Key Points

- If you like your current 401(k) plan features and investments, staying put could be your best option.

- An IRA can provide you with the ability to consolidate your money into one account.

- Taking an early withdrawal may subject you to a 10% tax penalty and is usually advised against.

Whether you are quitting your job, getting laid off, or you are retiring, figuring out what to do with your 401(k) is an important step. There are a few options for what you can do with your retirement account, however they will be dictated by the balance in your account.

- If your account balance is less than $1,000, your employer will most likely mail you a check for that amount. You can either choose to take the cash (not usually recommended), or deposit it into another retirement account.

- If your account balance is between $1,000 and $7,000 your employer may be able to boot you out of the plan. They can then either automatically roll your balance over to your new employer’s retirement plan or they must transfer the funds into an IRA. This is known as an involuntary cash-out.

If your employer offered a company match, it is also important to review your vesting schedule. The vesting schedule will dictate how much of the employer contributions you will get to keep. If there is no vesting schedule, 100% of the employer contributions will be yours. Employee contributions are of course yours either way.

Let’s explore the various options that you may have for your 401(k) plan after you leave your job.

Stay In Your Current Plan

If your account balance exceeds $7,000, your employer may allow you to keep your retirement savings in their plan after you leave. While your savings will grow tax-deferred, you won’t be able to make any additional contributions into the plan.

If you like the features of the plan and how the funds are being invested, then staying put may be the best option for you.

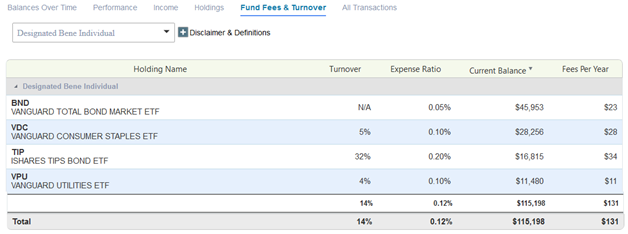

Be mindful of fees: Many 401(k) plans are managed by investment advisors who charge a fee based on the overall balance of the plan. There are other fees that apply as well such as Administrative Fees and Investment Fund Fees (Expense Ratios). Make sure to review your annual statement to ensure you are not overpaying in your current 401(k) plan.

Move Your Money Into an Individual Retirement Account (IRA)

Another option is to roll your funds into an IRA. With this option you will usually have more investment options, the ability to self-direct your investments and it allows you to continue contributing to your retirement account (provided you have earned income).

If you have multiple retirement accounts, an IRA can provide you with the ability to consolidate your money into one account. By moving the funds into an IRA, it remains in tax-deferred status, and you will not incur any penalties.

Move Your Money Into a New Employer's Plan

If you are leaving your current employer for a new job, it is a good idea to check with your new employer if they will accept a rollover from your previous plan. If the new plan offers similar or better services than your current plan, this may be a great option.

Managing multiple retirement plans can become confusing and cumbersome, so consolidating them may make your life a bit easier. Most plans have waiting periods, often ranging between 6 months to 1 year, before you can enroll and roll-over your current retirement plan.

Make sure to review the costs and services associated with the new plan before making your decision.

Take a Cash Distribution

Taking a voluntary cash distribution is typically advised against. If you are below the age of 59 ½, you will incur a 10% tax penalty and you will pay regular income taxes on top of that.

Leaving your money in a tax-advantaged retirement account preserves the tax benefits and keeps you on track for saving for retirement. However, if you have debt or bills that you need to pay and you are comfortable with the tax implications, then this may be an option for you. You could withdraw a portion of the account, or the entire account.

Most 401(k) plans also allow for hardship withdrawals to pay for things like medical bills, college tuition, money to avoid foreclosure, funeral expenses and more. If you qualify for a hardship withdrawal you will not incur the 10% tax penalty, but you will still need to pay income tax and withdrawal limits may apply.

It is important to consult with your tax advisor or financial advisor before taking a withdrawal from your 401(k) to know the implications you might face.

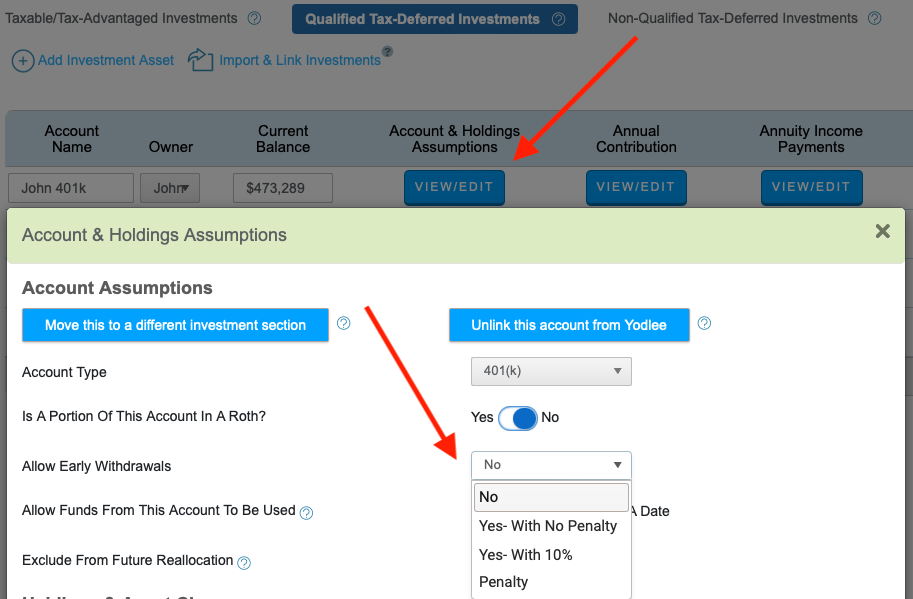

Using WealthTrace you can see how an early withdrawal would affect your retirement situation.

The Bottom Line

Deciding what to do with your 401(k) after you leave your job will depend on your goals, account balance, age, and personal preferences. Being prepared and planning ahead of time will make the transition easier. Make sure you are aware of the rules of your old account, and your potential new account, before making any moves.

Are you saving enough for retirement? To find out, sign up for a free trial of WealthTrace and build your retirement plan today.