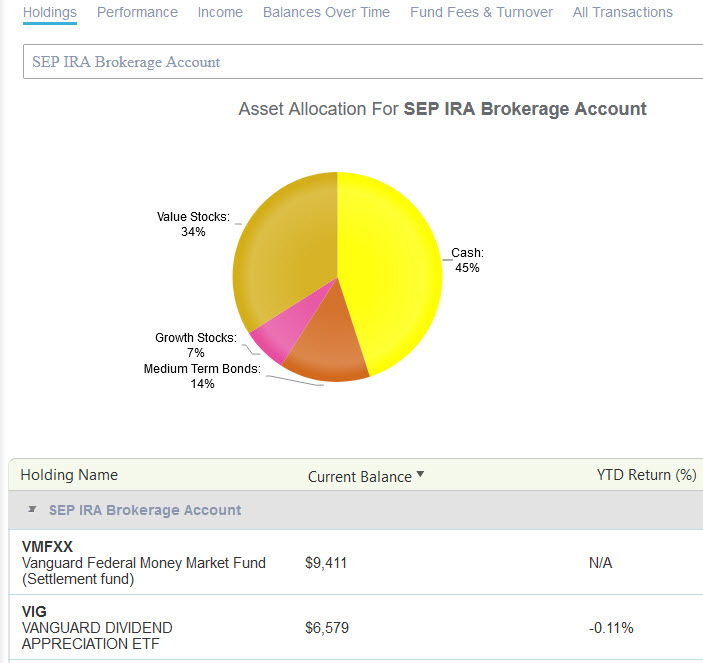

It is imperative that you have accurate investment balances and holdings information for all of your investments when running a retirement plan. You simply cannot get accurate results otherwise. When you have all of your investment holdings in one location you can then confidently run retirement planning scenarios such as if and when to convert to a Roth IRA, what happens if inflation stays high, should you delay taking Social Security, and how will your retirement portfolio hold up if there is a major recession?

The ability to pull in updated investment holdings along with their asset classes and historical data also allows for a much more accurate Monte Carlo retirement simulation. Monte Carlo simulations tell you the probability that you will never run out of money. This calculation is extremely important because it takes into account the level of risk you have with your investments as well as historical returns on those investments. It also takes into account how diversified you are. But if the underlying investment holdings do not have accurate data, it’s garbage in, garbage out.

Tracking your holdings by account in WealthTrace allows you to run accurate what-if scenarios and Monte Carlo retirement simulations.

Performance History

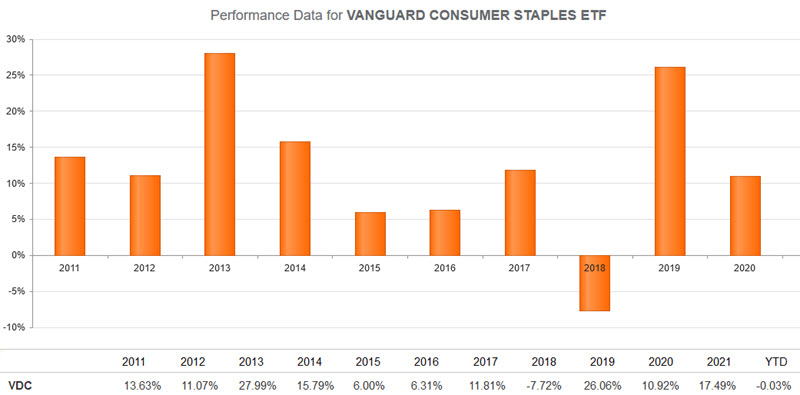

Do you know how your funds have performed lately? What about over the past 10 years? Do you know what your fees are on the funds you own? Good portfolio tracking software allows you to view all of this information.

View performance history, compare performance vs. other funds, and see how much you are paying in fund fees with WealthTrace’s retirement planning software.

Perhaps you own a fund that has high fees and has performed worse than a similar low-cost Vanguard fund over many years. You might not know this unless you can view performance history over time. Seeing this type of valuable information can help you figure out which funds you should sell and which funds you should keep.

The ability to compare your historical fund performance vs. other similar funds can also help you find funds that meet your investment goals, but have performed better historically.

View Transactions for all Accounts in one Location

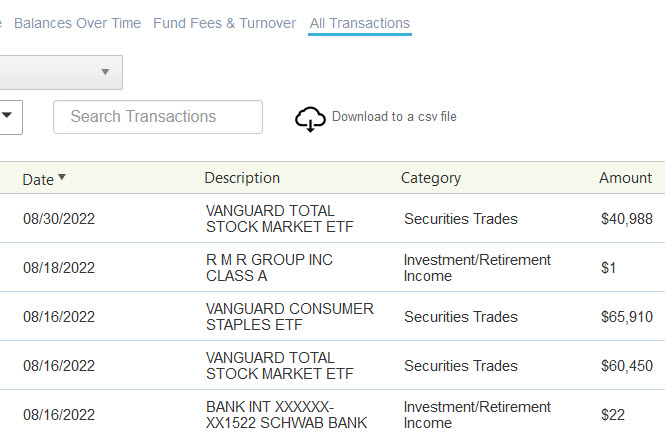

Most of us have been annoyed at one point or another when we have to log into multiple different websites in order to view various transactions for our bank and brokerage accounts. Some websites make it difficult to figure out how to view this information and others don’t provide the information at all.

Using WealthTrace you can view your historical transactions for all accounts in one location. View security trades, deposits, withdrawals, dividend payments, and interest payments.

Don’t Sell Yourself Short

There is no need to guess at what your retirement situation is. There is also no need to settle for free and inaccurate retirement calculators. Planning and tracking software such as WealthTrace allows you to get your arms around your financial situation and be empowered to be your own financial planner.

WealthTrace is the only financial and retirement planning software built for consumers that also allows you to accurately track your investment holdings. Sign up for a free trial of WealthTrace to find out more.