Key Points:

- Using equity in your home can help keep your retirement plan intact.

- Downsizing is a way to get equity out of your home for retirement.

- Selling your home or using the equity should generally be a last resort.

There are plenty of stories of people outliving their retirement savings, especially if they live long past their life expectancy. One way to make ends meet at that point is to sell your home or take equity out of it. If you have substantial equity in your home, selling to help fund your retirement can sound tempting, but is it the best option for you?

Assuming you have paid off your mortgage, or you have a very small balance, selling to downsize or rent can be a good option. You may not need the additional space or the hassle of the upkeep of your home, but there are a few things to consider.

Capital Gains

When you sell your home, you could be subject to capital gains tax which, depending on how long you have owned your home, and how much it has appreciated since you purchased it, can be quite substantial.

Sellers can exclude the first $250,000 in profit ($500,000 for married couples filing jointly), provided you have owned the house for at least two years and used it as primary residence for at least two of the past five years.

Finding out your estimated capital gains can be calculated by subtracting what you purchased your home for from your current home value. Any major improvements that you have done to your home while owning it will also increase your cost basis and reduce your tax bill, so make sure to keep track of those and keep all receipts.

Scenarios in WealthTrace

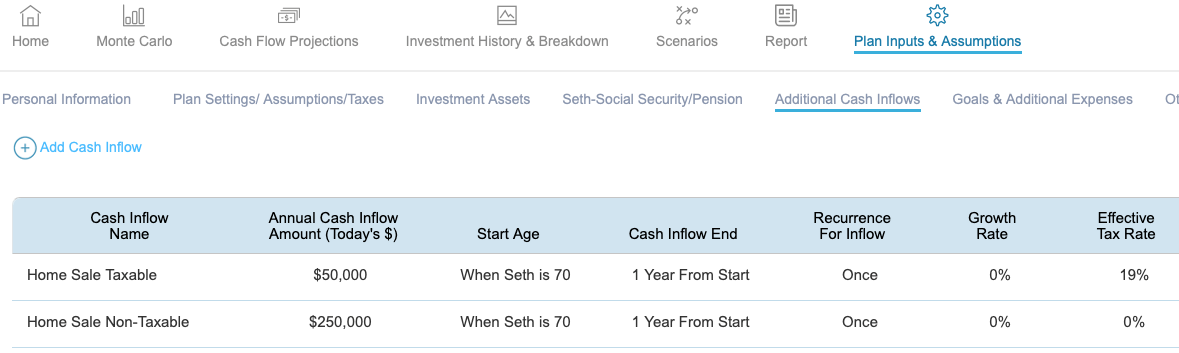

To accurately model this in WealthTrace, you need to separate your taxable portion from your non-taxable portion as shown below.

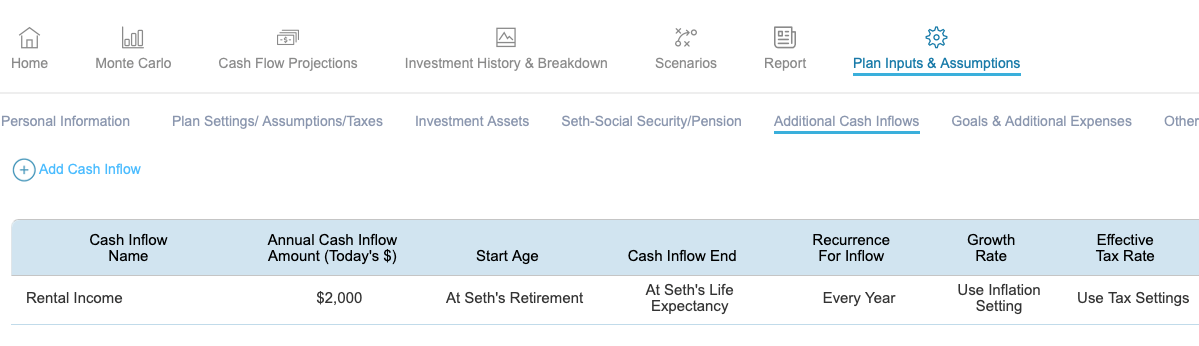

Renting out your house can also provide another source of income and the option to pass your house down to your children or move back home, provided you have somewhere else to live. Renting out your property can however push you into a higher tax bracket. This can be modeled in WealthTrace by adding your rental income as an annually recurring cash inflow.

Using an HECM Loan

A third option if you want to access the assets in your home without selling is to take out a HECM loan which is a type of reverse mortgage offered to those 62 and older. An HECM (Home Equity Conversion Mortgage) loan enables borrowers to withdraw funds in either a fixed monthly amount or a line of credit, or both.

The main downside of a reverse mortgage is that the balance of your loan increases over time because no monthly mortgage payments are required. You have the right to make payments at any time without penalty, thus reducing or eliminating the growing balance if you choose. The HECM loan can be paid back by the borrower’s estate upon passing or when you sell your home.

Monte Carlo and Home Equity

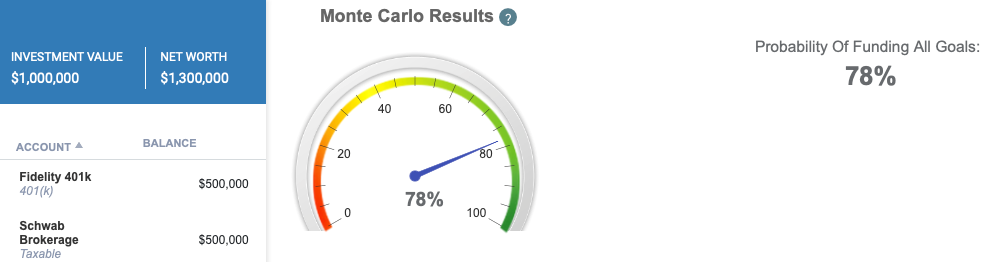

To model how selling your home may affect your plan in WealthTrace, we will look at a single individual named Seth, aged 63 with a goal of retiring at 70 years old. He currently has $1,000,000 in savings, split 50/50 between taxable and tax-advantaged accounts. Seth owns a condo worth $300,000 with no mortgage. He has the option to move in with his daughter and wants to know if liquidating his condo will make his probability of a successful retirement higher. His Monte Carlo results are displayed below, and his probability of funding all goals is currently 78%.

If Seth decided to sell his $300,000 condo at age 70 with a taxable capital gain of $50,000, his probability of success increases by 16%, landing him at a much more comfortable probability of 94%.

In WealthTrace it is important to note that if you enter your home as an asset in the “Other Assets and Liabilities” section, the program will add this to your overall net worth, but it will not account for any income generated even if you set a sell date. To accurately add your home sale in your plan, you will need to add it in the “Additional Cash Inflows” section. Remember to separate your tax-exempt and taxable gain by creating two separate cash inflows with the effective tax rate adjusted.

Bottom Line

Whether to sell your home or not will, like most other financial scenarios, greatly depend on your situation. More and more retirees find themselves needing specialized care in their senior years and end up moving into assisted living homes. This could cause you to sell at a time that isn’t most opportune for your situation and could result in unnecessary losses.

Downsizing to a smaller home and freeing up some liquid cash can make a huge difference for those who do not have adequate savings to last through retirement.

Do you have enough saved to withstand unforeseen expenses or emergencies in retirement? To find out, sign up for a free trial of WealthTrace and build your financial plan today.